Greater business confidence helps Vietnam manufacturing sector rebound

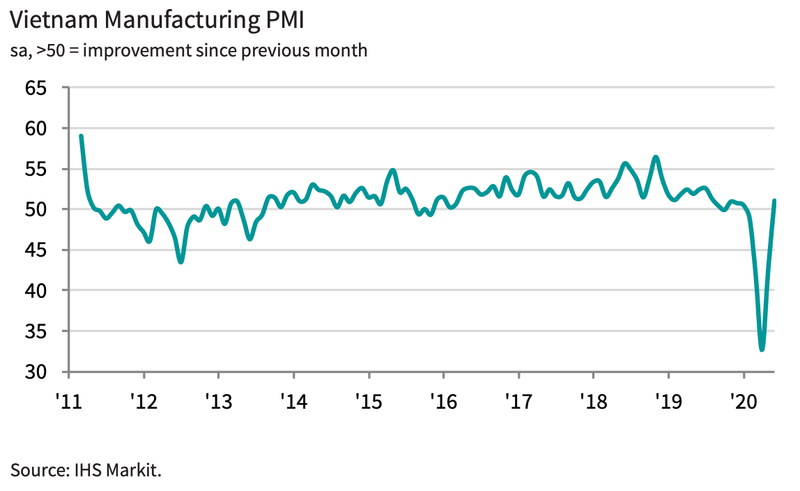

The Vietnam Manufacturing Purchasing Managers' Index (PMI) posted 51.1 in June, up from 42.7 in May and above the 50.0 no-change mark for the first time in five months.

The Vietnamese manufacturing sector returned to growth in June as success in suppressing the Covid-19 pandemic and greater business confidence helped lead to renewed expansions in output and new orders, according to Nikkei and IHS Markit.

| Vietnam Manufacturing Purchasing Managers' Index (PMI) posted 51.1 in June, up from 42.7 in May. |

The Vietnam Manufacturing Purchasing Managers' Index (PMI) posted 51.1 in June, up from 42.7 in May and above the 50.0 no-change mark for the first time in five months. The reading represented a continuation of the recovery seen since the PMI hit a record low in April.

A reading below the 50 neutral mark indicates no change from the previous month, while a reading below 50 indicates contractions and above 50 points to an expansion.

New orders increased for the first time in five months, and at a solid pace that was the fastest in just under a year. Respondents indicated that the Covid-19 pandemic being brought under control in Vietnam had contributed to rising new business. Both the consumer and intermediate goods sectors posted expansions in new business, but investment goods orders continued to fall.

While total new orders increased, new export business declined again amid restrictions on international movement and customer closures in some export markets.

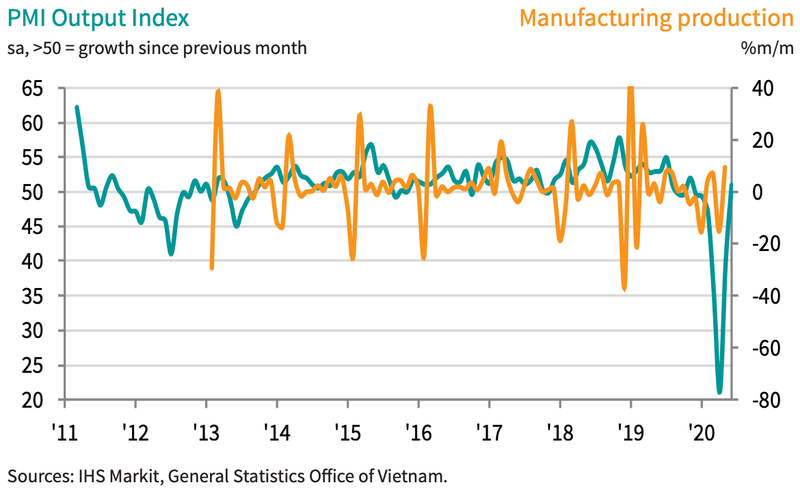

A renewed rise in production was also signaled in June, driven by the consumer goods sector.

Despite new orders increasing at the end of the second quarter, there was continued evidence of spare capacity in the sector. Backlogs of work fell again, while staffing levels were reduced for the fifth month running. That said, the pace of decline in staffing levels was the weakest since February. Efforts to expand production led firms to accumulate stocks of purchases, facilitated by a marginal rise in purchasing activity. Moreover, pre-production inventories increased to the greatest extent since November 2018. Stocks of finished goods also expanded, partly reflecting delays in the shipment of finished products.

Firms signaled a rise in input costs for the first time in three months during June. Where input prices increased, respondents linked this to the scarcity of certain materials. That said, the rate of inflation was softer than the series average as suppliers responded to relatively weak demand for inputs.

While some firms reacted to higher input costs by increasing their own selling prices, others continued to reduce charges amid demand weakness. Selling prices fell for the fifth month running, but at a marginal pace that was the slowest in this sequence.

Panelists reported continued issues in supply chains as a result of the Covid-19 pandemic, particularly with regard to imported items. Suppliers' delivery times lengthened for the seventh consecutive month, albeit to the least extent since January.

Confidence that Covid-19 is under control in Vietnam and that new orders will expand supported optimism that production will increase over the coming year. Sentiment strengthened sharply for the second month running and was the highest since January.

“The Vietnamese manufacturing sector returned to growth in June, thanks to Covid-19 being brought under control and subsequent improvements in customer demand within Vietnam. The main hurdle to a strengthening recovery is likely to be the performance of the global economy, which is still suffering due to the virus. New export orders continued to fall, while firms again cited difficulties in securing inputs from abroad,” said Andrew Harker, associate director at IHS Markit, which compiles the survey.

"Moreover, Covid-19 appears to have taken a large toll on the economy in recent months. IHS Markit currently forecasts GDP to rise by just 1.0% in 2020, well down on the 7.0% increase seen in 2019."