Domestic consumption to drive Vietnam’s economic growth in 2022: VinaCapital

Last October, Vietnam’s Government pivoted from a “Zero Covid” approach to a “Living with Covid” approach, which drove a reopening boom.

Vietnam's GDP growth is set to surge from 2.6% in 2021 to 7-7.5% in 2022, or even exceed 7.5% this year, driven by vigorous rebounds in Vietnam’s domestic consumption and construction activity, as well as by a resumption of tourist arrivals at some point in the months ahead, according to Michael Kokalari, the chief economist at VinaCapital.

| Michael Kokalari, the chief economist at VinaCapital. |

Kokalari pointed out real retail sales in Vietnam are forecast to surge from a 6.2% drop in 2021 to 5% growth in 2022, versus consistent 8-9% annual growth pre-Covid.

In addition, the growth of Vietnam’s construction activity could go up from 0.6% in 2021 to 8% in 2022, driven by “catch up” infrastructure spending and by an expected relaxation in regulations governing real estate development.

Last October, Vietnam’s Government pivoted from a “Zero Covid” approach to a “Living with Covid” approach, which drove a reopening boom, he said.

The Government’s aggressive vaccination campaign raised the proportion of the country’s population who have received two Covid shots from 4% in September to over 90% of adults as of January 5, 2022, giving most Vietnamese people the confidence to return to work and paving the way for a resumption of foreign tourism – which directly accounted for about 8% of Vietnam's GDP in the pre-Covid period.

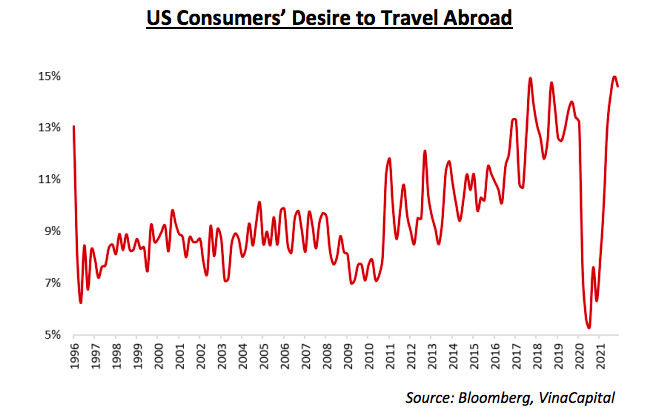

Meanwhile, the timing of a resumption of Vietnam’s tourist arrivals will be clearer after the Lunar New Year, which is at the beginning of February this year, but the prospects for Vietnam’s tourism industry are already clear and are evidenced by a surge in the desire of US consumers to travel abroad, according to the Conference Board’s recent US consumer sentiment survey, Kokalari added.

Continuation of long-term growth drivers

Vietnam’s long-term growth drivers remain intact despite Covid, he said, attributing the country’s most important growth driver is the foreign direct investment (FDI), and FDI inflows remained remarkably resilient over the last two years.

“We expect continued strong inflows in 2022 – especially as travel restrictions are eased - which will make it easier for executives from Japan, South Korea, and elsewhere to travel to Vietnam,” he said.

Additionally, the recent announcement that LEGO corporation will invest US$1 billion in Vietnam to build its first carbon-neutral factory will help attract other FDI investors that prioritize ESG (Environmental, social, and governance) when deciding where to invest.

In 2020, Vietnam’s FDI inflows fell by just 2% (to $20 billion) despite a circa 40% drop in global FDI due to Covid.

In 2021, Vietnam’s FDI inflows drop by just 1% despite the country’s several lockdown measures during the Delta Variant outbreak.

The difficulty, however, did not prevent firms producing high-tech products from being enthusiastic about investing in Vietnam. For example, LG Display announced $2.2 billion of planned investments in 2021 that will nearly double the company’s total investment in Vietnam.

Samsung, which is Vietnam’s biggest foreign investor (and private-sector employer), announced that it will increase its production capacity of foldable devices in Vietnam by 50%, while Toshiba said it will relocate all of its electronics production in China to Vietnam and Japan.

Further to that last point, Vietnam remains the most attractive country for Japanese companies to invest in, according to a survey published by Deloitte in September.

Factors supporting FDI inflows

Vietnam’s main appeal as a destination for FDI stems from the fact that factory wages in Vietnam are about one-third of those in China, and the quality of the workforce is comparable to that of China, according to surveys by JETRO and others. Vietnam’s close geographic proximity to Asia’s supply chains, especially in the high-tech industry, is another factor.

Further, an increasing number of multinational firms are seeking to diversify their manufacturing outside of China for a variety of reasons, including the fact that the US has maintained tariffs on China’s exports to the US in the face of continued tensions between those two countries. In contrast, the US Treasury Department and the State Bank of Vietnam reached an agreement in July that removes the risk of tariffs being imposed on Vietnam’s exports to the US.

Next, the impressive speed of Vietnam’s Covid vaccination campaign once the Delta variant emerged gives foreign companies confidence that the Government is committed to achieving a prudent balance between public health and economic health concerns as part of the “Living with Covid” strategy it has pursued since October.

Finally, the above-mentioned investment by Denmark’s LEGO Corporation will reinforce Vietnam’s environmental, social, and governance (ESG) credentials to other prospective investors at a time when foreign investors are increasingly focusing on such considerations. LEGO has an outstanding and highly publicized commitment to sustainability, as do many other major European companies.