Malaysia’s Economy: From agriculture and commodity-based to manufacturing, technology and services-driven

Now, it’s turning its competitive advantage into a comparative advantage.

INVESTMENT

Malaysia’s Escalation as The Manufacturing Powerhouse in Southeast Asia

Deep in the heart of Southeast Asia, businesses from around the world are tapping into one of the region’s most significant advantages: Malaysia’s manufacturing prowess. With its skilled workforce, business-friendly Government and strategic location, the country has long been a manufacturing hub of choice. Now, it’s turning its competitive advantage into a comparative advantage.

Central to that transformation is Shared Prosperity Vision 2030-the Government’s plan to turbocharge the economy. Therein lies a strategic focus on manufacturing, which accounts for roughly a quarter of annual GDP and 2.2 million jobs. The Government’s commitment to helping manufacturers embrace Industry 4.0, bolster their technical know-how and add value promises to propel the economy and deliver significant benefits for businesses.

This emphasis on manufacturing is not something new. Malaysia’s long track record of investment secured its position in the top quartile of the 2020 Global Manufacturing Risk Index due to its cost competitiveness and ability to bounce back in the face of disruption. Both proved crucial amid the fallout from COVID-19. Manufacturing led Malaysia’s economic recovery late last year, driven by exports from the electrical and electronics (E&E) segment. The sector will continue to fuel the economy in the year ahead, which is forecast to grow 6.5-7.5%.

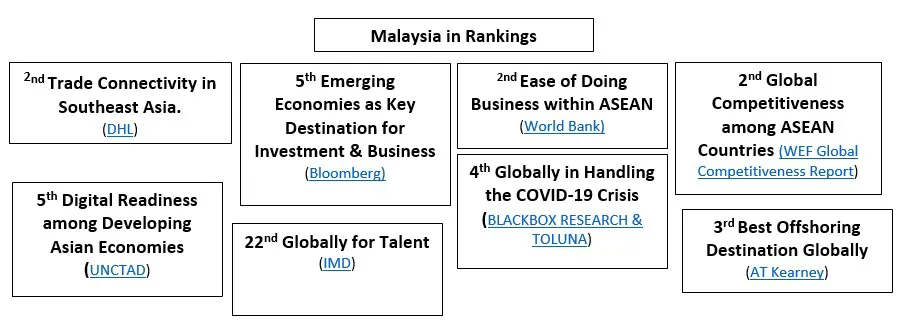

As global businesses get back on track, many see Malaysia as an attractive manufacturing hub. Beyond durability, several other factors make it the ideal location, including the ease of doing business, top talent, the depth of its connectedness, tax and investment incentives, and its commitment to innovation. Likewise, its strategic location creates vital opportunities for supply chain diversification amid the ongoing pandemic and lingering U.S.-China trade uncertainty.

The Three Mainstays of Manufacturing

While Malaysia’s robust manufacturing sector boasts several advantages, the “3+2” high-growth segments stand out. Three mainstays -electrical and electronics (E&E), machinery and equipment (M&E), and chemicals-are longstanding economic pillars, while two other growing segments-medical devices and aerospace-offer huge potential.

E&E is the single largest contributor to the manufacturing sector. Over the past few decades, the segment attracted tremendous foreign investment into the country. It quickly climbed the value chain, moving from high-volume low-mix to high-mix low-volume operations. Today, it produces 13% of global back-end semiconductor output and accounts for roughly 40% of Malaysia’s annual exports. With end uses linked to 5G, autonomous vehicles and the Internet of Things (IoT), chips made in Malaysia power products in the world.

Penang’s contribution stands out. The state is one of the most significant microelectronics assembly, packaging, and testing hubs in the world, positioning Malaysia as both a vital link in electronics supply chains and an ideal location for research and development (R&D). This has attracted global tech heavyweights companies to continue investing. Last year, for instance, US chip-gear giant Lam Research (LAM) invested USD225 million to build a new manufacturing facility in Batu Kawan Industrial Park, Penang, while German engineering company Bosch announced its plans to set up a manufacturing facility at the same location. Bosch also announced its expansion project in setting up the manufacturing facility park for testing of semiconductor components and sensors in Penang.

