Who dominates the e-commerce markets in Q3?

Three e-commerce platforms are the most popular multi-vendor ones across Vietnam, Thailand and Malaysia.

Shopee, a Singapore-based company, has taken hold of most of the market share in term of website traffic across three countries Vietnam, Thailand and Malaysia.

| The company takes hold of most of the market share in Vietnam's e-commerce market. Photo: Shopee |

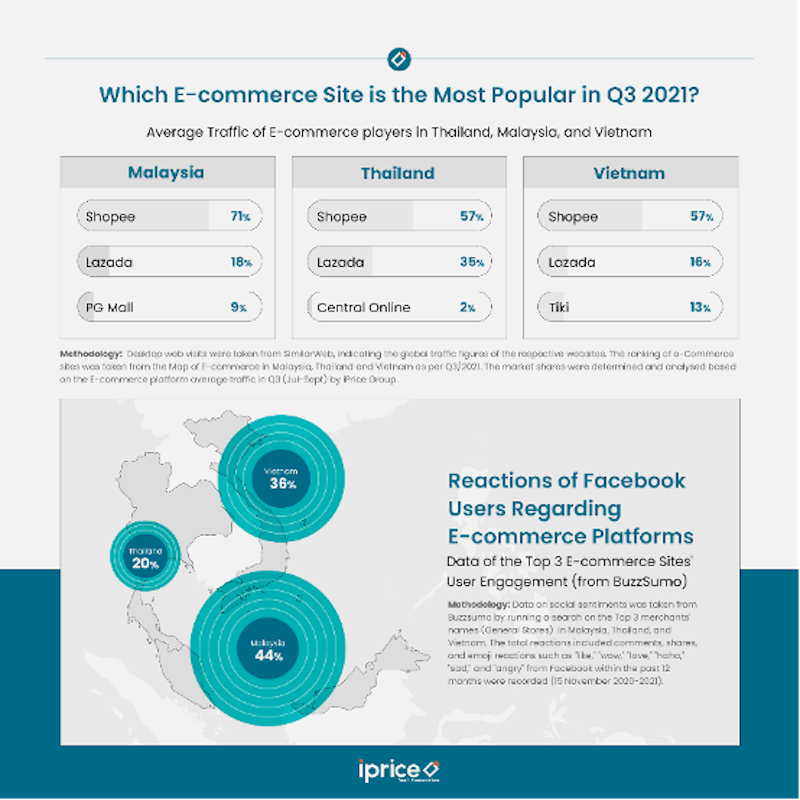

According to the latest iPrice study with data from SimilarWeb, in Vietnam, Shopee obtained 57% of the website traffic from all multi-vendor e-commerce sites in the third quarter (Q3).

Meanwhile, Tiki and Lazada Vietnam took 16% and 13% of the market, respectively. The remaining 14% of the rankings were evenly accounted for by the other platforms.

In Malaysia, Shopee held 71% of the region’s overall multi-vendor e-commerce website traffic, followed by Lazada with 18%, and PGMall with 9%.

In Thailand, however, the market share was divided between Shopee and Lazada. In particular, the two platforms account for 57% and 35% of the total website traffic respectively. The Central Online got only 2% of the total.

The e-commerce aggregator found an interesting trend in all three countries that local sites rank in the top three. Tiki (Vietnam), PGMall (Malaysia) and Central Online (Thailand) have done, relatively well in establishing themselves in their respective markets.

In addition, Vietnamese and Malaysians have the most social engagements relating to e-commerce sites.

Recognizing Facebook’s huge role in modern-day advertising and publicity for e-commerce events, iPrice Group also tracked Facebook users’ social sentiments on the top 3 multi-vendor e-commerce platforms.

Based on Facebook reactions, Vietnamese are the second-most engaged with e-commerce sites on social media, accounting for 36% of total social engagements recorded by iPrice. The data shows that users tend to drop “like”, “love” and “haha” in posts related to e-commerce.

Malaysians are the most active on social media when it comes to e-commerce sites, accounting for 44%, while Thai users only account for 20%.

| Chart: iPrice Group |

A Napoleon Cat report states that 81% of the entire Vietnamese population are Facebook users (as of October 2021). This goes to show that Facebook plays an essential role in effectively reaching the Malaysian market for any e-commerce announcements or events.

According to iPrice Group’s data, the overall website traffic of the top 10 in Vietnam was twice as much as Thailand’s and nearly three times as much as Malaysia’s in the third quarter of 2021.

“Vietnam has been and is becoming one of the rising markets in the e-commerce industry in Southeast Asia,” Nguyen Nhat Duy from iPrice Group said. “The post-Covid-19 era-when digital consumption has become a new way of life and digital merchants continue to rise -has most certainly positively impacted the size of the country's e-commerce market.”

This year, Vietnam's e-commerce market is expected to reach $13 billion, according to Google’s SEA e-Conomy report. It would grow by 32% in the coming years, reaching $39 billion in 2025, making it the second largest e-commerce market in Southeast Asia after Indonesia.