Solutions beyond fiscal support to boost Vietnam’s long-term economic growth

Vietnam should be prepared for a new wave of FDI inflows after the Covid-19 medical issue is resolved, which could be in around one year from now, said CEO of VinaCapital Don Lam.

In addition to fiscal measures already in place to mitigate the Covid-19 impacts on the economy, Don Lam, CEO of VinaCapital, said there are more ways for Vietnam to boost the economic growth in the short-, mid-, and long terms.

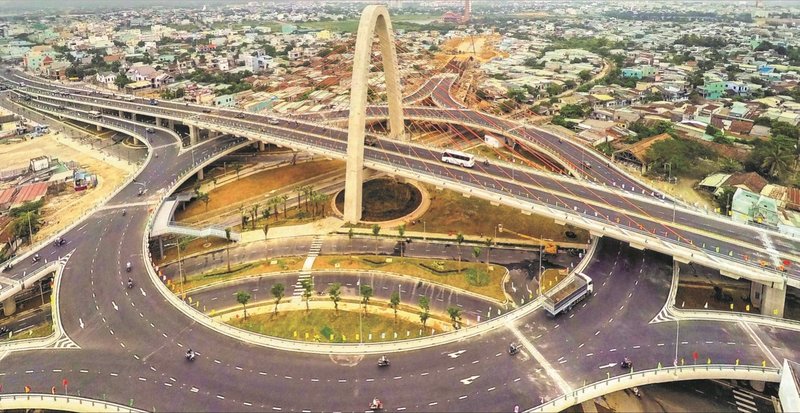

| Illustrative photo. |

Funneling credit to small and medium enterprises (SMEs)

The State Bank of Vietnam (SBV), the country’s central bank, has asked the cooperation of commercial banks to help support local businesses by extending loans with below-market lending rates. The economic impact of those concessionary loans will be borne by the banks themselves.

To date, Vietnam’s commercial banks have reportedly restructured US$44 billion in loans for businesses hurt by Covid-19, and extended US$22 billion in new loans to such businesses at concessionary interest rates at the behest of the SBV.

Despite these initiatives, many companies are reporting that they have been unable to access to the credit they need to fund their working capital and/or to pay salaries during this difficult time. Banks are apparently reluctant to lend to some of those businesses in doubt of their repayment capacity.

According to Don Lam, the difficulty small businesses face in accessing credit is not unique to Vietnam. The US government set up a special fund with its own money that is intended to finance small businesses negatively impacted by the Covid-19, but there have been media reports that less than one-in-ten firms that applied for these loans have actually been able to receive them.

Therefore, Don Lam suggested the Vietnamese government could study a different approach for lending to SMEs from the German government. Unlike the scheme in the US, Germany’s government is not lending its own money, but it is guaranteeing the loans made by the country’s commercial banks to small businesses affected by the pandemic.

.

Such a government-backed loan scheme could work in Vietnam because it would minimize the government’s spending (i.e., the government would only lose money if businesses fail to repay their loans). Additionally, the government has a variety of ways at its disposal to reduce loan losses.

Infrastructure development, job creation

The most feasible way for the Vietnamese government to stimulate the economy immediately is by ramping up infrastructure spending, as new projects can absorb large numbers of relatively low-skilled workers, one of the most affected groups by the pandemic.

Don Lam cited experiences from China and the US that major infrastructure projects would help solve the unemployment issue.

While the country’s garment industry is struggling with a plunge in demands from major markets such as the US, or the EU, Don Lam suggested the Vietnamese government could help garment firms shift their focuses from apparel to personal protective equipment (PPE).

According to Don Lam, there will be massive demand for such products for years to come, especially since China currently exports about one-quarter of the world’s face masks and consumers in the US and Europe have become increasingly wary of buying medical-related products made in that country.

In addition to PPE, a wide range of other medical products and services will also be in high demand in the years to come, so it would be ideal if Vietnam were able to attract FDI into high-value niches such as the manufacture of medical devices.

That said, the Vietnamese government could take steps to foster the development of other medical-oriented businesses with a lower degree of complexity, such as the “Clinical Research Outsourcing (CRO)” industry. CRO firms organize the medical trials of new drugs and handle the burdensome administrative processes including the application to the FDA on behalf of pharmaceutical companies. So far, about three-quarters of their medical research activities have been outsourced to CRO firms.

The CRO industry has been relocating to emerging market countries (and especially to China) for several years, largely to cut costs. The demand for CRO services will clearly grow at a much faster pace in the years ahead in the post Covid-19 pandemic period.

Attracting high quality FDI

A survey from Harris Polling that was conducted earlier this month revealed over 70% of Americans think that US firms should scale back their manufacturing in China. There have also been an increasing number of articles in publications such as The Economist and Foreign Policy, as well as comments from notable investors like Mark Mobius, and from organizations like JETRO and AT Kearny all predicting that Vietnam is set to benefit from an acceleration in the movement of manufacturing out of China.

Therefore, a wave of FDI inflows is inevitable after the Covid-19 medical issue is resolved, which could be in around one year from now, stressed Don Lam. However, the Ministry of Planning and Investment (MPI) can start taking steps now to promote high quality FDI inflows for years to come.

For example, the MPI can document and promote the measures that have been taken to successfully manage the outbreak.

Thanks to the Vietnamese government’s early and far-reaching public health policies, combined with the innovative measures such as the unique “scoring system” approach to evaluate the risks of the spread of the virus to various businesses, Vietnam could retains its position as an attractive destination for FDI, concluded Don Lam.