Vietnam natural gas consumption forecast to more than double over next decade

US firms are spearheading the developments of 12 out of the 22 LNG-to-power projects in the pipeline worth a combined US$35.9 billion.

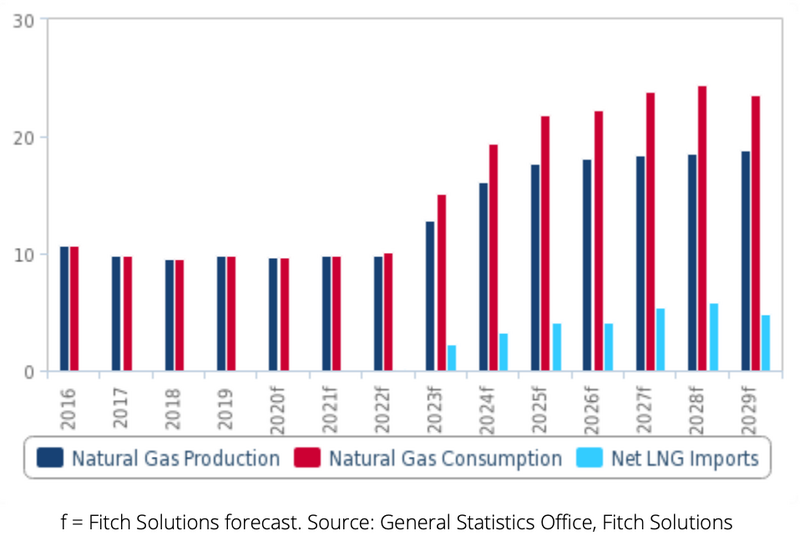

Vietnam's natural gas consumption is forecast to more than double over the course of the next decade as the start of liquified natural gas (LNG) imports allows domestic demand to surpass production for the first time, according to Fitch Solutions, a subsidiary of Fitch Group.

Demand growth is forecast to accelerate post-2022, coinciding with the start of first LNG imports via the Thi Vai LNG terminal in Ba Ria-Vung Tau, the first such facility in the country.

The development of Thi Vai LNG is being spearheaded by PetroVietnam subsidiary PV Gas, and will have the capacity to process 1.4bcm of LNG per annum.

Thi Vai has signed preliminary supply agreements with the likes of Gazprom, Shell and Premier Oil. US-based Alaska Gasline Development Corporation (AGDC) also signed a memorandum of understanding (MoU) to supply LNG to PV Gas in the future from its massive in-development 36bcm Alaska LNG project.

LNG To Unlock Demand Vietnam - Natural Gas Production, Consumption & Net LNG Imports, bcm. |

Improved supply availability beyond the constraints of declining production is expected to enable stronger gas adoption across different sectors, led by strong growth in power generation.

The Ministry of Industry and Trade (MOIT)’s master plan for the gas industry envisions the power sector to come to account for 70-80% of total domestic gas consumption by 2035 as gas-fired generation becomes more prevalent, next to more gradual uptakes across chemicals, industry, transportation and households.

Vietnam gov't pushing for LNG

Meanwhile, the government has stepped up the push for LNG so as to pre-empt a potential shortage in domestic gas but also as coal starts to face stronger opposition.

Vietnams’ gas consumption continues to be capped by production, which has registered three year-on-year declines in the past five years. The sector draws heavily on investment operations certificate (IOC) investments for growth, and as such has been dealt a heavy blow in recent quarters as the collapse in global crude prices and Covid-19 led these firms to slash spending.

The current medium-term output growth outlook is bullish, although contingent on the successful delivery of several large offshore projects, stated Fitch Solutions.

This, however, is by no means guaranteed amid continuous IOC investment pullbacks and rising maritime tensions with China, adding impetus to expedite other gas options. A forecast downturn in global LNG prices into the mid-2020s further adds to the fuel’s appeal, with Vietnam expected to be able to pick and choose from an array of different global suitors.

Vietnam Offers Growth Potential Selected Markets - Population (LHS) & Gas Share, % Of Total Power Generation (RHS). |

Investor interest into the domestic LNG sector is already on a rapid rise. Apart from China and India, Vietnam is among the least dependent on gas for power generation among markets in the Asia-Pacific, as coal has primarily been preferred.

However, the recent shift in government rhetoric indicates significant further upside for gas’ share in the domestic power mix. The government has stepped up its LNG project approvals in recent months. The upcoming National Power Development Plan (PDP VIII) applicable for the 2021-2030 period is due for submission to the prime minister for approval in October, and is expected to include a further seven LNG import terminals excluding the aforementioned Thi Vai and 22 LNG-to-power projects.

The National Steering Committee for Power Development has recommended scaling the share of coal down in the upcoming PDP VIII, eliminating nearly 15GW of planned coal projects and for coal to account for only 37% of Vietnam’s electricity by 2025, from 40.6% currently, due to slow progress and environmental opposition to some coal projects, lending further support to gas.

US firms spearheading development of LNG projects in Vietnam

The LNG projects pipeline is heavily backed by pledged funding from US-based firms for reasons both economic and geopolitical. US firms are spearheading the developments of 12 out of the 22 LNG-to-power projects in the pipeline, which are worth a combined US$35.9 billion in estimated fees and would add 36.6GW of new gas-fired generation capacity to Vietnam’s books over the next decade.

According to Fitch Solutions, expanding into Vietnam offers many advantages for the US. Its growing market for natural gas makes for an ideal complement for US LNG, as the outlook for future sales to the largest gas market in China turns murky amid souring bilateral relations between the two superpowers.

The US is forecast a near threefold expansion in its LNG exports over the coming years as new projects massive in scale are brought online, albeit amid a prolonged market glut, financing for most will be heavily reliant on the ability to lock-in demand from such as those in Asia.

As the tension between the US, its allies and China intensifies, the importance of infrastructure investments as proxies for larger underlying conflicts for geopolitical supremacy is expected to come that much more to the fore, stated Fitch Solutions.

Vietnam’s strategic placement allows the US to exert influence over a market right at China's doorstep, while also deepening its exposure to trade through the South China Sea, where China has been increasingly assertive in staking its historical claims.

China for its part remains keen to expand its downstream footprint across Asia as low global oil prices reduce the appeal of investing in the upstream. However, it has seen limited success in Southeast Asia owing to a checkered history of bilateral relations with regional governments due to circumstances surrounding the South China Sea and strong competition from global investors.