Vietnam forecast to see narrower current account surplus in 2020

Fitch Solutions forecast Vietnam to record real GDP growth of 3.0% in 2020, and the global economy to contract by 4.0%.

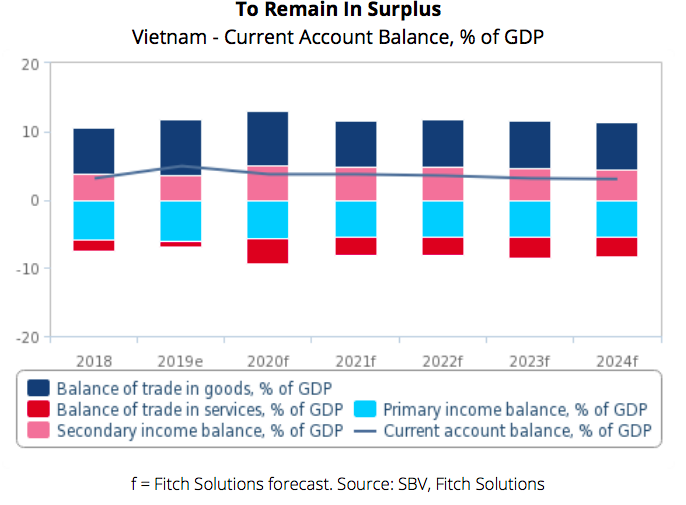

Vietnam’s current account surplus is set to narrow to 3.7% of GDP in 2020, down from 4.9% in 2019, mainly due to the collapse in tourism causing a sharp fall in the services trade balance, according to Fitch Solutions, a subsidiary of Fitch Group.

Meanwhile, the primary income deficit is likely to narrow slightly on the back of Vietnam’s economic growth outperformance relative to the global economy, which will support profits for foreign investors and by extension, the income paid abroad, stated Fitch Solutions.

Fitch Solutions said the external goods trade balance is likely to remain fairly stable, considering the high composition of intermediate goods in Vietnam’s imports for use in export manufacturing, which see both exports and imports track each other closely.

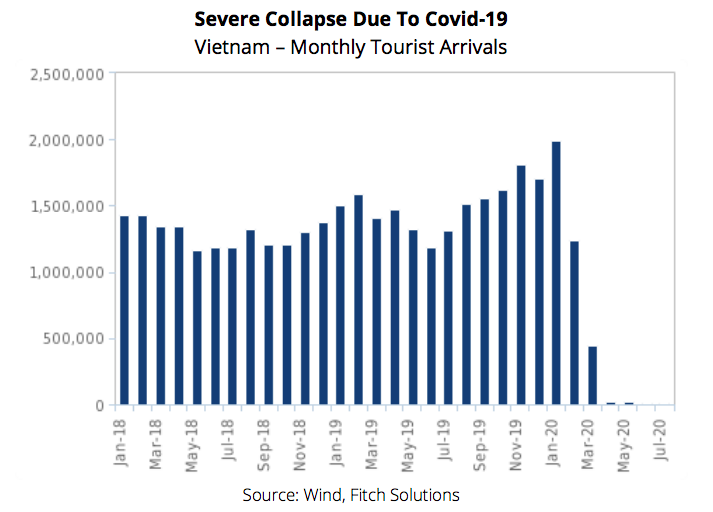

According to Fitch Solutions, the collapse in tourism as a result of Covid-19 induced travel restrictions would cripple services exports.

Indeed, following border closures, tourist arrivals have fallen significantly from generally above a million every month to below 30,000 from April to July. While services imports are likely to fall due to weaker global and domestic economic activity, Fitch Solutions expected stronger domestic growth relative to other economies globally to blunt the decline in services import demand.

Fitch Solutions forecast Vietnam to record real GDP growth of 3.0% in 2020, and the global economy to contract by 4.0%.

The primary income deficit is likely to narrow slightly. This is because Vietnam, having transformed into an export hub and being a strong beneficiary of supply chain diversification trends from China, should continue to experience resilience in exports over the year.

Vietnam’s multitude of free trade agreements, favorable business and labor environment help it grow its market share of global exports despite a fall in aggregate global demand, Fitch Solutions explained.

This should support the returns for foreign businesses which have set up export manufacturing sites in Vietnam, and their associated investment income remitted back home. Accordingly, Fitch Solutions forecast only a 5% fall in primary income payments abroad to about US$17 billion, but a 33% fall in receipts to US$1.5 billion due to a weak economic environment externally.

