JP Morgan names risks related to investments in Vietnamese banks

Vietnamese banks belong to a handful of examples that combine well two factors of high growth of profit and long-term stability.

JP Morgan has pointed out a number of risks related to investments in Vietnamese banks.

Firstly, Moody’s placed Vietnam’s Ba3 local and foreign currency issuer and senior unsecured ratings of the government of Vietnam under review for downgrade. The decision was due to institutional deficiencies that led to delayed payments on an obligation by the government. JP Morgan stated any potential downgrade would cause negative impacts on stocks.

Secondly, foreign exchange rate could lead to lower profit for investors with USD-denominated investments.

Thirdly, Vietnam is in the US’s watchlist for currency practices.

Fourthly, strong volatility of the surplus of the current account and balance of payment could lead to tightened liquidity and restriction of credit growth.

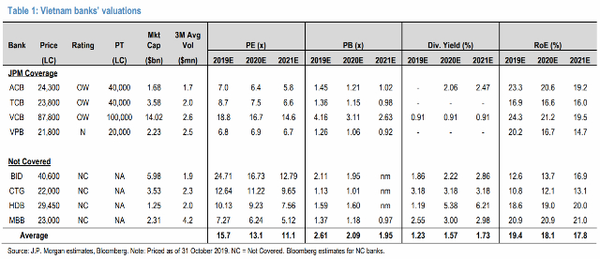

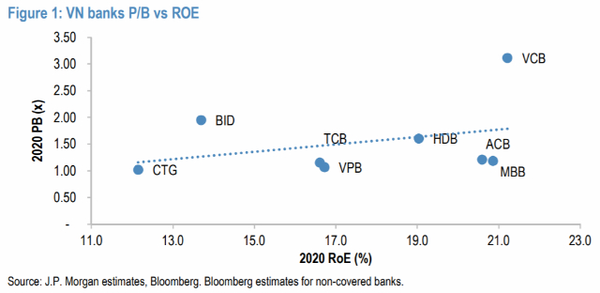

In its report, JP Morgan has given out “overweight” to three Vietnamese banks under its coverage, including Vietcombank, Techcombank and ACB, and “neutral” to VPBank, expecting stocks of these four to expand 14 – 68% in the next 12 months.

Following the report, these banks are estimated to post return on equity (ROE) at 15 – 21% in the next two years. Credit growth under control, a compound annual growth rate (CAGR) of 16% in the next five years, and nominal GDP of 9% are considered main growth drivers for banks.

These factors would contribute to a net interest margin (NIM) at an appropriate level of 3.58%, except VPBank, despite the current account and saving account (CASA) ratio at low rate of 22%.

JP Morgan considered the balance of payment at 2.5% of the GDP key to liquidity and growth of the banking sector, particularly as the loan to deposit ratio (LDR) at 94%.

Vietnamese banks belong to a handful of examples that combine well two factors of high growth of profit and long-term stability, stated the report.

This assessment, along with a favorable cycle of credit, would bring considerable profits to these lenders in the coming time.

According to JP Morgan, investment opportunities in Vietnamese banks are equal to those in Indonesia in the 2005 – 2013 period and India in 2010 – 2017.

A positive prospect on Vietnam’s nominal GDP growth and a surplus of current account led to a projection of strong growth in income and credit in Vietnam. However, the ratio of credit to GDP in Vietnam remains high at 104%, or equal to GDP per capita of US$2,500, which could restrict the economic growth in the next few years.