Total assets of banks in Vietnam increase 9% to nearly US$520 billion

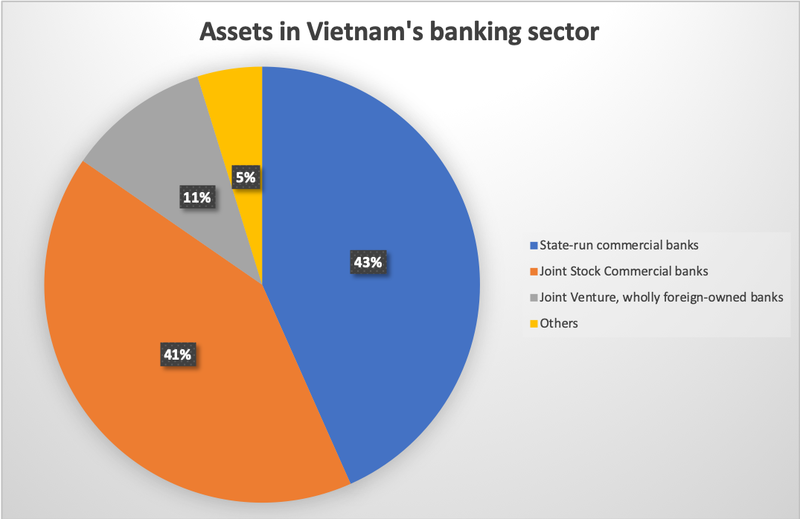

The total assets of commercial banks under state ownership accounted for 43.4% of the total of the banking sector, followed by joint stock commercial banks with 41.4%.

Total assets of Vietnam’s banking sector reached over VND12,000 trillion (US$518.65 billion) as of September 30, up 8.48% compared to the beginning of the year, according to the latest report of the State Bank of Vietnam (SBV).

| Data: SBV. Chart: Ngoc Mai. |

Total assets of seven state-controlled commercial banks, including three major lenders namely Bank for Investment and Development of Vietnam (BIDV), Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank), and Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank), were reported at over VND5,200 trillion (US$224.74 billion), an increase of 7.12% over the beginning of the year and accounting for 43.4% of total assets in the banking sector.

Meanwhile, joint stock commercial banks had total assets of a combined VND4,960 trillion (US$214.37 billion), an increase of 9.06% compared to the beginning of the year and making up 41.4% of the total assets.

They were followed by joint venture banks and wholly foreign-owned banks with total assets of VND1,260 trillion (US$54.45 billion), up 11.36%; financial and leasing companies with VND190.79 trillion (US$8.24 billion), up 13.69%; co-operative banks with VND33.77 trillion (US$1.46 billion), up 4.15%; and people’s credit funds with VND124.11 trillion (US$5.36 billion), up 9.67%.

As of September 30, total own capital of the banking system reached VND882.49 trillion (US$38.13 billion), up 9.47% against the beginning of the year, equivalent to an increase of VND8.57 trillion (US$370.35 million).

In terms of owner's equity, state-owned commercial banks are behind joint stock commercial banks with VND293.73 trillion (US$12.7 billion) against VND365.44 trillion (US$15.79 billion), posting growth rates of 9.36% and 8.06% compared to the beginning of the year, respectively.

On the other hand, owner's equity of joint venture banks and wholly foreign-owned banks was VND183.75 trillion (US$7.94 billion), up 12.82%, and that of financial and leasing companies was VND35.73 trillion (US$1.54 billion).

As state-owned commercial banks’ growth rate of owners’ equity is higher than that of total assets (9.36% versus 7.12%), the capital adequacy ratio of these lenders increased from 9.52% from the beginning of the year to 9.78% at the end of September.

Meanwhile, growth rate of owners’ equity of joint stock commercial banks was lower than that of total assets (8.06% versus 9.06%), leading to their CAR going down from 11.24% in early 2019 to 10.81% at the end of September.

In terms of short-term capital for mid- and long-term lending, both state-owned and joint stock commercial banks have brought the rate under the acceptable limit of 40% according to law, reaching below 30% and 30.89%, respectively.

This would make the SBV’s request for the banking system, which was regulated in recent Circular No.22, to take such rate to below 30% in 2022 feasible.