Vietnam manufacturing activity returns to growth in December

Firms are confident looking ahead to the coming year, with hopes that export demand in particular will recover should the Covid-19 pandemic be brought under control worldwide.

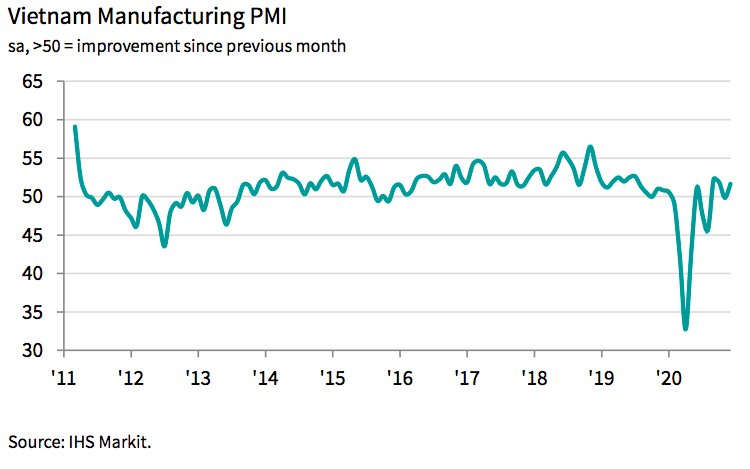

The Vietnam Manufacturing Purchasing Managers' Index™ (PMI) rose to 51.7 in December, up from 49.9 in November, signaling a modest improvement in business conditions in the Vietnamese manufacturing sector, the third in the past four months, according to Nikkei and IHS Markit.

A reading below the 50 neutral mark indicates no change from the previous month, while a reading below 50 indicates contractions and above 50 points to an expansion.

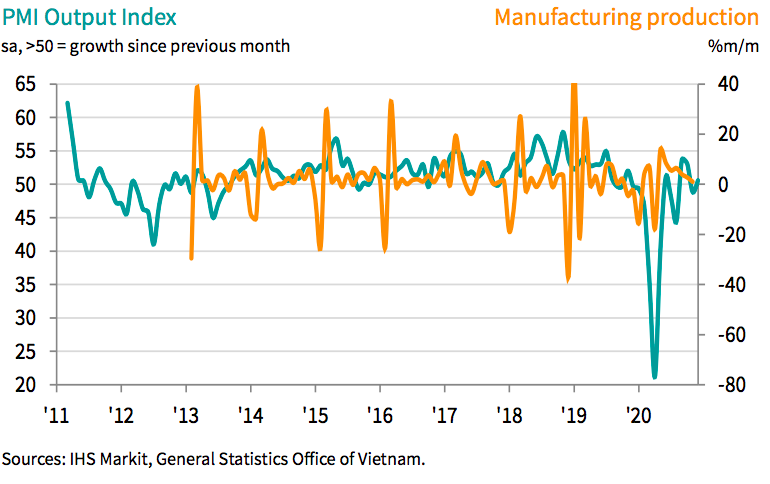

Data signaled a return to growth of manufacturing output as production volumes recovered from the storm-related disruption in the previous month. New order growth was central to the expansion in production.

“PMI data showed that the Vietnamese manufacturing sector ended 2020 on a positive note, as the temporary blip from storm disruption in November gave way to growth in output, new orders and employment in December,” said Andrew Harker, associate director at IHS Markit, which compiles the survey.

“The average PMI reading over the fourth quarter was the highest of the year, suggesting building momentum heading into 2021. Firms are confident looking ahead to the coming year, with hopes that export demand in particular will recover should the Covid-19 pandemic be brought under control worldwide,” he noted.

New business increased for the fourth successive month, and at a solid pace that was faster than that seen in November. Improving customer demand was reported by panelists. Demand also strengthened in international markets. New export orders increased for the first time in three months.

Higher new orders fed through to increased production requirements, thereby encouraging firms to expand their staffing levels. December saw employment rise modestly for the second time in three months.

Rising production and expanded workforce numbers meant that firms were able to reduce backlogs of work, and to the greatest extent since August.

In line with the picture for output and employment, purchasing activity returned to growth in December.

Manufacturers stay positive

However, difficulties securing inputs and rising costs were a feature of the latest survey.

"The main issue hampering growth at present appears to be severe supply-chain disruption, often linked to the pandemic. Firms are finding it hard to source materials, particularly those from abroad. In turn, prices are rising sharply, with input costs up to the greatest extent in two and-a-half years," stated Mr. Harker.

Supply shortages, disruption caused by the Covid-19 pandemic and particular issues importing materials meant that suppliers' delivery times lengthened markedly. In fact, lead times increased to the greatest extent since the height of the pandemic in April.

These challenges in securing raw materials contributed to a sharp increase in input prices. Moreover, the rate of input cost inflation quickened for the fourth successive month and was the fastest for two-and-a-half years.

Output prices also rose at a faster pace in December, albeit one that was still much weaker than seen for input costs. The increase in charges was the steepest since July 2018.

Despite difficulties sourcing materials, Vietnamese manufacturers were able to achieve a marginal increase in stocks of purchases. On the other hand, stocks of finished goods declined as firms used inventories to help fulfil new orders.

Manufacturers remained confident that output would increase over the coming year, with respondents expecting less disruption from the Covid-19 pandemic. Reports suggested that this would be especially true for export demand, which was severely impacted during 2020.