Businesses promote digital transformation for Covid-19 response: WB

As Vietnam has effectively controlled the Covid-19 pandemic, it witnesses the increasing number of businesses reopening in September-October, bringing the total share of fully opened businesses to 94%.

About 60% of Vietnamese businesses have now adopted or increased use of digital platforms in response to Covid-19, according to a survey of 500 businesses released by the World Bank (WB) on December 9.

The rate, while seen as an improvement from the 48% reported in a similar survey in June, has slowed down in September-October but “still significant, with an additional 11% of new firms reported increased use of digital platforms,” noted the WB in a report.

Meanwhile, a similar share of firms is investing in digital solutions and switching to new products and services.

The WB also noted that small and medium enterprises (SMEs) are more likely to use digital platforms for less complex front-end business functions, suggesting potential capacity or resource constraints.

“Most digital adjustments are in customer-facing functions such as sales and payment methods, which are likely less complex and cheaper to implement than changes in other business functions,” it added.

Large firms, however, are more likely to use digital platforms for more sophisticated functions such as production planning and Supply Chain Management, suggesting a capacity or resource constraints among small-size firms. At the same time, SMEs are gradually catching up in investments in digital solutions.

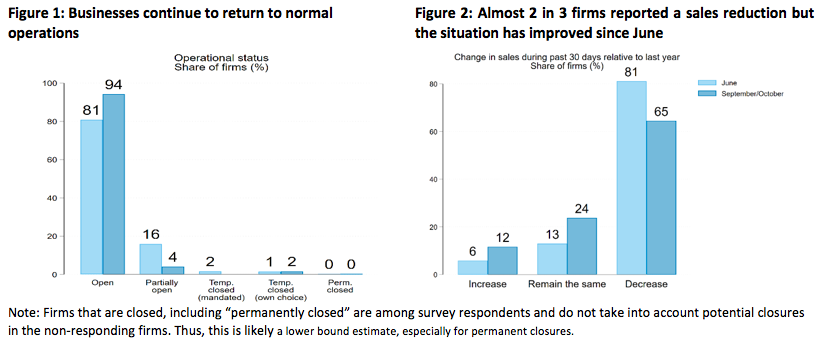

As Vietnam has effectively controlled the Covid-19 pandemic, there is continued business reopening in September-October. An additional 13% of firms are now fully opened, bringing the total share of fully opened businesses to 94%.

The pace of reopening appears similar across all firm sizes and is somewhat higher in services sectors, where there was the highest rate of firms closed or partially open in June, stated the WB.

While most firms are opened, many are still running below normal (pre-crisis) capacity. Almost 1 in 4 firms still have decreased operating hours. On average, firms’ operating hours are 6.7 percent lower than last year.

Another key point of the survey is that almost 2 in 3 firms reported a reduction in sales during September-October, but the situation has improved since June.

Sales has continued to recover, but firms are still experiencing significant revenue loss. On average, firm sales are about 36% lower than the same period last year.

“Small firms and firms in manufacturing and agriculture continue to experience revenue shocks as severe as in June,” added the WB.

Looking ahead

Amid global uncertainties as the Covid-19 situations remains complicated worldwide, most firms have become more pessimistic about growth prospects with negative sales and employment growth in the next 6 months.

On average, firms are expecting highly negative growth in the next 6 months of 11-51% for sales and 7-61% for employment.

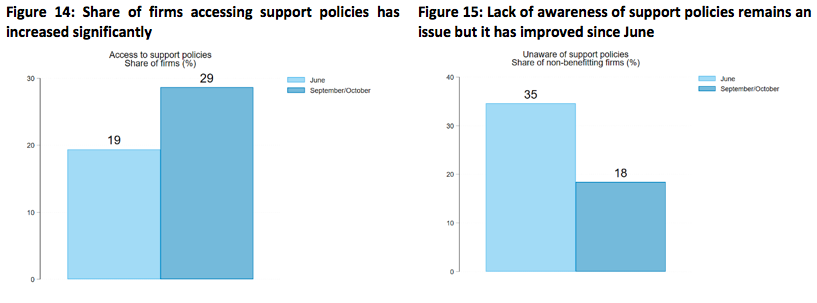

According to the WB, the share of firms accessing support policies has increased significantly between Sept-Oct and June. There is an increase of 10% between the two survey rounds in the share of firms accessing to support policies. The vast majority of support is in the form of tax and other payment deferrals (17% of firms). Large firms and manufacturing firms continue to have higher access to government support, with considerably more agriculture firms receiving support.

Lack of awareness and difficult procedures, nevertheless, remain barriers to access government support, but firms’ awareness has improved since June.

So far, there has been no evidence suggesting that firms previously receiving government support is correlated with current sales, likelihood of hiring workers, laying off workers, or having cashflow shortages, stated the report.