Local industrial firms’ optimism surges to 18-month high for year ahead

Firms are increasingly optimistic that the sector will move back into gear in the months ahead, and this confidence helped to drive accelerated job creation at the end of the first quarter.

Manufacturers were increasingly confident that production would increase over the year ahead, with optimism at the strongest level in a year and a half, according to a report from S&P Global.

Firms expect the launch of new products to boost output while also hoping that an improvement in market demand will help to support new order growth. Manufacturers also stepped up their recruitment efforts in March, raising employment for the second month running and at the fastest pace since October 2022.

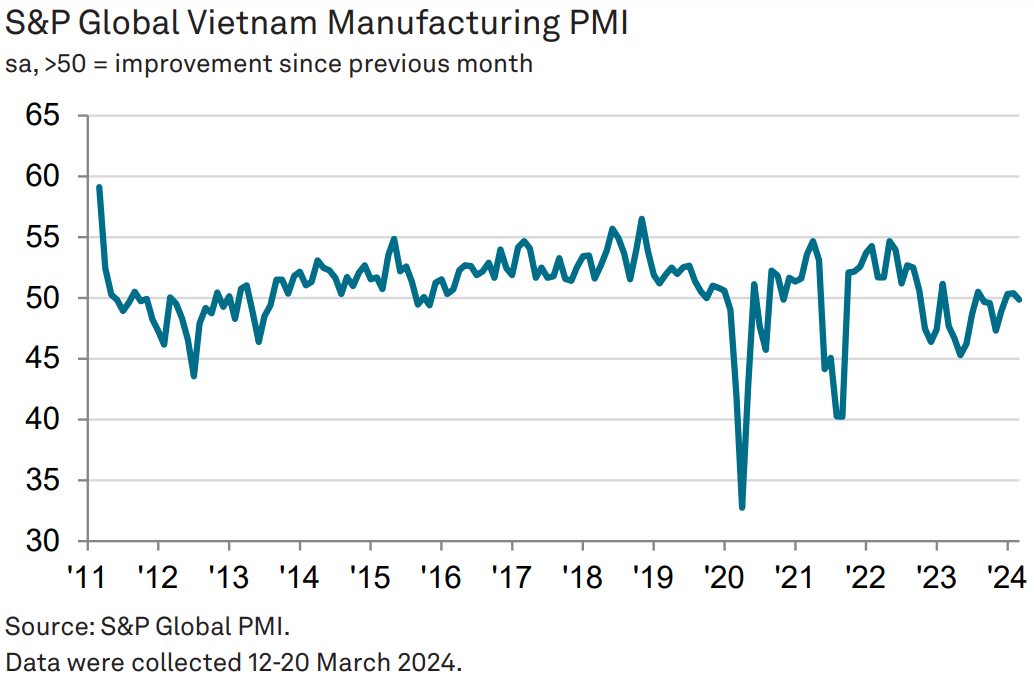

Meanwhile, the business conditions in the manufacturing sector were broadly unchanged in March after recording marginal improvements in the first two months. The S&P Global Vietnam Manufacturing Purchasing Managers' Index (PMI) dipped below the 50.0 no-change mark in March, posting 49.9 after a reading of 50.4 in February.

The index therefore signaled an end to the two-month period of improving business conditions at the start of 2024 but pointed to broadly unchanged operating conditions overall. There were signs of demand weakness in March, leading to a drop in new orders despite discounts offered to help secure sales. New export orders were also down, and to the greatest extent since July 2023 amid competitive pressures and geopolitical issues.

With new orders down, firms also scaled back production at the end of the first quarter of the year, following growth in January and February. The drop in production was only marginal, however, and limited to intermediate goods firms as expansions were recorded at consumer and investment goods producers.

| Electronics production at Katolec Vietnam Company in Quang Minh Industrial Cluster. Photo: Pham Hung/The Hanoi Times |

“Growth stalled in the Vietnamese manufacturing sector in March as subdued demand put the brakes on new orders and production. Demand weakness was also reflected in the PMI survey's price indices as input cost inflation slowed and an outright reduction in selling prices was recorded,” said Andrew Harker, economist director at S&P Global Market Intelligence.

"On a more positive note, firms are increasingly optimistic that the sector will move back into gear in the months ahead, and this confidence helped to drive accelerated job creation at the end of the first quarter," he noted.

Rising staffing levels, and a drop in new orders, helped firms to work through outstanding business for the second consecutive month. Moreover, the rate of depletion was the fastest in five months. Lower output requirements led firms to reduce their purchasing activity in March, the fifth month running in which this has been the case. In turn, stocks of inputs decreased solidly.

Stocks of finished goods also decreased, and to the greatest degree in 33 months. Lower production and the shipping of products to customers were behind the drop in postproduction inventories. In a number of cases, goods destined for export had been dispatched. Reduced demand for inputs contributed to a slowdown in the pace of input cost inflation, with the latest rise the softest since August last year and weaker than the series average.

Where input prices did rise, panelists linked this to higher raw material and oil prices. Manufacturers reduced their selling prices for the second time in the past three months. The marginal decline in March followed a slight increase in February and reflected a combination of competitive pressures, subdued demand, and softer cost inflation.

Finally, suppliers' delivery times were broadly unchanged at the end of the opening quarter of the year. International shipping delays and conflicts led to delays in receiving goods in some cases, but this was broadly canceled out by vendors having sufficient inventory holdings to meet orders.