European companies endorse Vietnam as investment destination

A large number of European companies foresee an improvement in the macroeconomic outlook for Vietnam in the first quarter of 2025.

European businesses endorse Vietnam as a top investment destination, underscoring the country's strategic importance in Southeast Asia, according to the European Chamber of Commerce in Vietnam (EuroCham Vietnam) in its Q4 2024 Business Confidence Index (BCI).

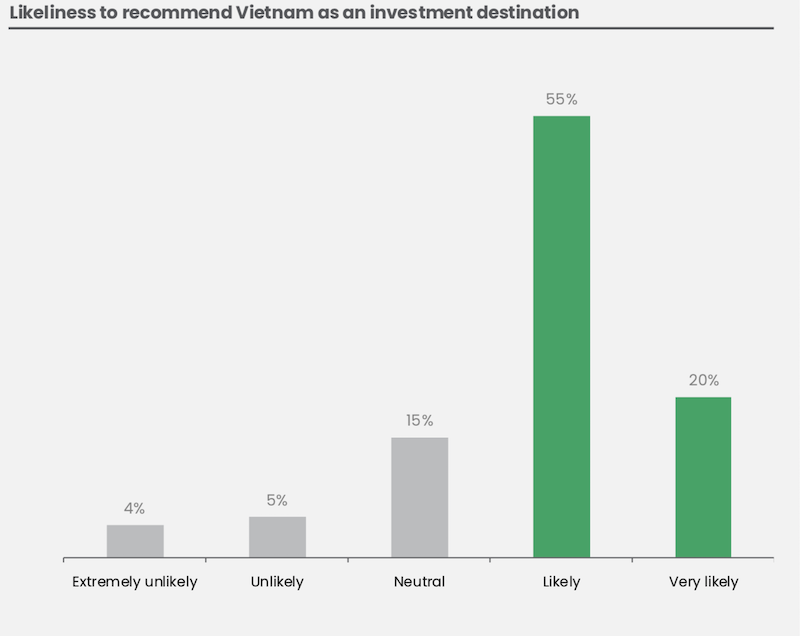

The survey found that 75% of European business leaders would recommend the country for investment. The combination of strong growth rates and expanding infrastructure positions Vietnam as an attractive option for European businesses seeking to expand their operations in the region.

| Chart from BCI report on the likelihood of EU companies recommending Vietnam as an investment destination. |

Thue Quist Thomasen, CEO of Decision Lab, said the data shows that European businesses in Vietnam are increasingly optimistic about the country’s potential as an investment destination.

He added that a significant proportion of businesses indicated plans to expand their operations in Vietnam. About one in four member companies are considering partnerships with Vietnamese suppliers or service providers, and more than one in five respondents are looking to expand their presence in the country.

"Another 30% are looking to increase their import/export operations and/or shift production to Vietnam. This move is consistent with Vietnam's successful geopolitical positioning amidst global trade shifts, especially in light of recent disruptions to global supply chains," he said.

Bruno Jaspaert, Chairman of EuroCham Vietnam, said that despite global challenges, Vietnam's positive investment climate is creating new opportunities for European businesses, especially in key sectors such as technology, manufacturing, tourism and renewable energy.

