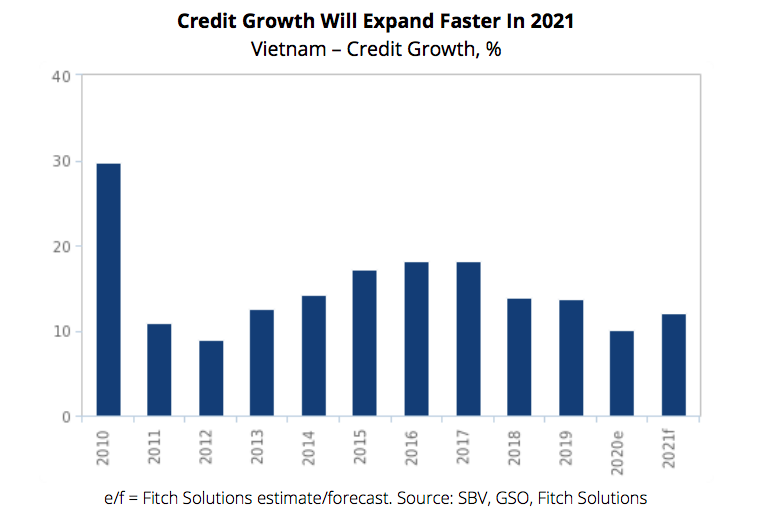

Vietnam credit growth forecast to hit 14% in 2021: Fitch Solutions

A GDP growth of 5.8% in 2021, nearly double the 2.9% growth last year, would boost credit demand.

Vietnam’s credit growth is forecast to expand by 14% in 2021, higher than the growth rate of 12.1% recorded last year, according to Fitch Solutions, a subsidiary of Fitch Group.

“We project GDP growth of 5.8% in 2021, twice as fast as the 2.9% gain posted in 2020, so improved economic conditions should result in stronger credit demand, particularly given already low interest rates,” stated the Fitch Solutions in a note.

Fitch Solutions previously forecast Vietnam’s GPD growth at 8.6% in 2021, however, a lower estimate came as tourism has not recovered as expected, added Fitch Solutions.

“Borders are not likely to reopen until a significant proportion of the population has been vaccinated,” stated Fitch Solutions, but, according to Oxford University data, just 0.69% of the population had received their first dose as of May 5.

As further support, Fitch Solutions expects the State Bank of Vietnam (SBV), the country’s central bank, to hold its policy discount and refinancing rates at 4.00% and 2.50%, respectively, particularly since inflation is within the central bank’s target range.

Consumer price inflation was nonexistent in 2020 but is likely to accelerate to average 6.8% in 2021. Due to base effects, inflation in the first half is likely to be higher than in the second half, allowing inflation to fall into the central bank’s target range before the end of the year.

With the global economy beginning to recover, Vietnam’s export sector is expected to benefit. However, the shortage of shipping containers and higher shipping costs could limit the contribution of manufacturing to the economic recovery. In addition, the global recovery may be uneven which may also constrain export growth and, by extension, the demand for Vietnamese manufactures.

| Customers at a Vietinbank branch in Hanoi. Photo: Kinhtedothi |

On the positive side for growth, the construction sector is likely to benefit from higher public spending in 2021. In addition, the implementation of the public-private partnership law since January 1 2021 should result in faster implementation of capital projects. That said, the SBV has recognized that banks are taking on more risk in the property sector and is actively trying to reduce risk in real estate.

Loans to purchase automobiles would likely support the credit growth acceleration in the second half of 2020 as the government slashed vehicle registration fees by 50% for the purchase of domestically-produced vehicles until the end of 2020.

“If the timeframe for lower registration fees is extended, then we could see additional tailwinds to credit growth coming from the vehicle sector,” said Fitch Solutions.

Fitch Solutions, however, warned any reduction in domestic activity from the further spread of Covid-19 could result in weaker economic growth than its forecast.

“Since asset prices, both physical and financial, surged in Vietnam at the end of 2020, any restrictions in credit extension to reduce risk in the banking sector could result in weaker credit growth,” it concluded.

With Hanoi’s consumer price index (CPI) in the first five months declining by 0.5% year-on-year, the city remains on track to realize the inflation growth target of below 4% for this year. In May, the city’s CPI rose by 1.8% against April and 0.43% year-on-year. |