Foreign investors continue to target Vietnam’s pharmaceutical industry

Vietnam's pharmaceutical market has a lot of potential coming from the demographics, rising income and priority policies of the government.

Foreign investors would continue to target Vietnam’s pharmaceutical industry following deals such as DHG Pharmaceutical with Taisho Pharmaceutical (Japan), Mekophar Pharmaceutical with Nipro Pharma Corporation (Japan), Pymepharco with Stada (Germany), or Domesco Medical Import-Export with Abbott (US), according to Viet Dragon Securities Company (VDSC).

As the pharmaceutical industry remains undeveloped in Vietnam, local companies want to find a foreign partner who can transfer production technology and solve output problems through drug export. On the other hand, Vietnamese firms are attractive by the low production costs and the potential domestic market, stated VDSC’s latest report.

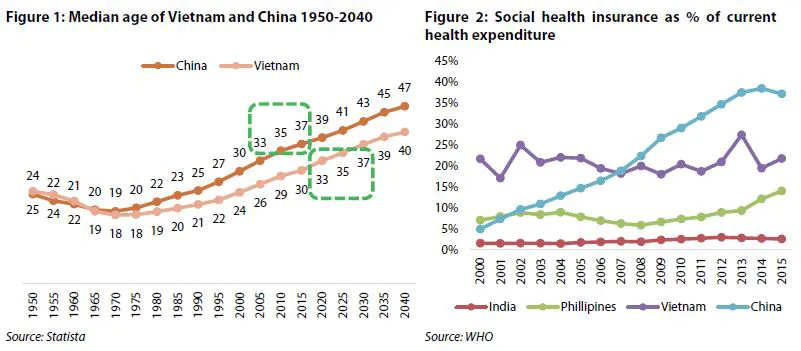

A study from the United Nations Population Fund (UNFPA) suggested although Vietnam is still a young country, the population entered the "aging phase” in 2017. Meanwhile, a report from the World Bank warned that population aging will likely hit Vietnam with full force within a very short span of time. This transition could come in a mere 15 years and be completed well before the 2040s. An aging population means more spending on pensions and healthcare.

In 2019, sales of Vietnam's pharmaceutical market are estimated at US$6.5 billion, of which hospital channel sales account for 75%. In addition, VDSC expected the government will have to increase spending on health care in the coming years. That was what took place in China, and it is likely to happen in Vietnam. This means that pharmaceutical companies focusing on the hospital channel will benefit.

Moreover, rising health care spending is only a matter of time. It requires the government to control expenditure better, and also to control inflation. Therefore, reducing costs and improving efficiency in health facilities is an inevitable trend. One such solution is to encourage health facilities to use domestic drugs instead of imported ones, through policies that the government has been implementing.

Challenges remain

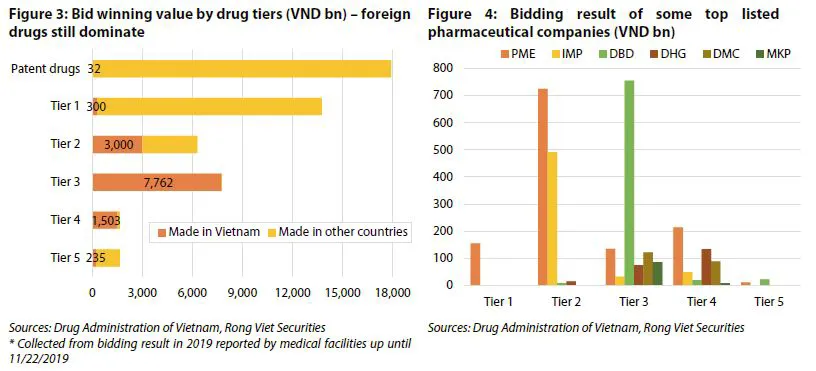

Currently, domestic companies are not capable of pursuing the research and development of patent drugs and can only manufacture generic drugs. However, even in the generic drug segment, Vietnamese medicine only meets about 40% of the domestic demand. The reason is that most national manufacturers only have WHO-GMP standards and can only produce medium-low quality generic drugs.

Meanwhile, high quality generic drugs (which can bid for Tier 1 and 2 in hospital channels) require manufacturers to have EU-GMP or PIC/S-GMP standards - currently only 17 facilities meet either one of these two standards, besides 222 WHO-GMP standard facilities. Among the listed companies, only Pymepharco and Imexpharm are capable of bidding into Tier 1 and 2 due to having EU-GMP standard factories.

There are more than 90% of drug materials using in the industry still being imported, of which about half from China. In addition to exchange rate risk, especially the USD/VND and USD/CNY pairs, raw materials price from China has also skyrocketed in the last two years due to the closure of many factories in China, as an attempt to protect the environment. This has a negative impact on the profit margins of most Vietnamese pharmaceutical companies because medicines price is under the government’s control and the fierce competition in the industry makes it almost impossible to pass increasing cost to consumers.

VDSC’s report suggested the Vietnamese pharmaceutical market has a lot of potential coming from the demographics, rising income and priority policies of the government, however, as with any development of other industries, after the fragmented phase will be the competitive and selective one.

“The end goal is for consumers to use medicines with high quality standards and reasonable prices,” stated the report.