The goods trade balance is likely to remain fairly stable as a minor contraction in imports is somewhat matched by a corresponding fall in exports. This is because intermediate inputs, including fabric for exports apparel production and components for exports consumer electronics manufacturing, account for more than 50% of total imports, according to Fitch Solutions’ estimates.

Fitch Solutions expected the positive goods trade balance to offset the sum of the services trade deficit and net primary income payments. Finally, Covid-19 grants from multilateral organizations such as the World Bank and other transfers from overseas persons and entities should keep Vietnam’s secondary income balance positive as it has been since 2012.

Current account to remain surplus in next decade

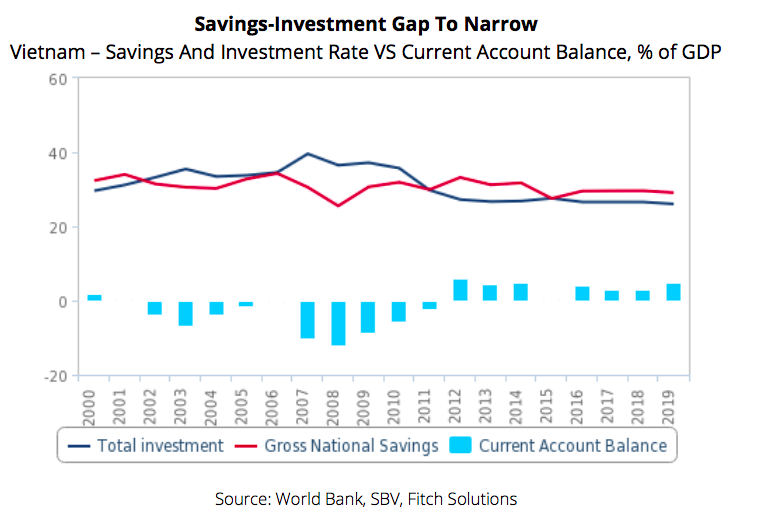

From a savings-investment perspective, Vietnam’s negative savings-investment gap flipped positive since 2011, correspondingly seeing the current account post surpluses thereafter.

Since then Vietnam has been a net direct investor overseas and Fitch Solutions expected this current account surplus to continue but narrow over the coming decade.

Risks to Vietnam’s external financing position will remain low over the coming decade. Vietnam’s foreign reserves, at US$82.84 billion as of May 2020, represents four months of import cover.

While this may appear to just cover the minimum of three months required, Fitch Solutions flagged that Vietnam’s reserve position is actually stronger than it seems. This boils back to the fact that Vietnam’s imports comprise largely of inputs for exports. If focused on only imported goods for local demand, the figure would be almost eight months of import coverage.

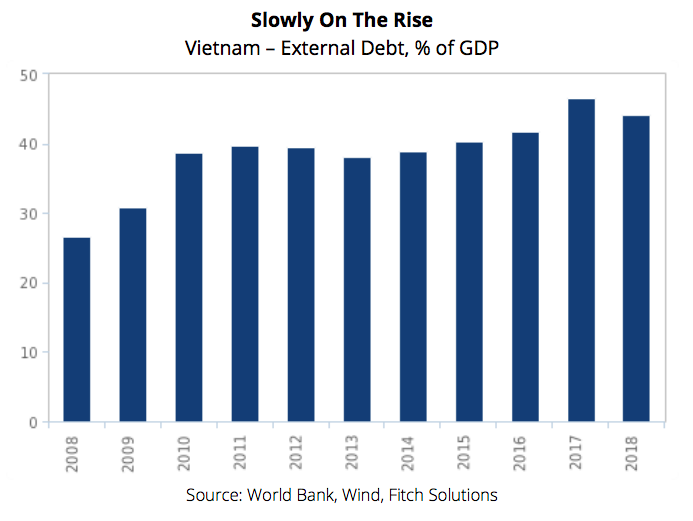

Additionally, there are limited risks from Vietnam’s growing external debt burden. According to World Bank data, Vietnam’s external debt level was at 44% of GDP in 2018, and has been on an uptrend since 2008 when it was 27% of GDP. Given that more than 80% of total external debt is in the form of long-term debt, Fitch Solutions did not see major risks stemming from the need for high debt repayments over the short term, especially considering the low interest rate environment the world has been in for the past decade.