Fees and charges make up growing shares in Vietnam state budget revenue

Such increases have created a burden on the citizens, while multinationals are taking advantage of Vietnam’s incentive policies to avoid taxes.

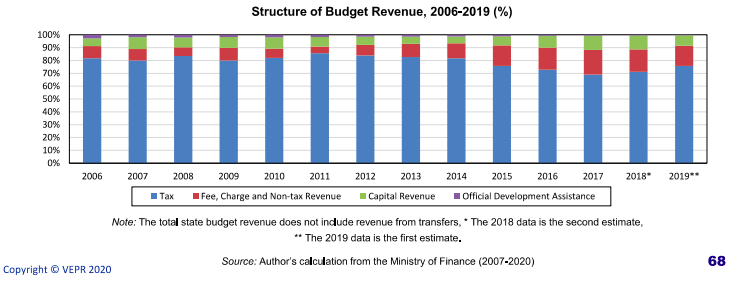

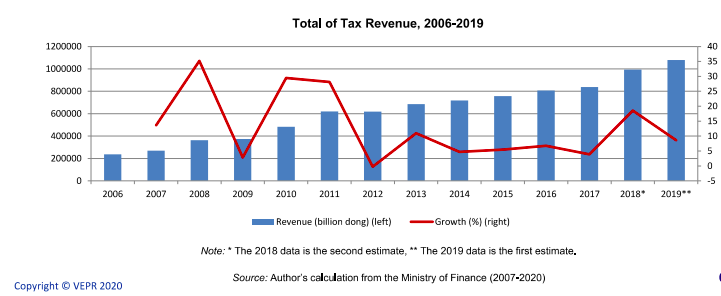

While the total tax revenue substantially decreased during 2009-2011, the proportion of fees and charges in the total state budget revenue tended to grow again during 2012-2019, according to a report by the Vietnam Institute for Economic and Policy Research (VEPR).

In the last three years, revenues gained from fees and charges increased robustly, with the average growth rate reaching 21% per annum, stated VEPR in its latest annual economic report.

Such increases have added a burden on the citizens, the report added.

Additionally, revenues gained from non-refundable ODA only represented 1.15% of non-tax revenue in 2019. This shows that Vietnam’s current budget revenue closely depends on indirect tax, especially value-added tax, VEPR stated, warning this tax is highly regressive.

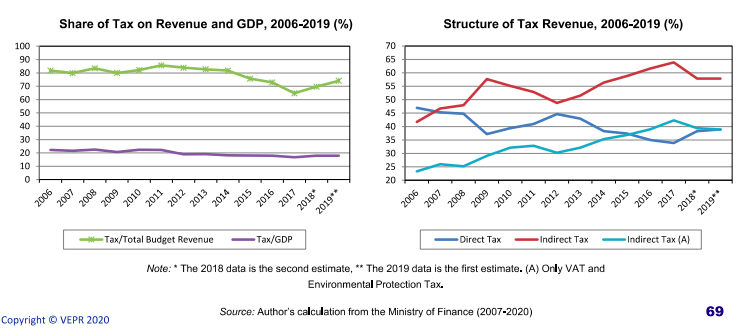

In terms of tax structure, the proportion of indirect tax in the total tax revenue has increased substantially up to more than 60% while the direct tax accounts for less than 40%. This has made Vietnam’s taxation system less progressive, VEPR said.

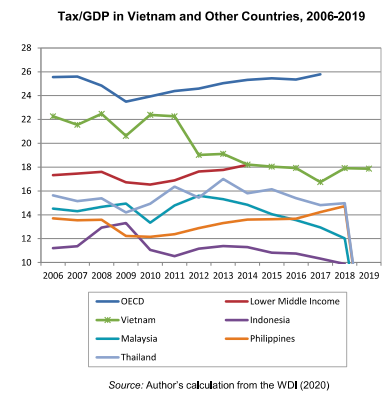

In comparison with other nations of the ASEAN-5 (Indonesia, Malaysia, the Philippines, Thailand and Vietnam) and OECD, the percentage of tax revenue to GDP in Vietnam was lower than that of OECD countries but higher than that of the ASEAN-5 countries.

However, the share of direct tax in Vietnam was much lower than countries of the OECD but ranked second among the ASEAN-5. By contrast, the share of indirect tax to GDP in Vietnam was higher than that of the OECD nations and ranked number two in the ASEAN-5 group.

