Growing concern over overload on Vietnam stock market

The problem if further persists in long-term will make investors become disillusioned on the fairness and transparency of Vietnam’s stock market.

The frequent overload of orders forcing the stock exchange to halt market trading is causing frustration among investors.

Insiders have said that the trading halts, which occurred on the Vietnamese stock exchanges recently, aim to correct an order imbalance as a result of a technical glitch or due to regulatory concerns. When a trading halt is in effect, open orders may be canceled and options still may be exercised.

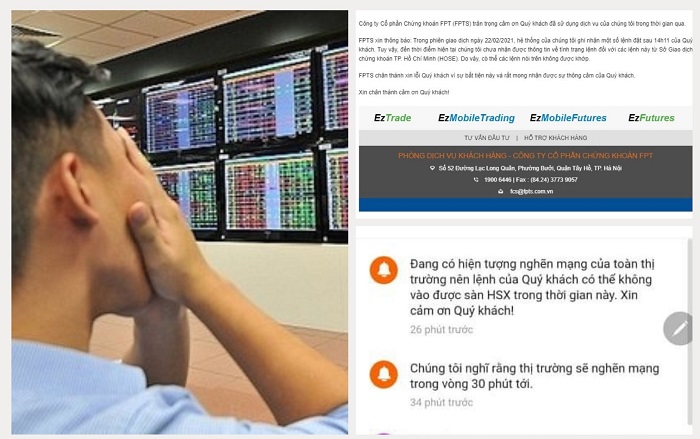

| The unstable system is putting investors at risks. Photo: kinhtedothi |

“Investors want competent authorities to take responsibility for these incidents, not just an apology,” said Nguyen Bich Ngoc, an experienced investor in the stock market, adding the unstable system is putting investors at risks.

Both before and after the Tet holiday, the overload occurred multiple times on both the Ho Chi Minh City and Hanoi stock exchanges whenever liquidity in a trading session hit around VND14-17 trillion (US$608-738 million).

“The phrase of “unplug the power cord” has become a hot topic in every securities forum and social networks,” Ngoc added.

From her own experience, Ngoc said at a trading session on February 19, when she and other investors placed an order at 1pm, but until 2:48pm, the system notified their placement was expired while the transaction period had not ended.

“Orders for purchasing stocks after 1:30 pm or 2pm in the past month were often delayed in process and not submitted to the stock exchanges,” she continued.

“Investors were left to watch their stocks going up or down in values and do nothing,” Ngoc fumed, while saying a lack of solutions to resolve the matter substantially from the Ministry of Finance or the State Securities Commission of Vietnam (SSC) only makes the matter worse.

“We are now forced to live with a faulty system and bear all the risks when we could not sell or buy stocks in case of system overload,” Ngoc stressed.

Last year, the stock market has witnessed strong growth and beat a series of records in terms of the number of new investors and the amount of capital inflows. In contrast with such strong growth, the issue if further persists in long-term will make investors become disillusioned on the fairness and transparency of Vietnam’s stock market, Ngoc stated.

“Investors will not accept losing money in such way or any apology from the authorities when the situation remains unchanged,” she said.

“The SSC must give a clear deadline to resolve this issue one and for all,” Ngoc concluded.

Previously, the SSC attributed the overload issue on the Ho Chi Minh Stock Exchange to the transaction processing capacity of the stock exchange that limits the number of transactions per day, while a recent surge of orders has exceeded the expectation of the market.

To ensure the smooth operation of the stock market, the SSC requested related agencies to optimize the transaction process by increasing the minimum trading lot from 10 to 100 shares, starting from January 4, 2021.

The SSC also urged securities firms to prevent their internal errors or limit automatic transaction.

For mid-term, the HoSE is tasked with upgrading the transaction backup system to ensure the safety of the system until the new IT system for the stock market with support from the Korea Exchange (KRX), South Korea’s bourse operator, is put into operation.

Data from the General Statistics Office (GSO) revealed the amount of capital poured into Vietnam stock market surged 20% in 2020 to VND383.6 trillion (US$16.64 billion). The average transaction value in the stock market is estimated at VND7.05 trillion (US$304.8 million) per session, up 51.5% year-on-year. Meanwhile, the number of new investors soared by 109% in 2020 against the previous year. |