Vietnam highly likely to be upgraded to second emerging market next September

The upgrade is likely to widen Vietnam’s access to large funds allocated according to the FTSE Emerging Index, including Vanguard FTSE Emerging Market ETF.

Vietnam is has good chance of winning the second emerging market status in the next review in September 2020 by FTSE Russell, a leading global provider of financial services, according to KB Securities.

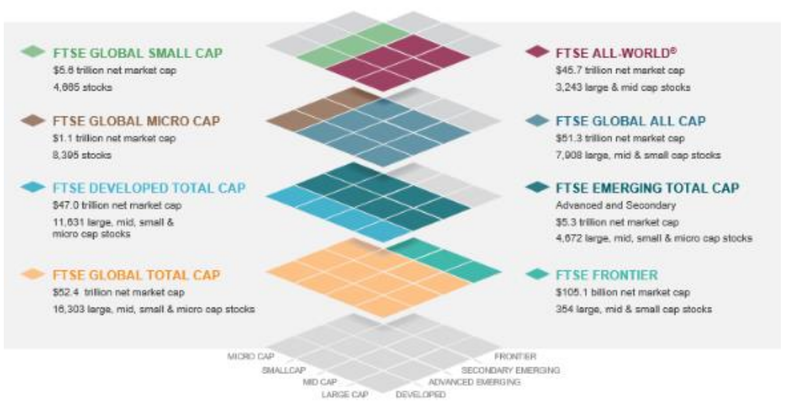

| FTSE benchmark. Source: FTSE, KB Securities Vietnam. |

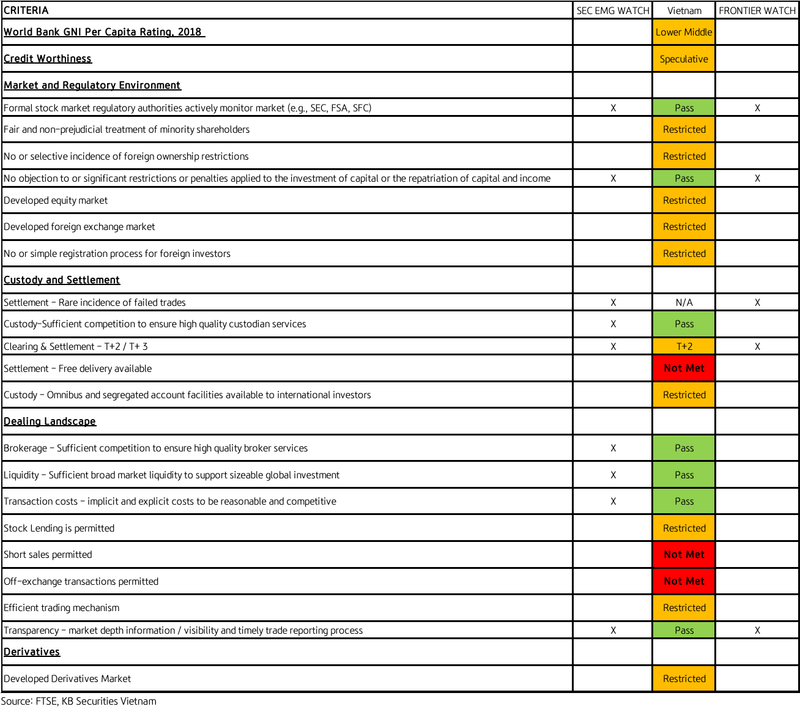

Vietnam is currently in the Frontier market group, and was added to the FTSE Russell’s watchlist for posible upgrade to Secondary Emerging Market in September 2018. However, after one year of review, Vietnam only met seven out of nine criteria of FTSE.

| Vietnam & FTSE criteria as at September 2019. |

The criterion of “Settlement – rare incidence of failed trades” was not evaluated. The brokerage believed that this is not a big issue, simply due to the low supply of information from the State Securities Commission (SSC), while the “clearing & settlement mechanism” remained a barrier to Vietnam's upgrade.

In general, Vietnam's payment activities are still based on the method of prefunding. According to FTSE Russell, Vietnam needs to follow international practices in terms of Delivery vs Payment, by just checking the balance on the T+2 and then transferring the stocks and doing the payment, instead of checking the account and deducting money on the T+0 as at present.

It is expected that Vietnam could solve the technical issues soon, as the legal basis of Vietnam, namely the Circular 203/2015/TT-BTC providing guidelines for trading on securities market, has given a green light for institutional investors with accounts at a depository bank. They only need a payment guarantee/confirmation from the bank to transact business immediately. However, in fact, the benefits from the banks are still limited, which undermined the implementation of the circular.

Moreover, some securities companies have actively provided guarantee/payment services with foreign organizations and initially recorded some promising achievements.

“We think that one year will be enough for Vietnam to solve the prevailing payment issues with foreign institutional investors. However, for individual investors, we expect that if the guarantee issue cannot be solved, at least, the bank should only block money at the time of buying securities and then deduct money on T+2 later (when the securities return to the account). However, this may still be a risk that partially obstructs the review of FTSE,” stated KB Securities.

According to the brokerage, the upgrade is likely to boost Vietnam’s access to large funds allocated according to the FTSE Emerging Index, including Vanguard FTSE Emerging Market ETF – the largest emerging market ETF in the world. Therefore, although the weight of Vietnamese stocks in the EM Index is forecast to stay low, it will still generate a huge cash flow into Vietnam stock market.

However, a lag could exist between the withdrawal of investment funds of frontier markets from Vietnam's stock market and the disbursement of those in EMs. In addition, active cash flows could be volatile around the upgrade. Some active funds are often poured into Vietnam to catch up the upgrade event, and then may take profits when the market is officially upgraded.

KB Securities suggested the most positive phase may only happen before the upgrade.

For example, Romania market, which has climbed roughly 38% since the early this year, before it was upgraded to Secondary Emerging Market in September 2019. Nonetheless, KB Securities said investors should note that the stock index could correct after the upgrade comes into effect, as in the case of the UAE and Qatar – where stock indices declined 5% and 20% respectively after the upgrade.

Moreover, market liquidity should be improved considerably after the upgrade. As a result, Vietnam will have better absorption rates for large investment capitals.

The upgrade also helps to raise the consistency of regulations and standards between Vietnam's stock market and international markets, thereby building up confidence for foreign investors to participate in trading more. In addition, the FTSE upgrade may also enhance regulatory agencies to keep promoting market reform and upgrading.