“Every proposal on increasing consumption tax, fees, charges, needs to be taken into careful consideration due to its influence on the fairness in consumption,” the report noted.

Pham The Anh, VEPR Chief Economist, said one of the factors that greatly affect the tax revenue in Vietnam is tax incentives, especially ones related to the corporate income tax (CIT).

“Many multinational corporations that invested in Vietnam could be imposed with a 10% corporate income tax which was as low as half the common tax rate of 20%,” he said.

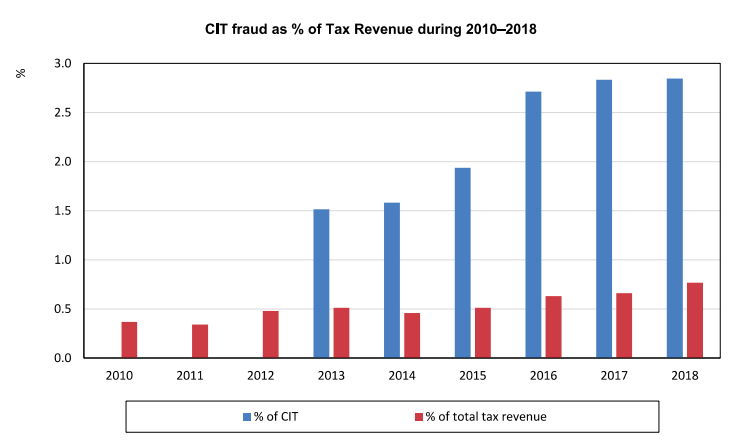

The incentives are prone to be taken advantage of by multinational corporations to evade tax. This kind of tax evasion has been rampant for a long time but been closely controlled since 2010.

Legal documents on the tax incentives were publicly announced but the budget revenue loss due to tax incentive has not been publicly reported, Anh stated.

Tax expenditure a major component of budget losses

VEPR’s report also pointed to the fact that tax expenditure, along with tax evasion and tax avoidance, is major components of budget losses.

Overall, tax expenditures are tax incentives for a specific group of taxpayers which are outside the benchmark tax system. Thanks to these treatments or incentives, the aforementioned group can be levied a lower tax rate than the average tax rate or taxable income threshold is set lower than one applied averagely. In another word, tax expenditure is the tax revenue loss due to the application of special terms or mechanisms.

The tax expenditure was nearly doubled from VND34 trillion (US$1.45 billion) in 2012 and 2014 to VND64 trillion in 2016, which was equal to 7% of the total state budget revenues, 30% of corporate income tax (CIT) tax revenue, 5% of the total state budget expenditures, and even higher than health expenditure.

Notably, the highest tax expenditure group is foreign-invested and industry, especially those in manufacturing. The effective tax rate of manufacturing enterprises was about one fifth of the general tax rate.

Based on VEPR calculation, the elimination of tax expenditure for CIT will have adverse effect on the high-income household groups, who receive the remarkable amount of benefit of tax incentives. If the government uses this incremental budget revenue to allocate into development projects or to tackle the poverty, the abolition might bring significant benefits to low-income households.

Tax offenses growing more complex

In Vietnam, tax offenses in recent years have occurred not only in CIT but also in other taxes. The businesses with breaking tax regulations are not only multinational but also state owned and private. The act of tax fraud is becoming more and more complex, the scope is wider, the scale is bigger and the tricks are increasingly sophisticated.

On average, in the period of 2013 - 2017, the estimated tax revenue loss due to tax avoidance and evasion each year ranged from VND13.3 trillion to VND20.7 trillion (US$573.42 – 892.64 million), equivalent to 6.4-9.9% of the total CIT revenue. These figures were about 3-4 times larger than the number detected annually by regulatory agencies.

In particular, the estimated annual tax revenue loss from the FDI sector can reach VND8 - 9 trillion (US$344 – 387 million or 4 - 4.5% of CIT revenue), while the corresponding number of the non-state sector is up to VND10.5 trillion (US$452.9 million or 5% of CIT revenue).

To address this issue, Vietnam should continue to maintain and improve existing policies, and study and develop new policies that are widely applied and recommended by developed countries and international organizations, it concluded.