US makes strong inroads into Vietnam power sector: Fitch Solutions

There are also strong involvement of Japanese, Korean and Thai companies, which have all expressed interest to develop the LNG power industry in Vietnam.

The US have been making strong inroads into Vietnam’s liquefied natural gas (LNG) and power sector in recent months, with an aim to boost bilateral trade of the fuel, particularly as the Vietnamese government plans to import more large-scale LNG from the US, according to Fitch Solutions, a subsidiary of Fitch Group.

The US Exim Bank and the US International Development Finance Corporation are looking to provide US$100mn in financial support for power producers in Vietnam to purchase LNG.

A US-Vietnam joint venture, Chan May LNG, plans to invest US$6 billion for a project in Thua Thien Hue province, which will include a 4GW power plant and LNG terminal and storage facilities. The project has been backed by the US government, and is expected to start construction in Q1 2021, and targets the first phase of commercial operations in 2024.

Additionally, Millennium Group has announced plans to develop a LNG project in the South Van Phong area in Khanh Hoa. The project will include a LNG terminal with a capacity of 180,000 cubic meters, a dock warehouse system, and four LNG-to power plants with a total combined capacity of 9,600MW. The project is still subjected to approval from the provincial authorities, but has also been backed by the US government.

Beyond the US, there are also strong involvement of Japanese, Korean and Thai companies, which have all expressed interest to develop the LNG power industry in Vietnam, Fitch Solutions added.

Prime Minister Nguyen Xuan Phuc has issued a directive to the Ministry of Industry and Trade (MoIT) to include the Mui Ke Ga LNG project to the National Power Development Plan (2021-2030). The project includes a multi-phased gas-fired power complex and a floating storage regasification unit in Binh Thuan. The project is developed by a consortium led by Energy Capital Vietnam and Korean Gas Corporation, and is targeting a final investment decision in late 2021, and commercial operation by 2025.

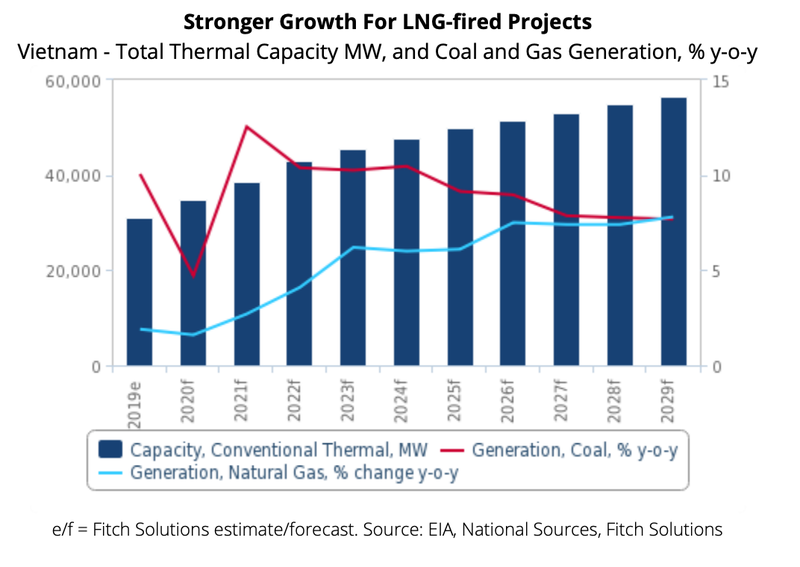

There are now approximately 26GW worth of gas-fired power projects in the pre-final investment decision (FID) phase in Vietnam, which are slated to come online between 2023 and 2029.

That said, Fitch Solutions noted that the lack of FIDs to date means that some of these projects are inherently exposed to a certain level of risk, including delays at the bureaucratic level. Moreover, there are no new gas-fired projects that have begun construction yet as at time of writing.

Concurrently, Fitch Solutions believed that several coal projects that are still in its early stages are unlikely to go through, given the increasing pushback against the fuel due to environmental concerns.

Fitch Solutions stated there is a gradual shift in trend away from coal as LNG-fired projects become increasingly viable for the country. The National Steering Committee for Power Development has recommended scaling the share of coal down for the upcoming Power Development Plan (PDP) VIII, eliminating nearly 15GW of planned coal projects and for coal to account only 37% of Vietnam’s electricity by 2025, due to slow progress and environmental oppositions in some coal projects. There is yet a decision to be made on this, and the MoIT is expected to present a draft on the new power development plan in October 2020.

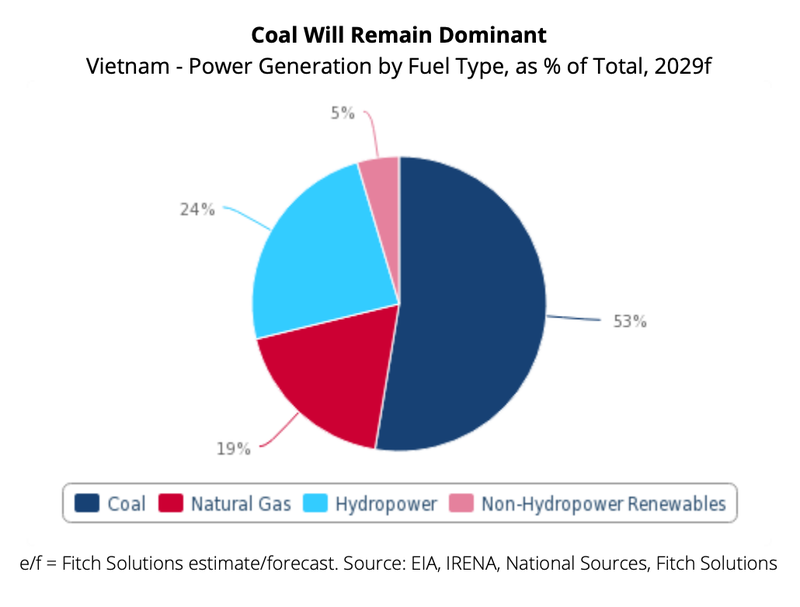

Coal to remain dominant

While coal projects that are still in its early stages face a high risk of derailing in preference for LNG, the large backlog of coal projects and an ongoing commitment towards coal will continue to support growth over the coming decade, Fitch Solutions asserted.

That said, there is already a substantial amount of capacity under construction at present, and it is unclear how the government will halt the development of these projects without incurring significant compensation costs. Furthermore, Vietnam has been dealing with looming threats of power shortages over the coming years and is in fact trying to fast-track the development of some of these projects since 2019.

According to Fitch Solutions’ Key Projects Database at present, there is still 17.5GW of coal power plants that are already under construction, and almost another 33GW under pre-construction stages.

The government initially had a coal capacity target of 106GW by 2025, and for an additional 55GW of coal capacity from 2017 to 2030. As such, even if the government decides to cancel 15GW worth of coal projects, it is merely scaling back on the excess capacity in the pipeline, as opposed to any structural shift away from coal, at least over the coming decade.

Fitch Solutions forecast less than 20GW of coal-fired plants to come online by 2029, which still remains significantly lower than the government’s new lowered targets even if it goes through for the upcoming power development plan.