Trade war, Covid-19 make Vietnam even more attractive to foreign investors: HSBC

Emerging economies are chasing companies to get more FDI, but companies are chasing Vietnam to move there, said HSBC.

External risks such as the US – China trade war and, most recently, the Covid-19 pandemic, in fact made Vietnam an even more attractive proposition relative to many other markets, according to HSBC.

In its latest report on Vietnam, HSBC said that the headwinds have become tailwinds, strengthening its longstanding view that trade tensions were not the trigger for the movement of supply chains to Vietnam, they merely accelerated the process.

In its latest report, HSBC said the concept of antifragility – introduced by academic, investor and author, Nassim Nicholas Taleb, – fits Vietnam to a tee. The country’s antifragility qualities – those that go beyond resilience or robustness and lead to improvement – are showcase as:

Firstly, Vietnam has handled Covid-19 better than most, recording no deaths and a relatively low number of infections, allowing Vietnam to re-open much earlier than other countries. Unless there is a second wave the economy has probably passed the trough.

Secondly, a number of economic indicators have held up rather well. Google data suggests that average non-residential mobility is now only 11% below its baseline levels, the best pace of recovery among ASEAN markets. Industrial production and exports have grown this year despite Covid-19, the decline in retail sales has been limited to less than 5%, and the equity market has bounced back quickly.

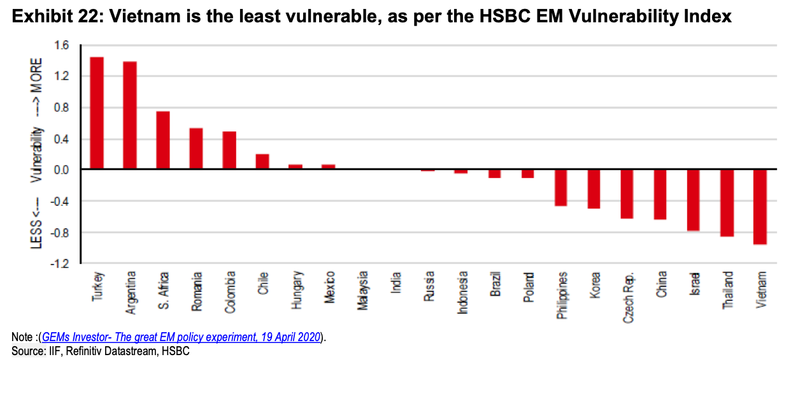

Thirdly, Vietnam is the only economy in the region where HSBC forecasts positive economic growth for 2020. Murat Ulgen, HSBC’s Global Head of Emerging Markets Research, argues that it is the least vulnerable to macro shocks, based on his HSBC Emerging Market (EM) vulnerability index.

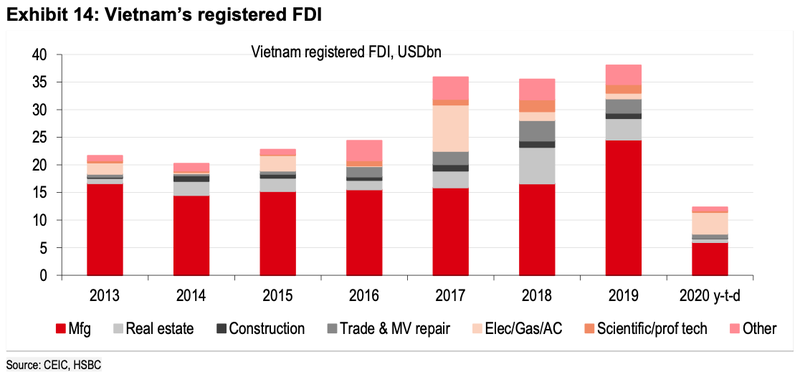

Fourthly, EM countries are chasing companies to get more FDI, but companies are chasing Vietnam to move there.

The country’s share of world exports has been rising rapidly and this is not just because of US-China trade tensions. Its role in Asian supply chains has been increasing for years and is set to expand further. While other markets are grappling with Covid-19, Vietnam has got back on its feet quickly and is poised to emerge stronger as companies re-evaluate and diversify their supply chains.

