Favorable conditions expected to boost Vietnam automobile sales in H2

A reduction of 50% of the registration fee for domestic cars and the removal of import tariff for car parts not available domestically would help boost the domestic car market.

Automobile sales in Vietnam is expected to recover in the second half of this year, thanks to improving economic conditions and supportive policies from the government, according to Viet Dragon Securities Company (VDSC).

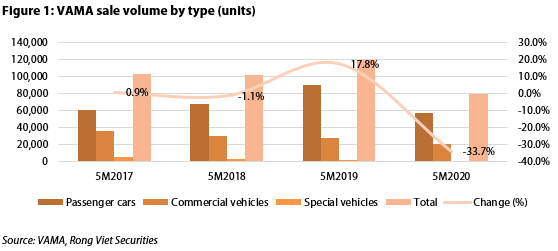

In the first five months this year, the sales volume of members of the Vietnam Automobile Manufacturers Association (VAMA) decreased by 34% year-on-year to 79,396 units, in which passenger cars had the deepest drop with -36% year-on-year as sales were only 57,261 units.

The main reason is the negative effect of the Covid-19 pandemic on people's income and consumption behavior, along with buyers waiting for the registration fee reduction to take effect, stated the VDSC.

In addition, sales of commercial vehicles and special vehicles decreased by 26% year-on-year (to 21,084 units) and 34% (to 1,051 units), respectively, with VDSC attributing producing and mining industries being interrupted by Covid-19 as a major factor.

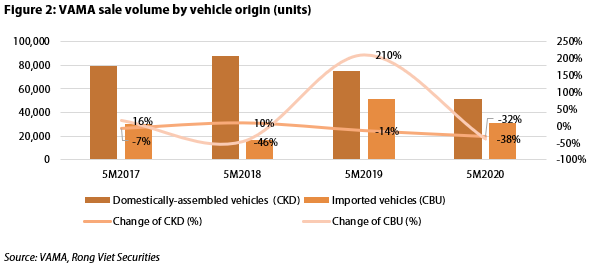

Meanwhile, the number of domestically-assembled vehicles sold decreased by 32% year-on-year (to 51,669 units) while imported cars fell by 38% (to 31,512 units).

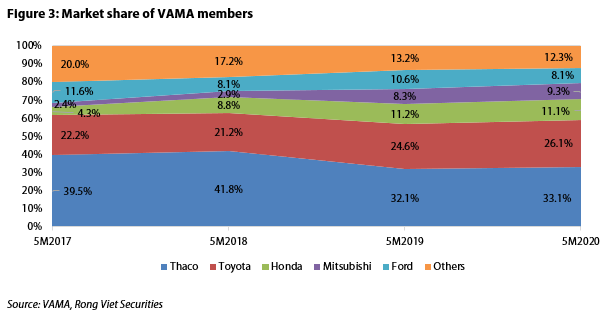

Truong Hai Auto Corporation (Thaco) continued to be the company with the largest market share at 33.1%, followed by brands from Japan such as Toyota, Honda, Mitsubishi. In addition, Ford – the leader in the pickup truck segment - ranked fifth with 8.1%.

Opportunities in remaining months

On June 28, the government’s Decree No.70 on reducing 50% of registration fees for cars manufactured and assembled domestically took effect.

Automobile is considered a key industry in Vietnam, accounting for approximately 3% of the national GDP. However, this industry was adversely affected by the Covid-19 pandemic, resulting in a 15% reduction in sales volume in the VDSC’s latest forecast of 2020 compared to the prevision earlier this year. Therefore, the policy is expected to reduce the cost of buying a new car.

In the January – June period, low consumption and the pressure of liquidating 2019 inventories forced companies to offer various promotion packages such as gifts, insurances and supporting a part of registration fees.

However, along with the registration fee reduction, many car manufacturers such as Toyota, Honda, TC Motor, Mitsubishi, and Mercedes-Benz have stopped offering those promotions. This will help companies reduce selling costs in the second half.

From July 10, 2020, the government’s Decree No.57 amending and supplementing Decree No. 122, allows domestic assembling companies (meeting standards) to be entitled with 0% import tariff on raw materials, components and supplies which cannot be produced locally. The move is set to reduce production costs by 2-5%, so that selling prices can be consequently lowered in order to boost demand.

Notably, the government has extended the deadline of special consumption tax payment to domestically manufactured/assembled cars, which takes place from March to December 31, 2020. This policy helps auto companies to better manage their cash flow.

Challenges

In the January – May period, the estimated production of domestically assembled cars was about 71,669 units, so currently there are 20,000 units in inventory (equivalent to 28%).

The volume of imported cars reached 36,798 units (86% from Thailand and Indonesia), so currently there are 5,286 units in inventory (equivalent to 14%). In total, there are currently 25,286 units in stock, accounting for 23% of total supply.

Along with that, the number of car in inventory in 2019 was about 182,000 units (accounting for 36% of the total supply in 2019) so the pressure to liquidate inventories is very high. Therefore, it is believed that in the remaining six months, car dealers will have to reduce the price of 2019 car models to attract customers. This will cause companies’ gross profit margin to decline.

Lower-than-expected income due to the Covid-19 pandemic would force consumers choosing middle or low classes cars instead of luxury cars. This will negatively affect the sales of luxury brands such as Lexus, Mercedes-Benz, BMW, Audi, Porsche and Volvo.

Currently, road area accounts for only 6-8% in Hanoi and Ho Chi Minh City compared to the international standard of 20%. At the same time, Vietnam lacks transport projects designed specifically for cars, making traveling by car not convenient.