Improvements in macroeconomic outlook

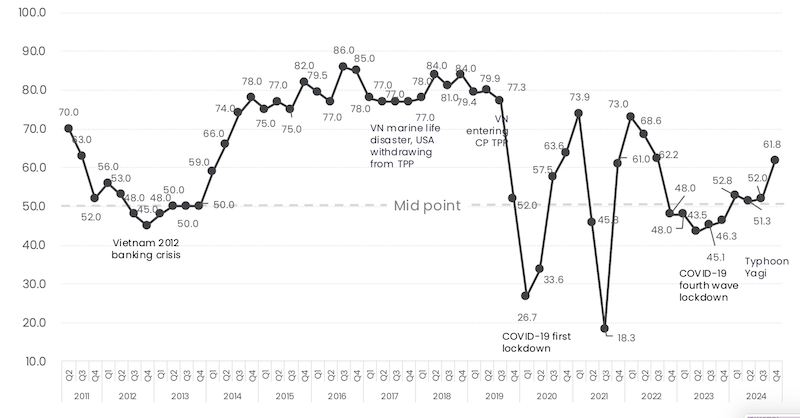

| Source: Q4 2024 BCI |

The Q4 2024 report indicates that the BCI has reached its highest level since early 2022, rising from 46.3 in Q4 2023 to 61.8. This significant increase reflects a shift from neutral to positive sentiment about both current and future prospects, despite ongoing operational challenges and global economic uncertainties.

According to the survey, 42% of respondents feel positive about the current business environment, with 47% expecting similarly optimistic conditions in the coming quarter. More importantly, 56% of respondents see an improvement in Vietnam's macroeconomic outlook in the first quarter of 2025.

Bruno Jaspaert, Chairman of EuroCham Vietnam, said: “This is a clear sign that European businesses are increasingly confident about Vietnam’s economic future.” This reflects their recognition of Vietnam’s political and economic transformation and confirms its role as a key player in Southeast Asian trade and investment.

Many respondents cited the "double transformation" of digital and green transitions as a key driver of optimism. Companies that have embraced these trends reported significant growth, with some citing a 40% increase in revenue over the previous year. The trend toward sustainability, driven by both government policies and global pressures, is becoming a significant factor in shaping business strategies across multiple sectors.

Operational challenges remain

| European businesses shared their views at a recent event hosted by EuroCham. Photo: EuroCham |

While sentiment among European companies in Vietnam is generally positive, operational challenges remain a significant concern. The top three obstacles listed are administrative burdens, unclear regulations, and difficulties in obtaining licenses. The complexity of visas for foreign workers was cited by 42% of respondents, while 30% cited tax issues, including VAT refunds.

Chairman Bruno Jaspaert said that Vietnam is at a critical juncture. Ongoing administrative hurdles challenge business operations, but European businesses are optimistic about the government's efforts to create a more conducive environment.

Last November, Prime Minister Pham Minh Chinh announced a steering committee to restructure the government, aiming to improve efficiency and accountability. Many survey respondents believe these reforms will streamline processes, with 43% expecting improvements, particularly through digital platforms. However, 36% expressed concern about potential delays during the restructuring phase.

Jaspaert stressed the importance of a transparent regulatory framework, comparing it to building a house with a solid foundation. He believed that the current changes could lead Vietnam into a "golden era" of economic growth and increased foreign direct investment.

| Typhoon Yagi: resilient recovery Of particular note in this report is the impact of Typhoon Yagi, one of the strongest storms to hit Vietnam in more than three decades, which devastated 26 localities and affected a significant portion of the country's GDP and population. Despite this widespread destruction, businesses have shown remarkable resilience in their recovery. Three months after the typhoon, 36% of European businesses surveyed reported full recovery, with another 8% expecting to recover soon. Notably, 70% said their operations in Vietnam were not significantly affected. Only 14% cited supply chain disruptions, while 12% expressed concerns about employee safety. The majority of respondents from a variety of industries indicated that Typhoon Yagi had little to no impact on profitability, underscoring the effectiveness of existing risk management strategies. “Vietnam’s ability to rebound from such a devastating disaster showcases the resilience and adaptability of its people and businesses,” said EuroCham Chairman Bruno Jaspaert. He added that the speed of recovery reflected the strength of the country's infrastructure and the determination of its business community, surpassing the disaster recovery efforts often seen in Europe. In the aftermath, the European business community is prioritizing climate resilience in Vietnam, focusing on improved weather forecasting, robust disaster protocols, and exploring parametric insurance. At the same time, efforts are underway to improve ESG compliance, aiming for sustainable goals and resilient infrastructure. As Vietnam continues its transformation, the opportunities for European businesses are clear. With the right policies, infrastructure, and business environment, Vietnam can continue to attract investment and drive sustainable growth in the coming years, Chairman Jaspaert concluded. |