Meanwhile, M&E contributes around 4% of Malaysia’s annual exports. The segment accounts for roughly 85% of the country’s Small Medium Enterprises (SMEs). Together, they comprise a sophisticated ecosystem offering world-class R&D, design, and engineering capabilities. These SMEs produce everything from metalworking and power generating machinery to specialized parts. Increasingly, they use Industry 4.0 technologies including robotics, factory automation, and predictive maintenance to deliver best-in-class products consistently.

The chemicals segment is another economic engine and accounts for 5% of annual exports. With abundant natural resources, the country has become a major contributor of petrochemicals and oleochemicals products often used as raw materials in the production of electronics, plastics, automotive parts, pharmaceuticals, and construction materials. Meanwhile, specialty non-fuel products including catalysts, aromatics, and white oil offer exciting opportunities, especially as digitalization creates new possibilities.

Two Budding High-Growth Segments

Malaysia’s less mature high-growth segments are equally important. The medical devices industry, for instance, comprises more than 200 manufacturers. Thirty, including Abbott, Boston Scientific, and B. Braun, are among the top multinationals that established bases in Malaysia to capitalize on the country’s unique advantages. Together, these companies export 90% of the devices they make-around US$5.6 billion worth-annually, shipping more than half to the US, Germany, China, and Japan.

Historically, Malaysia’s medical devices industry encompassed a broad range of consumable products including examination gloves, catheters, syringes, and dental implants. Now, the country is climbing the value chain, manufacturing complex products including pacemakers, defibrillators, endoscopes, radiographic equipment, and in-vitro diagnostic devices. With a commitment to adopting advanced manufacturing processes powered by Industry 4.0 technologies, it is fast becoming a medical manufacturing hub and outsourcing destination.

The same commitment to innovation underlies advances in the aerospace manufacturing segment. Last year, border closures and travel bans stemming from the COVID-19 pandemic devastated the industry worldwide. While the prospects for an immediate recovery remain tenuous, Malaysia’s manufacturers remain well-positioned to capitalize when travel returns.

Malaysia is home to 240 aerospace companies. Together, they export over USD2 billion worth of goods annually, reflecting the segment’s strength in maintenance, repair, and overhaul (MRO) services. Their primary exports are fuselages, empennages, and wing components. Now, the Malaysia Aerospace Industry Association (MAIA) together with MIDA and other relevant Government agencies are on a quest to transform the country into Asia’s premier aerospace hub. If the Digital KLIABC 2020 conference to reach the industry players, secure potential sales of USD34 million is anything to go by, that quest is well in progress.

Business-Friendly Government Initiatives

Establishing manufacturing operations abroad is challenging. To make that easier, the Malaysian Investment Development Authority (MIDA), an agency under the Malaysian Ministry of International Trade and Industry launched the Project Acceleration and Coordination Unit (PACU) to accelerate the approval and implementation of manufacturing projects. In efforts to accelerate the necessary approvals to expedite the execution of projects, MIDA launched the e-Manufacturing Licence (e-ML) module and the enhanced e-ML 2.0 module. For instance, eligible applications submitted through this module will be approved within two business days for non-sensitive industries and up to four weeks for sensitive industries.

PACU assists and accelerates the application process, identifies challenges that an applicant may face, monitors the progress of implementation, and facilitates collaboration with all parties involved. The process is hassle-free. With generous tax and investment incentives already in place, the latest effort provides a strong impetus to invest.

The Government is also quick to respond when businesses and investors are in need. COVID-19 has made it difficult to travel. To balance public health, livelihoods, and economic sustainability, MIDA set up a One-Stop Centre (OSC) to ease the movement of business travelers. This ensures both the legitimacy and health of travelers before they enter the country while supporting the growth of business and industry.

Amid the disruption stemming from the pandemic, the Malaysian Government also introduced a series of stimulus packages dubbed PENJANA to help businesses recover and incentivize foreign investment. The packages include several measures aimed at foreign companies. Those in the manufacturing sector who invest USD70-USD116 million are eligible for tax exemption for ten years. Larger investments could earn a 15-year exemption.

