Vietnamese dong expected to average stronger in 2020: Fitch

Vietnam’s central bank is expected to pursue a stronger dong, especially as this might weigh on the recovery of the country’s export-oriented manufacturing sector over the coming months.

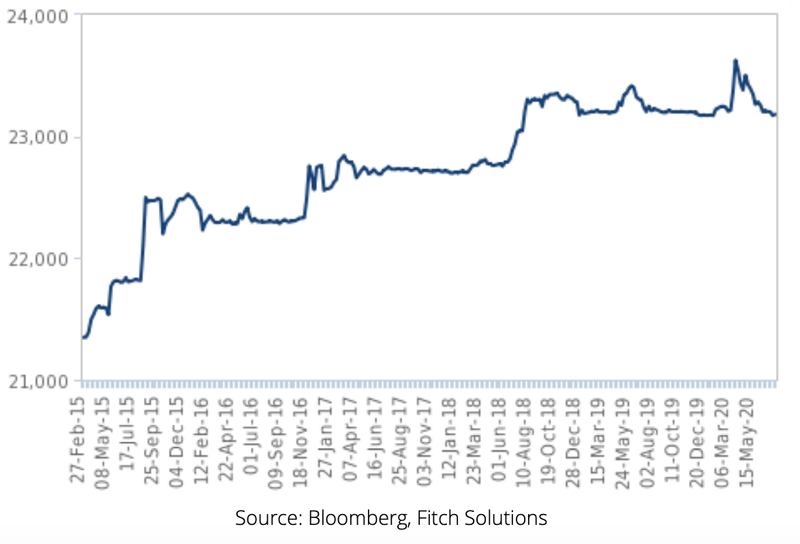

Although foreign direct investment (FDI) in 2020 is likely to be weaker than 2019 due to Covid-19, Fitch Solutions expected the Vietnamese central bank to continue intervening to maintain the Vietnamese dong (VND) stability over the coming quarters and have revised its forecast for the VND to average VND23,250/USD in 2020, from VND23,475/USD previously.

As of present, the VND has appreciated by 1.1% against the US dollar and has averaged VND23,290/USD in the year-to-date.

Relative Stability In 2020 Vietnam - Exchange Rate, VND/USD. |

Fitch Solutions, a subsidiary of Fitch Group, expected FDI inflow to be somewhat weaker in 2020 relative to 2019, adding this will provide less support to the dong. One key reason was Vietnam’s border closures in the second quarter due to Covid-19 having prevented investors from conducting site visits in Vietnam, which Fitch Solutions expected to impact FDI flow during the second half of this year.

While Vietnam has largely contained its domestic outbreak and eased restrictions for business travel, which should allow investors back in to the country, a lack of flights scheduled and also likely increased red-tape for business outbound travel approvals from the perspective of investors residing in foreign countries will continue to hamper FDI inflow to Vietnam.

Realized FDI for the first six months of 2020 was US$8.65 billion, 5% less than what was disbursed over the same period in 2019, and Fitch Solutions attributed the resilience so far to investments which have completed their due diligence up to the first quarter when borders were generally still open. Accordingly, it is expected realized FDI to lag further behind 2019 levels over the coming months.

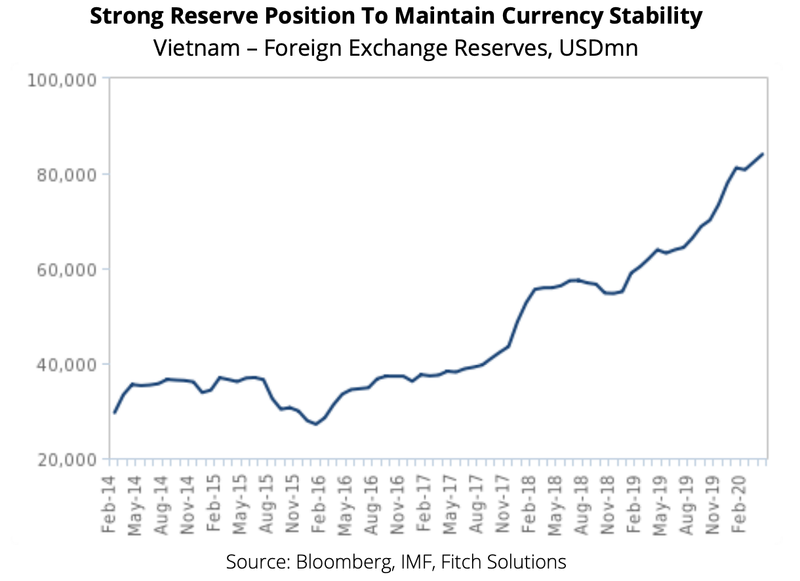

With a foreign reserve position of US$84 billion as of April, representing 3.9 months of imports, it is believed that the State Bank of Vietnam (SBV) has sufficient firepower to keep the dong stable over the coming months. Any effort to weaken the dong will be mild so as to avoid possible sanctions from the US given that Vietnam has remained on the US Treasury’s currency manipulator watchlist in its January 2020 report.

Being on the watchlist implies that Vietnam is still at risk of coming under punitive tariffs such as those levied on China, although these risks appear low, as the US will likely continue to reduce its dependence on Chinese exports by reorganizing its supply chain with other partners like Vietnam.