Companies were looking to move to Vietnam well before trade tensions became an issue. Vietnam offered lower costs, favorable tax policies, geographic advantages, relatively better infrastructure, and a young and skilled labor force. Trade tensions have accelerated this shift as companies looked to de-risk and diversify their supply chains.

The demand is clearly there and is growing. However, the main obstacles are on the supply side, given Vietnam’s relatively small size and limited resources, and a high level of dependence on China for imports. However, HSBC expected that the country has enough resources for the next 3-5 years in terms of land, labor, and electricity.

This should become increasingly important now that Covid-19 has highlighted the importance of shifting production out of China as companies move to diversify their supply chains and reduce their dependence on a single country for production and raw materials.

Therefore, FDI into Vietnam should accelerate post Covid-19. Industrial real estate continued to see demand in the first quarter. A Jones Lang LaSalle (JLL) report suggested that land prices rose 12% year-on-year during the period.

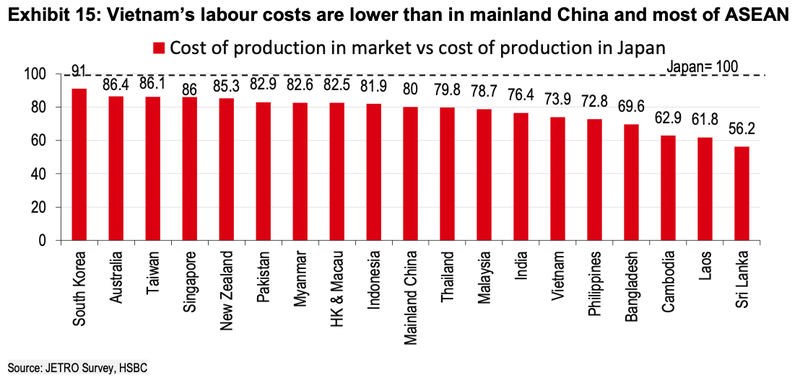

On average, manufacturing an item in Vietnam costs 73.9% of what it would in Japan. Across the region, only the Philippines, Cambodia, Sri Lanka, and Bangladesh have lower manufacturing costs. But these markets usually make less sophisticated products and don’t have the same level of manufacturing capabilities as Vietnam.

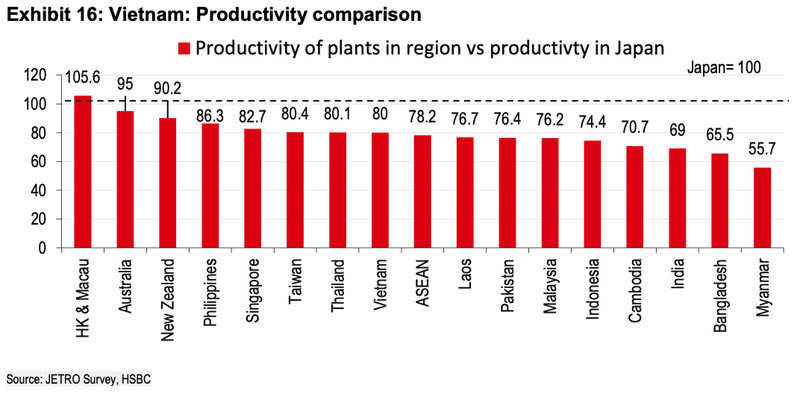

Fifthly, there have been concerns about productivity, especially given the increase in land prices and wages. But HSBC expected that Vietnam continues to provide an attractive balance between cost and productivity. Due to strong demand from firms and this attractive trade-off between costs and productivity, Vietnam is moving up the value chain. In addition to its huge production presence, Samsung has also opened an R&D center. The Apple eco-system is also moving to Vietnam through the assembly of AirPods. Several districts within Ho Chi Minh City have been combined to develop a “Vietnamese Silicon Valley” – a combination of hi-tech park, university precinct, and new financial center.

Sixthly, elsewhere in the region corporate balance sheets have taken on more leverage and interest coverage ratios have fallen. In Vietnam, leverage is declining and interest coverage ratios are on the rise.

Seventhly, over the past five years, the currency has depreciated the least among regional markets. Vietnam, which is a sub-investment grade bond market, has sovereign yields that are much lower than investment-grade markets such as Indonesia and India. The equity market has outperformed too.