Excluding flag carrier Vietnam Airlines, 347 non-financial stock exchang-listed firms in Vietnam maintained positive growth in the third quarter against the same period of last year, showcasing a V-shaped recovery during the process, according to a study by financial data provider Fiin Group.

|

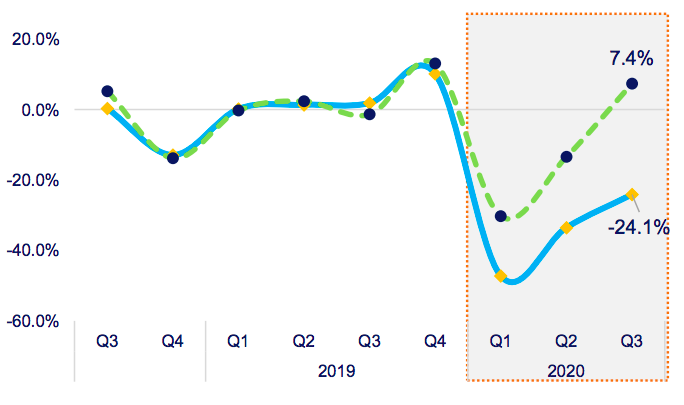

| Excluding flag carrier Vietnam Airlines, profits of 347 non-financial firms expanded by 7.4% year-on-year in Q3. Source: FiinGroup. |

While Vietnam Airlines is still struggling with an estimated loss of VND5.64 trillion (US$242.44 million), profits of these remaining non-financial firms expanded by 7.4% year-on-year in the first nine months of 2020, equivalent to the rate recorded in the pre-Covid-19 period.

Specifically, earnings before interest and taxes (EBIT) of these 348 public firms declined by 12.4% year-on-year in the third quarter, or one third of the decline in the second quarter. This showed core business activities of all non-financial firms have significantly improved once the Covid-19 pandemic was put under control.

|

| Chart: Ngoc Thuy. Data: FiinGroup. |

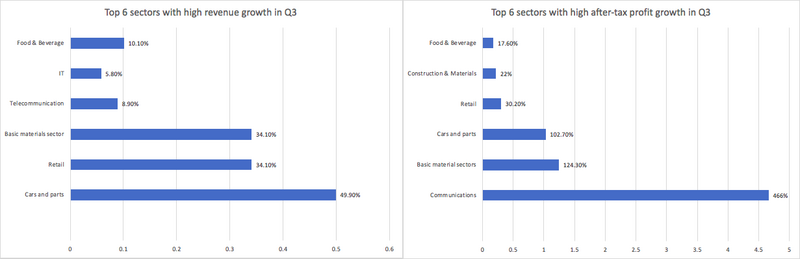

Notably, a number of sectors recorded strong growth in both revenue and profit, including the automobile and retail.

Revenues from the retail sector in the third quarter rose 7-fold against the previous one, while profit growth was over 30% year-on-year, with Digiworld (DGW) and PetroVietnam General Services Corporation (PSD) being major contributors.

FiinGroup attributed high demand for electronic products and smartphones during the Covid-19 outbreak to positive business results of these retailers.

For financial companies, including commercial banks, insurance and securities firms, their revenues in the third quarter rose by 7.1%, higher than the growth rate recorded in the second quarter, and profit growth was 4.5%.

The result, nevertheless, remained positive amid the economy facing severe impacts from the Covid-19 pandemic, stated FiinGroup.