Investors warned about risks of real estate corporate bonds

In the last two years, real estate firms have been the group issuing the highest volume of bonds.

Corporate bond investors will likely face huge losses when the real estate market is still growing in a hot trend, forming the high risk of a “bubble” in Vietnam.

The warning has been given by many experts in the context that almost all real estate corporate bonds have no collateral, or if any, the real estate project itself is used as collateral. When the market freezes, most businesses will not be able to pay interest while the market liquidity is low, placing the risks on the investors.

| An image of Aqua City project invested by Novaland. Photo: kinhtedothi |

Economist Nguyen Tri Hieu told Hanoitimes that the real estate businesses’ demand for capital mobilization through the bond channel is quite high, especially those with limited collateral for loans. “Therefore, interest rates on real estate bonds may increase and will be more attractive than other bond groups.”

“If the real estate bond market is not well controlled, it may lead to the bursting of a bubble,” Hieu said.

He attributed the first reason to a bubble that the real estate bond market grew “hot” in a short time, while the bond issuance cycle was both fast and thick. The second reason is that enterprises usually issue real estate bonds with double and triple interest rates on savings. The risk of a bond bubble may occur if the enterprises have to refinance when they are unable to liquidate bondholders.

Nguyen Van Hung, an investor in the corporate bonds of real estate living in Hanoi, told Hanoitimes that the real estate corporate bond yields are much more attractive than deposit interest rates.

He said the deposit interest rate on the banking market ranges from 3% - 7% per year, while the corporate bond products being issued by real estate firms having doubled or even three times higher than that of the bank interest rate.

“This is the factor causing many people to turn to real estate corporate bonds,” Hung said.

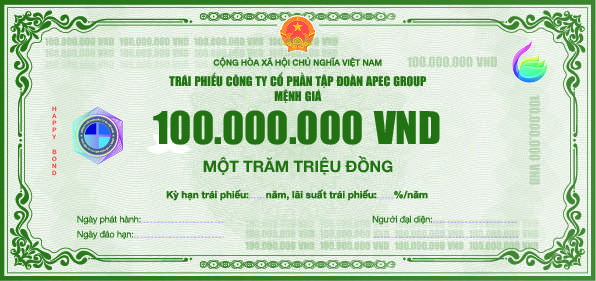

A number of companies have recently raised capital via real estate bonds including Sunshine Group issued a bond with an interest rate of 11% per year; Novaland at an interest rate of 10.5%; and Phat Dat at an interest rate of 14% per year. The most notable at present is Apec Group, which has recently offered Happybond with an interest rate of up to 13% per year guaranteed by high-end real estate in big cities.

| Happybond, issued by Apec Group, is expected to lure many investors as it is guaranteed by high-end real estate in the big city. Photo: Apec Group |

According to the Vietnam Bond Market Association, the increase in the corporate bond issuance with high-interest rates shows the long-term capital needs of real estate developers, as well as the effects of the industry's prospects and the impacts of the pandemic.

Bonds of real estate firms have since the end of 2020 tended to last the bond maturity longer, at an average of about 3.8 years, one year longer than that of 2019. Meanwhile, the average bond interest rate has also increased by nearly 210 basis points, from 9.7% to 11% per year.

A report on the corporate bond market released by SSI Securities Corporation showed that the real estate firms mobilized a total of VND23.15 trillion via corporate bonds issuance in the first quarter of this year, decreasing by 5% year-on-year but accounting for 61.9% of total value in the market.

In March, it gained the largest proportion with the issuance size of VND4.45 trillion, up 42.4% compared to the previous month.

In the January-March period, the commercial banks issued VND1.24 trillion, accounting for 3.3% of the market’s total value, while the securities companies and non-bank financial institutions launched VND2.54 trillion, occupying 6.8%. The rest came from other companies.

SSI forecasts that by the second quarter, real estate businesses will still be the largest issuers and their interest rates may increase.

In a move to tighten control over credit for potentially risky sectors such as real estate and securities, the State Bank of Vietnam has recently sent dispatch No. 3029/NHNN-TTGSNH to credit institutions and foreign bank branches, requesting them to take strict management in a number of high-risk credit areas including investment in corporate bonds, securities credit, real estate, traffic BOT (build-operate-transfer) and consumer loans.