Vietnam might lose position of leading SE wind market: GWEC

Steep reduction of feed-in-tariff (FIT) is believed to derail investment in new and planned wind projects in Vietnam.

The Global Wind Energy Council (GWEC) has warned that Vietnam might lose its current position as a leading wind market in Southeast Asia if the country proceeds with a feed-in-tariff (FIT) reduction plan for wind power in the next few years.

| A wind farm in Vietnam's central province of Ninh Thuan. Photo: Thuc Trinh/VnExpress |

In a press release on December 3, GWEC said the Vietnamese government’s proposed FIT reduction for onshore and intertidal wind power by respective 17.4% and 13.6% could “seriously damage” Vietnam’s wind market.

GWEC called the move is one of the most “dramatic” reductions seen for wind power globally, saying that this FIT cut threatens to deter investment and derail the long-term growth.

GWEC made the press release following the Vietnamese government’s recent decision to approve an extension of FIT scheme for wind power submitted by the Ministry of Industry and Trade (MOIT).

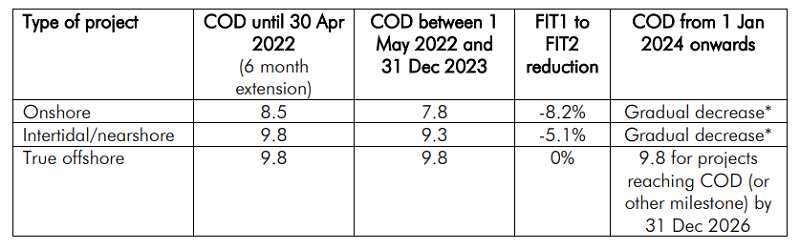

The proposed new FIT rates, which will be 7.02 US cent/kWh for onshore wind and 8.47 US cent/kWh for intertidal/nearshore wind, would apply to projects commissioned from November 2021 to December 2023.

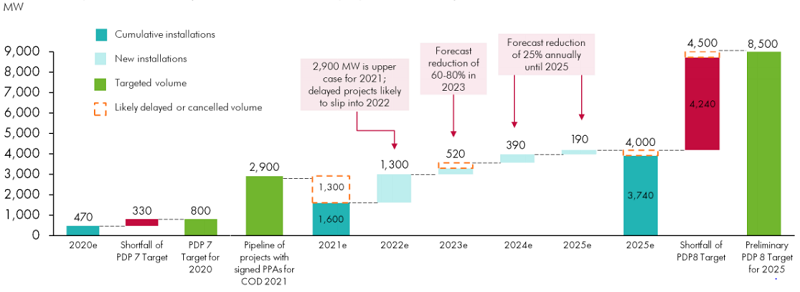

| Vietnam wind power installations (effects of Covid-19 and proposed wind FIT 2). Source: GWEC |

Why does reduction matter?

GWEC, based on market forecasts and experience in other wind markets, said such FIT cut would derail investment in new and planned wind projects in Vietnam.

In addition, difficulties in the Covid-19 pandemic together with challenges in an early stage of the wind market would dishearten investors and hurt Vietnam’s new wind capacity that is expected to increase by up to 80% in 2023, and a further 25% per year thereafter.

Thousands of people would be deprived of job opportunities and billions of dollars in inward investment would be missed following the reduction.

GWEC estimated that the slowdown would result in around 4 gigawatts (GW) of total installed wind power capacity in Vietnam by 2025 – far below the country’s potential and a likely drastic shortfall from government targets, given the MOIT already records 2.9GW of projects with signed power purchasing agreements (PPAs).

Ben Backwell, CEO of GWEC said: “The wind industry is on the cusp of achieving economies of scale and cost reductions which will make Vietnam the leading wind market in South East Asia, but if the proposed FIT is implemented, it would jeopardize long-term development and ultimately result in higher energy prices at a time when the country’s energy demand is soaring.”

He said Vietnam should avoid creating a similar ‘boom and bust’ cycle so the country can benefit from the cost-competitive prices and socioeconomic benefits wind power can offer.

Mark Hutchinson, Chair of GWEC’s South East Asia Task Force said a steep reduction with no consideration for pandemic-related challenges will shrink Vietnam’s wind project pipeline and lead to a likely shortfall of wind targets again in 2025.

| GWEC’s recommendations for the FIT2 scheme to MOIT, in US cents/kWh |

* As recommended by GIZ in its October 2020 report to MOIT, this could be a periodic decrease of 2.5% applied to the FIT for projects reaching COD from January 2024 onwards.

The current FIT for wind power was introduced in September 2018 and sparked investors’ interest, given Vietnam’s strong wind resource potential, rising power demand and decarburization goals.

However, GWEC Market Intelligence has downgraded its 2020 forecast for new wind power installations in Vietnam by 75% to 125 megawatts (MW) due to delays in the implementation of Law on Planning and disruptions from Covid-19.

This will bring cumulative wind capacity to only 472MW by the end of this year, which means that the country will miss its target of 800 MW of wind power capacity by 2020, set in the Power Development Plan VII, by 41%.

Notably, an installation rush was expected in 2021 ahead of the expiry of the current FIT, but prolonged delays mean much of the expected volume may spill over into 2022.

GWEC has recommended a 6-month extension of current FIT levels to allow projects in the current pipeline to come online, followed by a milder FIT reduction for onshore and intertidal/nearshore wind projects commissioned from May 2022 onward.

Vietnam is making efforts to diversify its power mix to feed the growing economy. Over the past years, the electricity prices have been keeping up. The increasing power prices have largely contributed to the commodity price hike, triggering public concerns over expensive cost in the country with per capita income of more than US$2,700.

Famous economist Pham Chi Lan more than once said the high power prices would affect people’s livelihoods, particularly the poor and it will also increase the cost of doing business.