Vietnam remains among top 10 remittance recipients in 2019

Remittance, along with foreign direct and indirect investment and official development assistance, is a major source of Vietnam’s foreign currency supply.

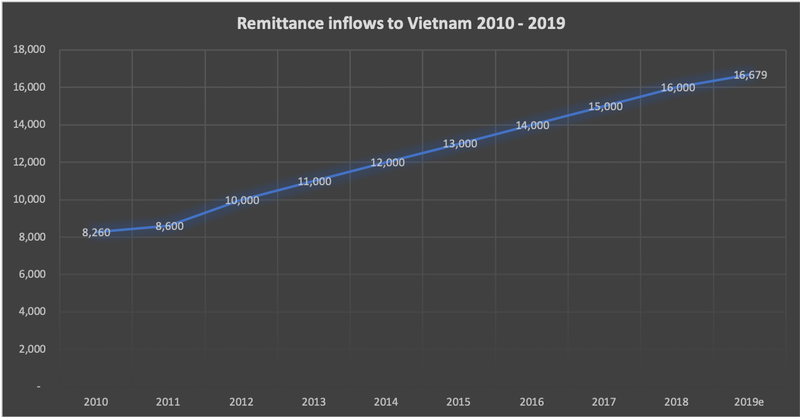

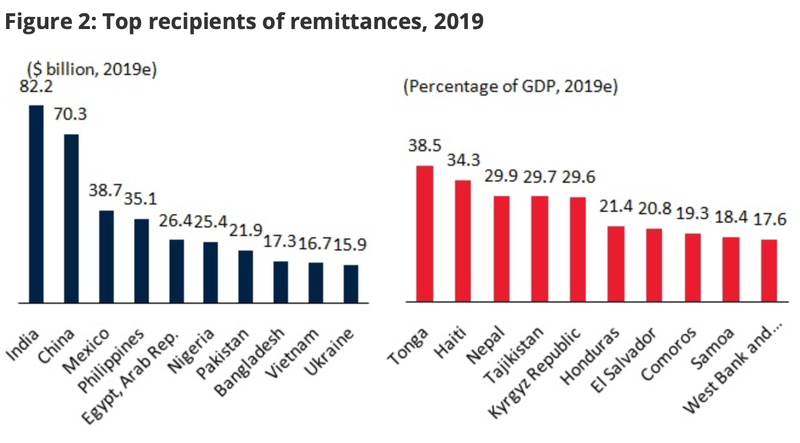

In 2019, in current US dollar terms, Vietnam is projected to be among the 10 largest remittance recipients with an inflow of nearly US$16.7 billion, or 6.4% of its GDP, a slight increase from the US$16 billion received in 2018, according to the World Bank’s latest data.

| Data: World Bank. Chart: Ngoc Thuy (Unit: million USD). |

This would be a third consecutive year that Vietnam continues to remain in the top 10 ranking in terms of remittance, reaching US$13.8 billion in 2017 and US$15.9 billion in 2018, respectively.

Over the last two decades, remittances to Vietnam have been increasing steadily, growing from over US$1.3 billion in 2000 and only declined once in 2009, due to the impact of the global financial crisis.

However, compared to the Philippines, another ASEAN country which is forecast to rank fourth in the list, the remittance inflow to Vietnam is only half of that of the Philippines at US$35.1 billion, or 9.8% of the Philippines’ GDP in 2019.

This year, the World Bank forecast countries in the top 10 ranking are India, China, Mexico, the Philippines, Egypt, Arab Saudi, Nigeria, Pakistan, Bangladesh, Vietnam and Ukraine.

| Source: World Bank. |

Chairman of the Ho Chi Minh City for Overseas Vietnamese said the growing remittance was thanks to an increase in number of Vietnamese working abroad.

Vice Chairman of the Vietnam Business Association of Overseas Vietnamese Peter Hong said earlier this year the Vietnamese community abroad totaled 4.5 million. In addition to sending remittances to Vietnam, overseas Vietnamese have been directly involved in investments and businesses in the homeland.

The remittances have been sent to the country through four channels – commercial banks, economic institutions, customs and posts. About 72% of the remittances are wired to Vietnam via commercial banks.

Annually, the proportion of remittance inflows as per GDP was 6-8% in the period 2006-2017 in Vietnam, much higher than that of other developing countries (which averaged about 1-2% of GDP).

Such flows, along with foreign direct and indirect investment, and official development assistance are major sources of Vietnam’s foreign currency supply.

According to the World Bank, the number of Vietnamese immigrants to Japan through official channel in 2018 is the largest among other countries and territories, standing at 68,700 out of 142,800 in 2018, followed by Taiwan (China) with 60,400 and South Korea with 6,500.

Japan also considers Vietnam one of its top nine suppliers of foreign workers.

Statistics from the International Labor Organization (ILO) in 2018 revealed the average monthly income of Vietnamese in Japan and South Korea was US$1,000 – 1,200, it was US$700 -800 in Taiwan, and US$400 – 600 in the countries in the Middle East.