On the other hand, given that exports account for more than 100% of GDP in 2019, it is unlikely that the SBV will pursue a stronger dong, especially as this might weigh on the recovery of the country’s export-oriented manufacturing sector over the coming months hit by Covid-19.

Long-term outlook

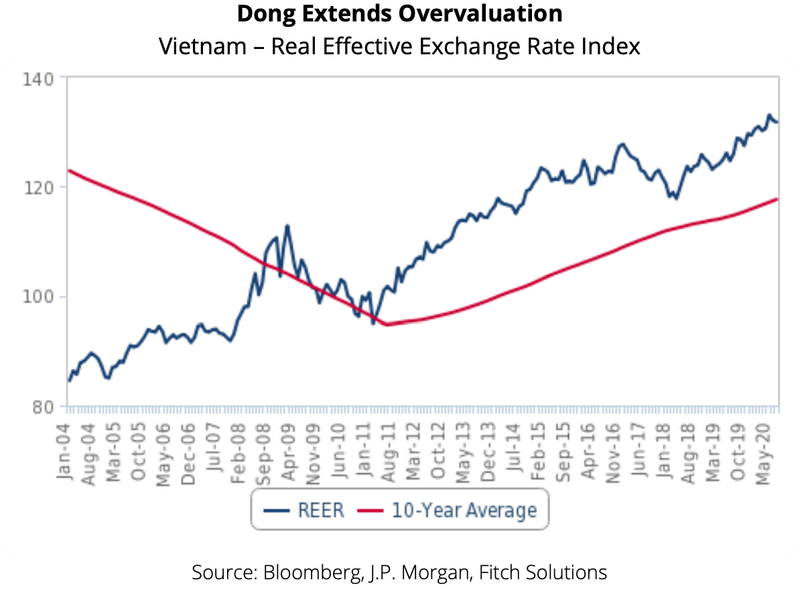

Fitch Solutions maintains its expectations for the dong to remain on a gradual depreciatory trend against the US dollar due to the dong’s persistent overvaluation and higher structural inflation in Vietnam versus the US, averaging VND23,400/USD in 2021.

The Vietnamese dong’s real effective exchange rate (REER) is trading 12% above its 10-year average, which suggests currency overvaluation. While it is likely that some of the strength in the REER could be attributed to productivity gains, an overvalued currency would in general still weigh on export competitiveness, dragging on export earnings and the strength of the dong.

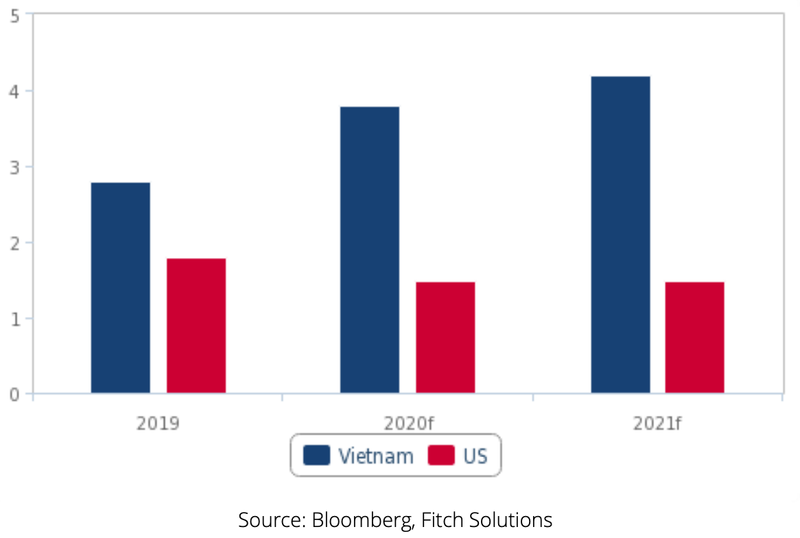

Higher Inflation In Vietnam Versus The US Vietnam And US – Average Inflation, %. |

Vietnam’s inflation is forecast to average 3.8% in 2020 and 4.2% in 2021, mainly on the back of food inflation due to rising animal protein prices as a result of continuing supply shortages.

African swine fever, which ravaged Vietnam in 2019, reduced the country’s hog herd by about a fifth and Fitch Solution expected pork production to only recover somewhat closer to 2023.

A shortage of pork will spur consumers to turn to other substitutes, and this will raise prices of animal protein across the board. Moreover, global supply lines could be disrupted for longer by movement restrictions driven by Covid-19, and as such obtaining imports to ease the supply crunch could also be challenging. This suggest that food inflation is likely to remain elevated for some time.

That said, this is likely to be partially offset by transport price deflation owing to low global oil prices amid a supply glut, and easing inflation in housing and construction materials due to a decline in construction activity amid movement restrictions put in place to contain the Covid-19 outbreak domestically.

Meanwhile, Brent oil prices are predicted to average US$44 per barrel in 2020, down from US$64.17 in 2019, reflecting Fitch Solutions' view for there to be some, but not extreme deflation in fuel and transport prices. High inflation would weigh on Vietnam’s export competitiveness in addition to incentivizing imports, which combined, would pressure the dong weaker over the long run.