Covid-19 outbreak leads to sharp fall in Vietnam manufacturing output

Firms remained optimistic overall that output will increase over the coming year.

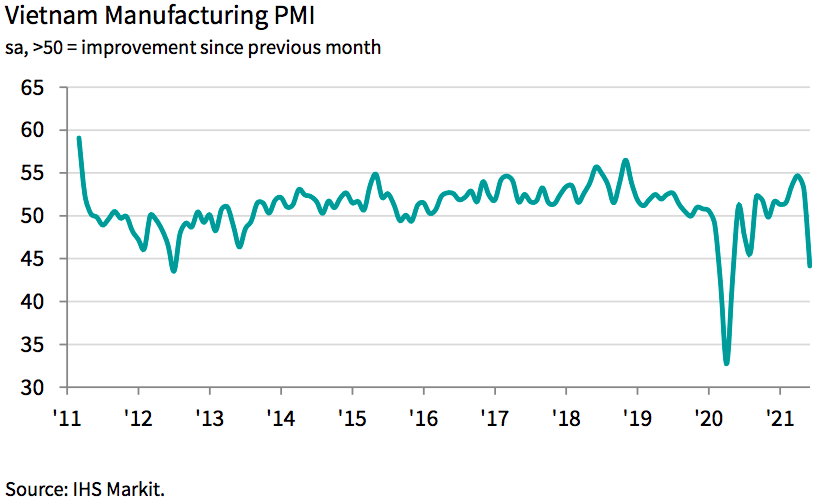

The Vietnam Manufacturing Purchasing Managers' Index (PMI) dropped sharply to 44.1 in June from 53.1 in May, the sharpest deterioration in business conditions for over a year, which ended a six-month period of growth, according to Nikkei and HIS Markit.

A reading below the 50 neutral marks indicates no change from the previous month, while a reading below 50 indicates contractions and above 50 points to an expansion.

“The June PMI data show clearly the impact of the latest wave of the Covid-19 pandemic on the Vietnamese manufacturing sector, with company shutdowns in areas facing restrictions, leading to sharp reductions in output and new orders across the sector as a whole. Firms responded quickly to a lack of workloads, scaling back their staffing levels and purchasing activity,” said Andrew Harker, associate director at IHS Markit, which compiles the survey.

"While less severe than after the outbreak of the pandemic in early-2020, the reduction in manufacturing output in June was stronger than anything seen prior to Covid-19 since the survey began more than a decade ago. Firms will therefore be hoping for a swift improvement in the health situation and the beginning of a return to more normal operating conditions," he noted.

According to the HIS Markit’s report, the Covid-19 pandemic, lockdown measures, and temporary company closures were all mentioned as factors leading to sharp reductions in both output and new orders during June.

Meanwhile, new business from abroad also decreased as transportation issues and container shortages exacerbated the impacts of the rise in virus cases.

These transportation issues, added to material shortages and restrictions linked to the pandemic, led to a marked lengthening of suppliers' delivery times,” it added.

In fact, the extent of delays was the second-largest on record, just behind that seen in April 2020. Manufacturers in Vietnam responded to falling workloads by cutting back their staffing levels and purchasing activity at the end of the second quarter.

| Production at New Wing Company in Van Trung Industrial Park, Bac Giang Province. Photo: Minh Linh |

Firms remain optimistic in the long-run

Employment decreased for the first time in five months, and at a sharp pace, that was the second-fastest since the survey began in March 2011. Similarly, purchasing activity fell at the fastest pace since the series nadir seen in April 2020 following the initial outbreak of the pandemic.

Declining input buying fed through to a steep reduction in stocks of purchases, while stocks of finished goods also decreased in June, following broadly no change in May.

Falling production and a desire to hold less stock amid declining new orders were behind the reduction in stocks of finished goods. Firms were able to deplete their backlogs of work for the first time in three months in line with lower new orders, and at a sharp pace that was unprecedented prior to the Covid-19 pandemic. There were signs of inflationary pressures easing in June as a lack of demand across the sector led to reduced pricing power.

Although input costs increased at the slowest pace in seven months, the rate of inflation remained above the series average amid reports of material shortages leading to higher prices. Metals were mentioned in particular as costing more. Output prices, meanwhile, rose only marginally as firms responded to a lack of demand.

Business confidence fell to the lowest since August last year, reflecting concerns about the ongoing impact of the pandemic. That said, firms remained optimistic overall that output will increase over the coming year.