Investors have high expectations on Vietnamese startups

2020 was a challenging year but also presented many opportunities for innovation and technology investment globally and domestically.

Total investment in Vietnamese startups is predicted to make a breakthrough this year despite the impacts of the Covid-19 pandemic on Vietnam's economy, according to the latest report.

| Touchstone Partners, the newcomer, strives to be an early-stage VC investor in Vietnam’s fast-growing technology ecosystem. Photo: Touchstone |

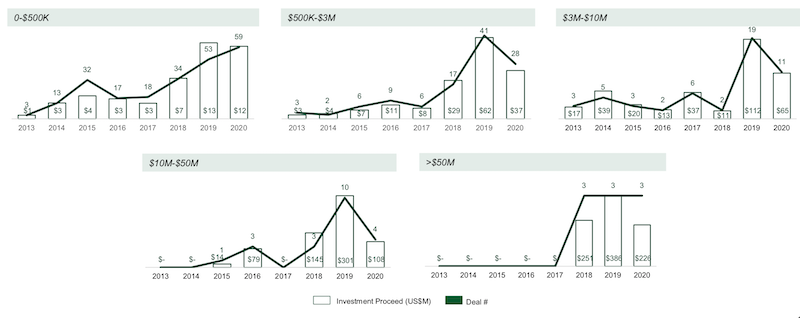

The “Vietnam Innovation & Tech Investment Report 2020”, jointly released by the Vietnam National Innovation Center (NIC) and Do Ventures, showed that the Vietnamese startups’ total investment capital reached US$451 million last year, down 48% against the previous year.

2020 was a year of turbulence but also of resilience for the global tech investment and the landscape in Vietnam was not an exception, according to the report. The decline was mostly due to the absence of outsized deals that were already closed the previous year by later-stage companies.

The number of deals slightly decreased by 17% to 60 deals in the second half of 2020, the number was equal to the same period in 2019. “After the slowdown during the first quarter of 2020, venture capital investing began to pick up from the second quarter,” the report noted.

After a swift decline at the onset of the pandemic, early financings began to return to the previous levels. Investors ultimately closed the same number of pre-A and A deals in 2020 as in 2019.

Later-stage investment fell steeply in terms of both deal value and number, partly due to the limits on travel that prevented the indispensable in-person due diligence process for large check size deals, according to Do Ventures.

| Chart: The number of deals and invested capital in Vietnamese startups, 2020. Source: Cento Ventures & Do Ventures Research |

Among the sectors, payment and retail have been dominating in terms of large amount funding, with a capital of US$101 million and US$83 million, respectively, due to their fundamental roles in the growth of the internet economy.

Employment (HRTech) and property (PropTech) continued to see rising interest, while industries such as education (EdTech), healthcare (MedTech), and business automation (SaaS) is on the rise due to drastic changes in consumer and business behaviors after Covid-19. Deal size and number remain modest as those sectors are still in their budding stage with plenty of room for growth in 2021 onwards.

Vietnam is still an attractive destination for investors, with the most active among them coming from South Korea, and Singapore, while the number of Japanese investors significantly decreased in 2020, the report wrote.

Vu Quoc Huy, NIC’s Director said: "With efforts from the government to promote digital economic growth and create a favorable business environment to attract foreign investment, Vietnamese startups will have many opportunities to make breakthrough as investment activities progressively resume at the normal pace."

Challenges for startups

The persistence of early-stage investments is significant to the health of the broader venture capital ecosystem. Do Ventures, an early-stage venture capital firm, found out based on the fact that more than half of the recorded deals were conducted by local funds and capital availability in the Vietnam market.

“It has proved to be one of the most crucial supports for early-stage entrepreneurs to keep thriving during uncertain times,” it noted.

Though the Vietnam tech investment landscape experienced an inevitable hit due to the global crisis, Vietnamese entrepreneurs have been doing their best with available resources during an unprecedented time. Do Ventures believe challenges could always be interpreted as opportunities that welcome the birth of new disruptive business models.

Le Hoang Uyen Vy, CEO of Do Ventures said: “The challenge has spanned the whole year 2020 and will probably not stop in the near future. However, as the enterprise operating in the field of innovation, we see opportunities in difficulties.”