The latest measures are a few of many reasons why Malaysia ranks 2nd for ease of doing business within the ASEAN region. As the country realizes its comparative advantage in manufacturing, businesses around the world will soon find a new home from which to make their greatest products. Whether they tap into one of the “3+2” manufacturing segments or discover new opportunities, one thing is clear: Malaysia is the manufacturing powerhouse of Southeast Asia.

INTERNATIONAL TRADE

Malaysia, a trade epicenter for the world

Malaysia, a nation located at the heart of Southeast Asia has established itself as one of the most trade-friendly nations in the world, exporting a competitive range of products and services to more than 200 countries and territories around the world. It is today an integral part of the global supply chain and recognized by the World Trade Organisation (WTO) as the world’s top 25th trading nation and 24th largest exporter as well as 26th leading importer in 2020. Malaysia’s top trade destinations include ASEAN, China, the United States, Japan, Taiwan, Hong Kong, the Republic of Korea as well as the European Union.

The year 2020 has been challenging to global trade as a result of the stringent lockdown measures imposed across the board due to the COVID-19 pandemic. This directly caused major disruptions to global supply chains, especially the movement of goods and services, and severely affected manufacturing activities.

Total trade in 2020 was valued at RM1.784 trillion, contracted by 3.3%. Exports declined marginally by 1.1% to RM983.83 billion compared to the preceding year, while imports contracted by 5.8% to reach RM800.48 billion. The trade surplus was the highest recorded at RM183.35 billion, maintaining 23 consecutive years of surplus since 1998.

However, for the period of January to June of 2021, Malaysia's total trade has surpassed RM1 trillion in just six months, the shortest period to breach this milestone. For the first half of 2021, trade totaled RM1.056 trillion, an expansion of 26% from the same period last year. Exports rose by 30.2% to RM585.56 billion and imports increased by 21.1% to RM470.53 billion. This was the highest half-year value recorded for trade, exports, and imports. Trade surplus surged by 87.7% to RM115.04 billion

Malaysia has kept up with the rapidly transforming technologies utilized in the global trade, commerce, and financial sectors. Today, it is capable of conducting business efficiently and effectively within the knowledge and digital economy.

With a population of around 32 million people, Malaysia has various capabilities in trade and is exporting high value-added products in various sectors including in technology, electrical and electronic parts, chemicals & chemical products, petrochemicals, optical & scientific equipment, medical devices, machinery, equipment & parts, automotive & aerospace components, building materials, renewable energy, processed food, furniture and lifestyle products. At the same time, Malaysia has been exporting commodities such as oil & gas and palm oil-based products as well as rubber-based products.

Malaysian electrical and electronic companies are leading global players with a significant amount of all electronic exports being contributed by semiconductor devices, integrated circuits (ICs), and transistors and valves. These companies are also capable exporters in their own right and specialize in various areas including electronic manufacturing services, wafer fabrication, IC designs, assembly, and many more.

ICT is another important sector for Malaysian exports and includes electronic government solutions, electronic commerce solutions, software development, and system integration for banking, finance, insurance, healthcare, and education among a range of many other services. Other areas of export include the digital content sector, game art production, and various aspects of audio-visual production for the film and computer industries.

Exports of machinery currently include specialized processes, metalworking, power generation, and general industrial machinery among other things. The country is also the largest manufacturer of boilers in Southeast Asia, with the capability to manufacture and supply high-grade and internationally accepted industrial boilers.

Recognized as possessing one of the most developed chemical industries in the world, Malaysia supplies a variety of products including polymers of ethylene, methanol, and saturated polyesters.

The country’s construction and professional services sector has also established itself as a major global player, having completed a variety of projects abroad including in the construction of buildings and infrastructure, roads and highways, railways and bridges, oil and gas installations, water treatment, and power plants, airports and more. This sector has the strong support of the building materials industry, which produces a wide array of quality items for the building and construction industries, as well as the renovation and refurbishing sectors.

The aerospace industry is another area in which Malaysia has been showing tremendous growth potential including in the MRO, machinery, and design engineering sectors, and the country is poised to carve a niche for itself in this highly specialized field.

Malaysia’s oil and gas industry is today among the most dynamic in the region and includes the provision of specialty services such as engineering, procurement, construction, commissioning & installation (EPCCI), fabrication of offshore oil and gas related structures, and various other logistics, infrastructure, storage, and management requirements.

