Gen X and Baby Boomers in Vietnam rapidly catching up with fintech

Vietnam has witnessed dynamic growth of the fintech sector, with the increasing participation of the older generations.

Studying the demand for online financing services in Asia in 2019, analysts of Robocash Group have revealed a steady increase in the number of customers aged 41-50 and 51-60 years and in particular, Vietnam had the highest monthly increase, 26%, of such clients.

Amid the overall digitization and growing penetration of online services in Asia, the daily use of financial technologies by older generations is growing too.

Against the background of similar trends identified in Southeast and South Asia, the Philippines took the first place by the share of 41-to-60-year-old users of online lending services. Indonesia took second place by the share of Gen X and Baby Boomers among users of online financing services.

Vietnam demonstrated similar trends but had higher dynamics. Vietnam outpaced surveyed countries it with a monthly rate of 26%. Analysts explain that the reason is the maturity of the population in Vietnam (30.9 years) and the insufficient penetration of banking services (30.8%), which is the lowest among the mentioned countries.

Following the growing digitization, the popularity of fintech services will only keep increasing. However, older generations are still rare users. The number of 41-50-year-old clients in Vietnam by December 2019 reached 4.63% (2.71% in January 2019), and 9.33% in India (4.44% in January 2019).

Moreover, the share of customers aged 51-60 years in Vietnam in January 2019 was only 0.08% while the rate was 0.44% in India. In a year, the rates in the two countries grew to 0.82% and 0.99%, respectively.

With age, fintech customers in Vietnam request higher amounts of financing

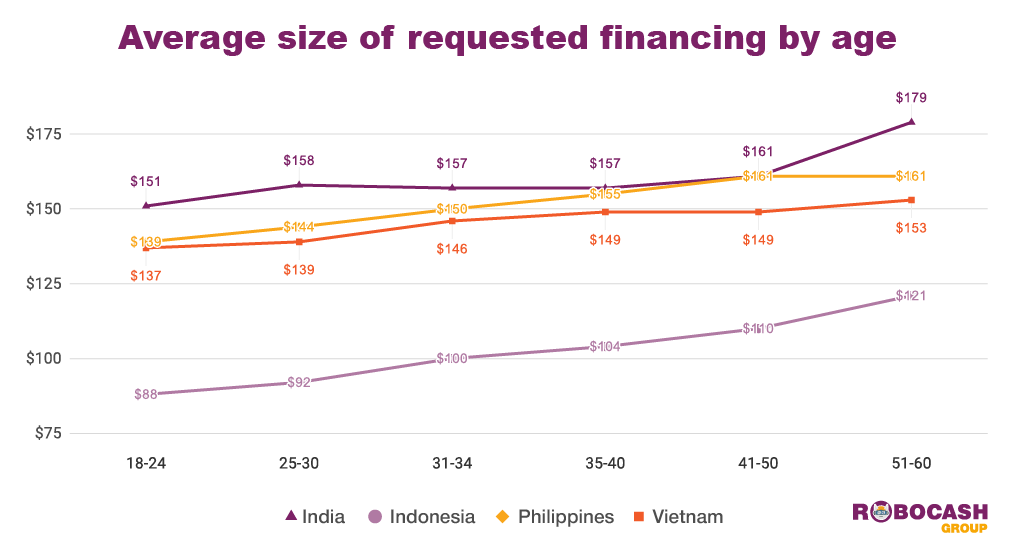

According to findings of Robocash Group based on the statistics of customer applications in Asia last year, the older customers become, the more financing they request when applying to fintech services.

In particular, with an increase of customers’ age by one year in Vietnam, there is a rise in the average size of requested amounts by 0.3%. Meanwhile, the growth in Indonesia is 0.8%, and the rate in the Philippines and India is 0.4%.

| Source: Robocash |

The analysis revealed a pattern according to which clients ask for more financing as they get older. Vietnam has shown the lowest contrast between generations. On average, 51-to-60-year-olds in Vietnam request by 11.7% more than clients aged between 18 and 24. It stands in contrast with Indonesia with a difference three times higher larger at 37.5%. The differences in India and the Philippines are 18.5% and 15.8%, respectively.

According to company analysts, people in the Philippines, Vietnam and India may have longer terms of gaps in their budgets. Then, in case of unexpected circumstances, the size of savings or reserved money may be insufficient too. As a result, it makes customers ask for higher amounts to cover the emerged gaps. At the same time, in countries with advanced incomes among the populations like in Indonesia, customers may take financing directly in a store to pay for a small desirable non-essential purchase.

Half of the users of fintech financing tools in Vietnam are married and have kids

Married people with one or two kids comprise the highest share of customers of services providing fintech financing in Asia, according to Robocash Group. In Vietnam, 54% of customers are married, and 40% have 1-2 kids under 18.

The reason for that is additional needs and expenses that usually grow, as a family gets bigger. Moreover, if any spouse has no or limited access to traditional financial services, it increases the interest in alternative opportunities for a whole family. In particular, Vietnam has 54% of married customers. The highest share is in Indonesia – 69%. India follows with 66%. The Philippines has 51%.

As for the family size, Filipino customers take the lead. 45% of respondents in the Philippines have one or two kids, while 27% have three or more. Indonesia is on the second place with 60% and 11%, respectively. The share of customers without kids reaching 55% makes Vietnam stand in contrast. Meanwhile, 40% of the Vietnamese clients have 1-2 kids, and only 5% - 3 or more.