Vietnam signals soft improvement in business condition at start of 2021

While the Vietnamese economy remains one of the better performers globally, there are significant headwinds that could prevent a return to the stellar growth rates seen pre-pandemic in the near-term at least.

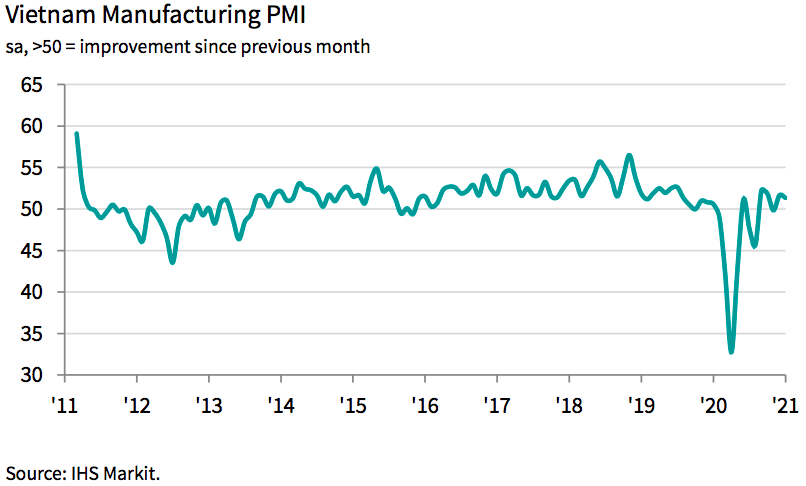

The Vietnam Manufacturing Purchasing Managers' Index (PMI) posted 51.3 in January, down from 51.7 in December to signal a softer improvement in business conditions at the start of 2021, according to Nikkei and IHS Markit.

A reading below the 50 neutral mark indicates no change from the previous month, while a reading below 50 indicates contractions and above 50 points to an expansion.

“The Vietnamese manufacturing sector struggled to gain momentum at the start of 2021, as the ongoing effects of the Covid-19 pandemic and substantial disruption to supply chains hampered operations,” said Andrew Harker, associate director at IHS Markit, which compiles the survey.

“The data suggest that while the Vietnamese economy remains one of the better performers globally, there are significant headwinds that could prevent a return to the stellar growth rates seen pre-pandemic in the near-term at least," added Mr. Harker.

New orders continued to rise, extending the current sequence of expansion to five months. There were some reports of customers increasing the size of their orders. That said, the rate of growth eased from December. Meanwhile, new export orders were broadly unchanged, with weakness noted in markets where Covid-19 case numbers remained elevated.

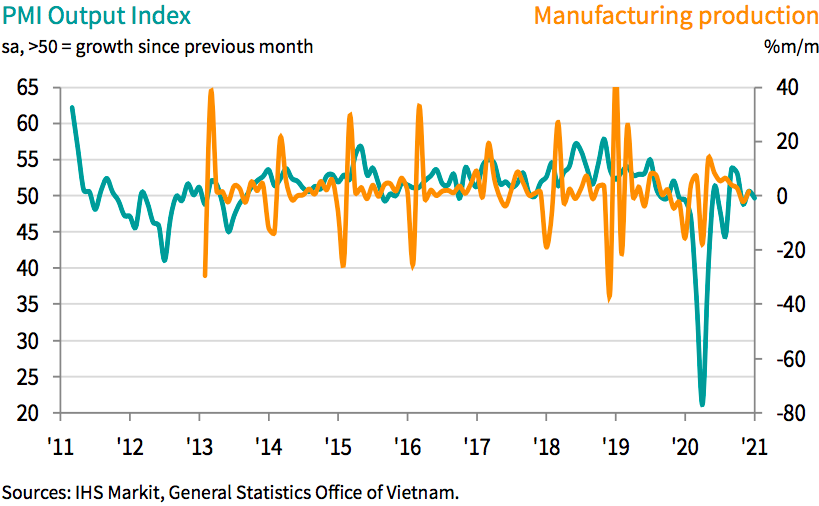

January saw a broadly stable picture for manufacturing production. While the rise in new orders supported increases in output at some firms, others reported that the effects of the Covid-19 pandemic continued to lead to falls in production.

The aforementioned increases in size of some orders started to impart pressure on capacity during January. Although backlogs of work decreased for the twelfth successive month, the rate of depletion was the softest in this sequence.

Manufacturers kept their workforce numbers broadly unchanged, following a rise in December. Some firms raised employment in response to higher new orders, while others noted a reduction amid the pandemic and staff resignations. Purchasing activity was also little-changed.

Efforts to secure inputs were stymied by severe disruption to supply chains again in January. In fact, the extent of the latest lengthening of delivery times was the greatest for almost a decade, except for during the worst of the Covid-19 lockdowns in March and April last year. Firms often reported a lack of shipping containers, as well as shortages of raw materials.

Issues with shipping and raw material supply added to inflationary pressures. The rate of input cost inflation quickened for the fifth month running and was the fastest since June 2018.

Output prices, meanwhile, increased for the fifth successive month, albeit at a modest pace that was much weaker than that seen for input costs. Efforts to guard against raw material price rises led firms to increase their stocks of purchases, the second month running in which this has been the case.

On the other hand, stocks of finished goods decreased, and to the greatest extent in five months.

Although manufacturers remained confident regarding the 12-month outlook, sentiment dipped to a five-month low amid concerns about the ongoing effects of Covid-19. Where firms were optimistic, this reflected hopes for a reduced pandemic impact and plans for investment and production expansions.