Food is another sector in which Malaysia excels and the largest export category here is edible products and preparations consisting of sauces, soya-based preparations, and extracts and concentrates that are used as food ingredients.

Malaysia has also established itself as a world leader in furniture design and manufacture with over 80% of its output exported to over 160 countries including kitchen and bedroom furniture, upholstered furniture with wooden frames, and office furniture.

Other major areas of export include Malaysia’s vibrant fashion industry, healthcare including hospital, medical and dental services, and franchising in F&B, car sales, service centers, retail and supermarkets, IT, and a wide range of other business opportunities.

The country’s export of quality products and services is made possible with support from the logistics industry, a well-developed and complete chain of service providers that include warehousing, transportation, freight forwarding, and other related value-added services such as distribution and supply chain management.

Malaysia is also considered the global leader in the halal sector. For example, among the Muslim-majority countries around the world, Malaysia is a hub for halal manufacturing and the nation is recognized as the pioneer in Islamic finance too. Over the years, Malaysia has built its image in this segment supported by the strong credibility of its halal certification. Malaysia plays a key role in promoting the awareness of halal, particularly that halal is not limited to only food and beverages, and covers the areas of services.

In Malaysia, Malaysia External Trade Development Corporation (MATRADE) spearheads efforts to promote Malaysian Halal products and services around the world. The agency under the Ministry of International Trade and Industry organizes Malaysia International Halal Showcase or MIHAS which has grown exponentially over the last 17 years to become the world’s largest halal trade fair. MIHAS is an excellent global trading platform for Halal manufacturers, suppliers, buyers, service providers, and distributors to network and discuss business opportunities.

As the National Trade Promotion Agency, MATRADE assists Malaysian companies to penetrate the global market by providing market intelligence, organize exporters' development programs, and export promotion activities. The challenges brought by the pandemic calls for a timely shift for Malaysian companies to tap into the opportunities arising in the new normal.

For more information about Malaysia’s strength in trade or to contact any Malaysian suppliers, please visit www.matrade.gov.my.

CONCLUSION

Driving Malaysia towards Excellence

Over the years, the landscape of the Malaysian economy has transformed significantly – from an agriculture and commodity-driven economy in the 1960s to the manufacturing, technology, and services-driven economy that it is today.

Being located in the Asia Pacific rim and at the center of many ASEAN countries, Malaysia has many competitive advantages to remain an attractive investment and trade destination, particularly with the favorable business environment, including the availability of excellent infrastructure, telecommunication services, financial and banking services, supporting industries as well as a big pool of talents with skills and trainable workforce.

This is reflected in Malaysia’s ability to maintain its strong position globally, ranking the second-highest in Southeast Asia and twelve (12th) out of 169 countries for trade connectivity in the DHL Global Connectedness Index (GCI) report in 2019.

A recent joint study by KPMG and The Manufacturing Institute in the US entitled “Cost of Manufacturing Operations around the Globe” ranked Malaysia fourth among 17 economies in an assessment comparing the economy’s competitiveness as a manufacturing hub, which is ahead of countries in Asia such as China, Japan, Vietnam, and India. This study evaluated a total of 23 cost factors that impact the cost of operations (Cost of Doing Business or CoDB) of a business conducting manufacturing operations in the United States relative to sixteen other countries that are leading manufacturing exporters to the US.

Today, the task to position Malaysia as an economic powerhouse and a force to be reckoned with in the region has become more arduous. The unprecedented COVID-19 pandemic has challenged the Malaysian Government through the Ministry of International Trade and Industry (MITI) to multiply its efforts in facilitating the resiliency of this nation through industrial developments, international trade, and investments – within a context that’s very complicated, for not just Malaysia but for countries around the world.

MITI and its agencies continue to play a key role in the revitalization of the country’s economy following the impact of the pandemic, particularly in the negotiations of Free Trade Agreements between Malaysia and several key economies. Thus far, Malaysia has signed 16 FTAs and implemented 14 FTAs (7 bilateral FTAs and 7 regional FTAs). The most recent is the Regional Comprehensive Economic Partnership (RCEP) that was signed on 15 November 2020 which is pending ratification and entry into force.