Vietnam parliament approves long-awaited PPP law

A shortfall of 25% compared to the initial financial plan would trigger the risk-sharing mechanism in public-private partnership (PPP) projects.

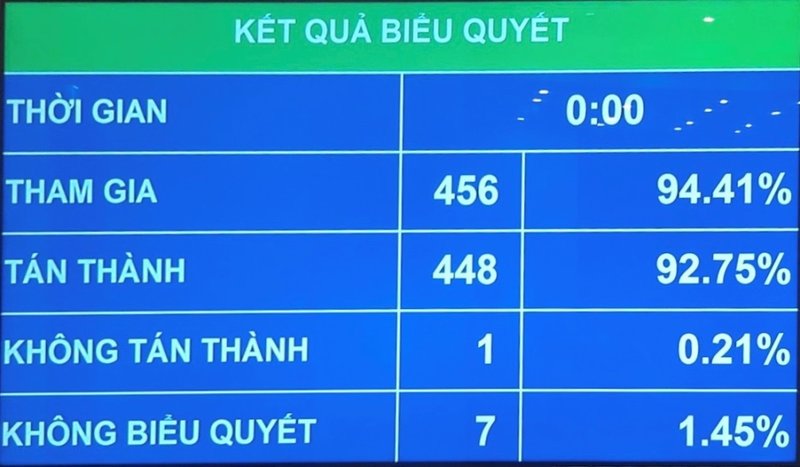

Vietnam’s National Assembly has approved the long-awaited public-private partnership (PPP) law with the endorsement of 92.75% of its deputies present.

| Vietnam’s National Assembly has approved the long-awaited PPP law with the endorsement of 92.75% of its deputies. |

Ahead of the voting, the NA Standing Committee informed there were opinions against the inclusion of build-transfer (BT) contract into the PPP law, saying this is actually not of public-private partnership nature.

Moreover, many deputies urged the suspension of new BT projects, which are causing severe economic consequences and frustration from the public, especially in cases where land used to exchange for infrastructure was often undervalued, causing huge losses to the state budget.

As a result, BT projects would not be regulated in the PPP law, while new BT projects would now be suspended from operation, starting from August 15.

The PPP law would consist of seven types of contracts, including: build – operate – transfer (BOT); build – transfer – operate (BTO); build – own – operate (BOO); operation and maintenance (O&M); build – transfer – lease (BTL); build – lease – transfer (BLT); or mixed contract.

The law also stipulates five sectors in which the PPP contracts are permitted, which are transportation; power plants and power grids (except for hydro-power plant and cases under state monopoly according to the Electricity Law); irrigation; clean water supply; water drainage, sewage and waste treatment; healthcare and education – training; and IT infrastructure.

Except for O&M contract, the PPP mechanism would only apply to projects with investment capital of at least VND200 billion (US$8.57 billion), and the such an amount is halved in poor provinces/cities.

Notably, the competitive bidding method would be applied for all PPP projects, while other methods such as competitive negotiation, direct contracting and selection of investors in special cases are subject to specific criteria.

The law maintained the government’s proposal on the threshold to trigger the risk sharing mechanism when the actual revenue is 25% less than the financial plan. On the contrary, when the actual revenue is above 125% of the plan, the government would request investors to share the increased revenue amount.

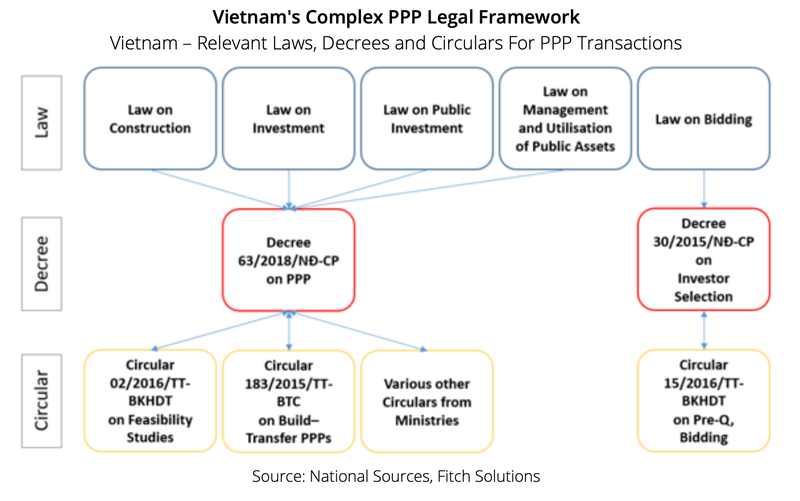

The introduction of this law would address the issue of lacking a unified legal framework governing PPP in Vietnam similar to that seen in some of its regional peers (e.g. the Philippines, Thailand).

| The introduction of this law would address the issue of lacking a unified legal framework governing PPP in Vietnam. |

Instead, there are provisions covering PPP dispersed in other pieces of legislation, such as the Law on Investment, Law on Construction and the Law on Bidding, government directives on PPPs alongside Decree 63. As such, in a bid to further improve the current PPP legal framework, the Standing Committee of the National Assembly had passed a resolution for the formulation of a PPP law back in 2017.

While certain types of government guarantees are provided for through various laws and decrees, the inadequacy of these guarantees and the lack of clarity of related articles and provisions have been a common stumbling block for foreign participation in Vietnamese PPPs.

Fitch Solutions, a subsidiary of Fitch Group, said a lack of a unified PPP legal framework is the main factor that Vietnam’s infrastructure sector growth potential is capped at 6.1% per year through 2029, despite having one of the fastest growing economies in the world.

Fitch forecast Vietnam’s economy to grow at an average of 6.4% year-on-year in real terms over the next decade through 2029, as it emerges as a choice for manufacturing hub and continues to attract foreign direct investments.

“A comprehensive PPP law is currently being crafted and discussed in Parliament. When passed, we believe the law will reduce project risk and be a boost to growth of Vietnam’s PPP market,” stated Fitch.