Vietnam’s economy to emerge as world’s top performer next year: HSBC

When considering factors such as political stability, cost-efficiency, a hardworking workforce, adaptability, and stable exchange rates, Vietnam stands out as an attractive destination for investment.

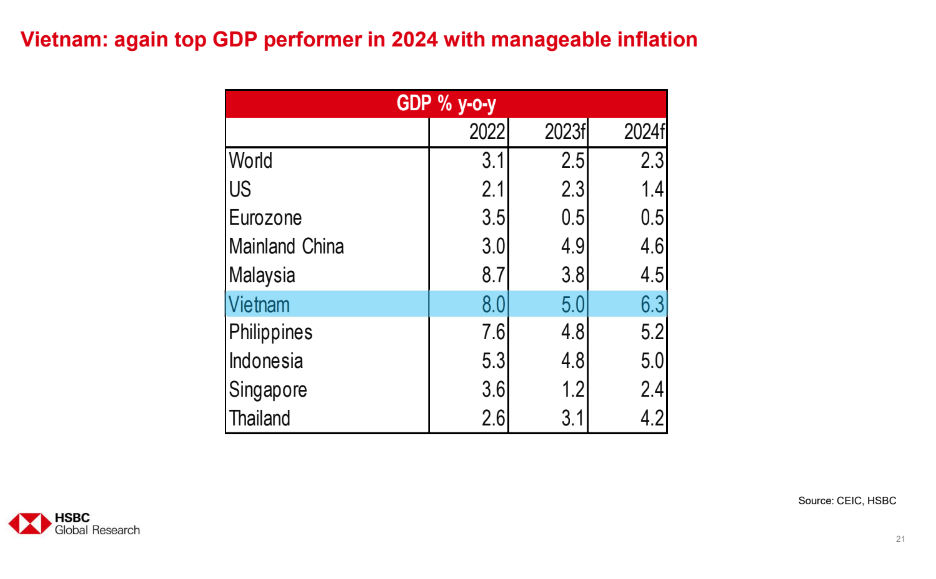

Vietnam’s GDP growth could remain at around 5% for 2023 due to unfavorable global context, but it is expected to remain the world’s fastest-growing economy with a rate of 6.3% next year.

| HSBC Vietnam's CEO Tim Evans. Photos: HSBC Vietnam |

Chief Asia Economist of HSBC Frederic Neumann shared the assessment at the UK-based bank’s annual flagship Market Outlook conference titled Vietnam: The Road Ahead, held today [October 10].

Neumann added two primary factors will drive Vietnam's GDP in 2024, including exports and a recovery in domestic spending.

In September, Vietnam’s export turnover reached over $31.4 billion, which was a 4% decrease compared to the previous month. Over the first nine months of the year, export value reached nearly $260 billion, down over 8% compared to the same period in 2022.

However, HSBC’s economist believes that exports will rebound in 2024 as global demand returns. He attributes the current weak production to overbuying during the pandemic, which has led to reduced consumer spending on goods and an increased focus on travel and eating out.

This situation is expected to reverse next year as global economic growth shifts. Services may slow down, while manufacturing picks up, and consumers are likely to return to shopping, boosting demand in Vietnam's main export markets.

The second driver of Vietnam's economy in 2024 will be domestic spending, encompassing both consumption and government purchases. Data from the statistics agency indicates that total retail sales of goods and consumer services rose by 9.7% in the first nine months of the year, although this is only half of what it was in the same period in 2022.

Sharing Neumann’s view, the CEO of HSBC Vietnam Tim Evans anticipated that consumers will regain confidence and increase spending as GDP regains momentum next year, projected to be at 6-7%.

Aside from exports and domestic spending, CEO of VinaCapital Investment Management Brook Taylor predicted a recovery in the financial, service, and real estate sectors, with an acceleration of infrastructure development in the coming year.

However, Neumann expected the State Bank of Vietnam to interest rates by another 50 basis points to contribute to the economic recovery and reach the 6.3% GDP growth target by 2024. He also pointed out that Vietnam's high degree of economic openness poses risks to exports. If major export markets such as the US, Europe, and China recover less than expected, it could impact Vietnam's export growth.

Megan Lawson, General Director and Country Director of ERM Vietnam emphasizes the importance of businesses paying attention to ESG (environment, society, and governance) factors, given the increasing focus on sustainability in global capital flows.

Meanwhile, Warrick Cleine, Chairman and CEO of KPMG Vietnam and Cambodia, suggests a 3C strategy for businesses: focusing on cash flow, capital, and customers. He underscores the significance of personalization in attracting and retaining customers.

| Experts at the discussion session. |

Future looks bright for Vietnam

Looking at the country’s long-term prospects, HSBC Vietnam CEO Evans pointed out that the country has signed 16 free trade agreements (FTAs), 15 of which involve members of the G20 group. This extensive network of FTAs enhances Vietnam's trade opportunities on the global stage, he noted.

Despite global economic uncertainties, foreign direct investment (FDI) commitments in Vietnam increased by 7.7% by the end of September. He noted that foreign investors are increasingly interested in Vietnam not only as a production hub for exports but also as a market for their products.

Additionally, Vietnam is in the midst of a transition to a digital economy, which is expected to reach a value of $50 billion by 2025, positioning it as the fastest-growing digital economy in Asia. By 2030, Vietnam is projected to be one of the world's top 10 largest consumer markets, surpassing the size of countries such as Thailand, England, and Germany, Evan stressed.

Evans emphasized that the Vietnamese economy benefits from several fundamental factors, including continued FDI inflows, the expanding middle-class market, and the rise of an ambitious business community. These factors are expected to provide support for Vietnam's economic growth in the long term.

The HSBC representative concluded that Vietnam has the potential to be a pioneering market among developing nations.

When considering factors such as political stability, cost-efficiency, a hardworking workforce, adaptability, and stable exchange rates, Vietnam stands out as an attractive destination for investment, he noted.

It offers advantages that are not readily found in many other countries in the region, making it a superior choice for attracting investment capital compared to developing countries such as Pakistan and Bangladesh, Evans asserted.