Rising disposable incomes augment wine consumption in Vietnam

Since 2010, the average Vietnamese household's disposable income has grown by a compounded annual growth rate of 9.9% in local currency terms, and 7.5% in US dollar terms.

Vietnam’s rapid economic growth, the expansion of households’ disposable income levels, combined with a large youthful consumer base, are driving greater levels of spending on alcohol, which is leading to greater wine consumption in the country, according to Fitch Solutions, a subsidiary of Fitch Group.

Traditionally, wine was mostly consumed via the hotels, restaurants and bars of the tourism sector and a small expatriate community in Vietnam. Wine and sparkling wine offerings were therefore of a higher price point. Such high price points out-priced the domestic consumer, with beer the more dominate alcohol consumed.

However, rising incomes and the entry of cheaper, New World wines (wines produced outside the traditional winegrowing areas of Europe and the Middle East) through Free Trade Agreements into the Mass Grocery Retail channel in Vietnam have increased the visibility of wines for the Vietnamese consumer, added Fitch Solutions.

It is now not uncommon to see wines from Chile, France, Italy and Australia for sale in local supermarkets. While there are no specific statistics on wine consumption during meals, the beverage has become a staple of many social interactions, including business dinners, it said.

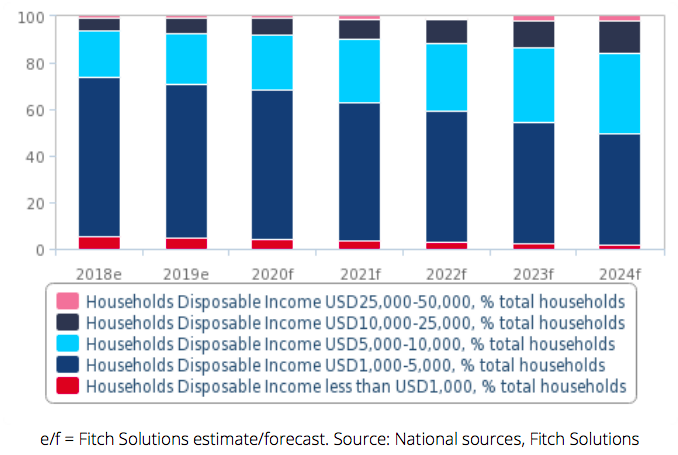

Rising Income Levels Creating A large Middle Class Vietnam - Household Disposable Incomes, % of Total (2018-2024) |

Owing to persistently strong economic growth over the past decade, Vietnamese households have recorded significant disposable income growth. Since 2010, the average Vietnamese household's disposable income has grown by a Compounded Annual Growth Rate (CAGR) of 9.9% in local currency terms, and 7.5% in US dollar terms, according to Fitch Solutions.

As of 2020, the average household now has a disposable income of VND113.6 million (US$4,890), while the per capita disposable income is projected at VND44.4 million (US$1,910).

Despite the short-term setback of the Covid-19 pandemic, Fitch Solutions said it still believes disposable incomes will continue on this growth trajectory in the medium term (2020 – 2024).

Over the next five years, Fitch Solutions forecast household disposable incomes to grow by a CAGR of 9.0% in local currency terms (7.9% in US dollar terms), taking household disposable incomes to a value of VND164.9 million (US$6,800) by 2024.

Such growth in income levels is rapidly developing the country's middle class, although overall the majority of households (roughly 69.0% or 21.0 million households) still earn below US$5,000 a year.

The number of households projected to earn above US$5,000 will grow at a CAGR of 13.9% to 2024, while those that earn above US$10,000 will grow at an even more rapid rate of 19.9% a year. These two income groups are the key target market for the wine industry, Fitch Solutions suggested.

Youthful demographics key for long-term development of wine majors

Vietnam offers an attractive demographics profile for wine producers. In 2020, approximately 72.8% (70.9 million people) of the Vietnamese population are aged over 18 (the legal drinking age in Vietnam). The 20-64 age group can be broken down into two sub groups, which each offer an important, albeit different, opportunity for wine majors.

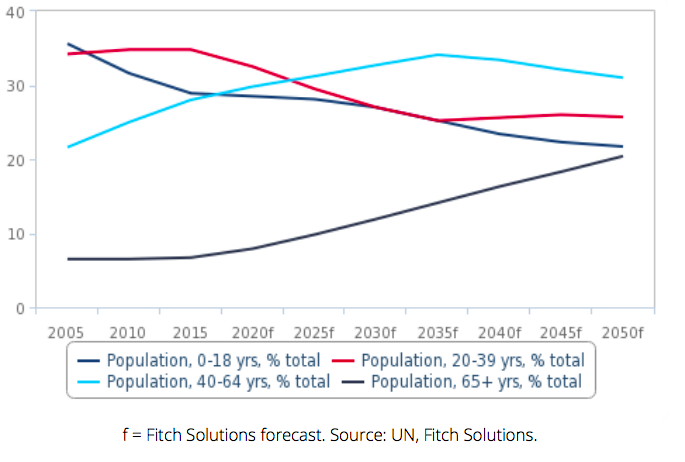

A Growing Middle-Aged Population Group Ideal For Wine Majors Vietnam - Population Categories, % Of Total (2005-2050) |

Young adults (aged 20-39 years) group is typically the range that companies target as a high spending/trendsetting generation and are over the legal drinking age. These consumers are first time buyers and have lower disposable incomes. As such, they often consume cheaper, mass produced wine products. Alcohol majors target this generation to drive revenue growth through small margins, but mass production. In 2020, the young adult population accounted for 32.5% (31.6 million people) of the population in Vietnam.

Middle aged adults (aged 40-64 years) group have higher incomes and more sophisticated tastes for alcoholic drinks. As such, they tend to consume more expensive, premium wine products. For wine majors, this consumer is targeted with higher margin products, but production is more niche.

In Vietnam, due to lower incomes, this population group is still heavily exposed to cheaper alcoholic drinks (which in developed economies is more traditionally demanded by the younger aged group), but with rapidly increasing income levels, this group will increasingly offer an attractive market for more premium brands. As a proportion of the population, this age group will grow from 29.8% (29.0 million) of the population in 2020, to 32.7% (34.1 million) by 2030.

Fitch Solutions also highlighted that Vietnam's population is rapidly urbanizing. In 2010, approximately 30.4% of the population lived in an urban area. This has grown to 37.3% in 2020.

With more people moving from the rural areas to towns and cities and rapid population growth, Fitch Solutions foresees the urban population growing to 57.3% of the population by 2050. This is a good indicator for wine majors, as combined with a growing target population, a higher urbanization rate makes for easier targeting of the specific consumer base.

Wine market is developing rapidly

The Vietnamese are not big wine consumers, often opting for cheaper beer products. The average Vietnamese adult consumers just 0.2 liters of wine per year. Regionally, consumers in Singapore, Thailand and Malaysia all consume more wine per capita.

However, with a population of approximately 97.0 million, Vietnam’s total wine consumption is relatively high, with the country offering the third largest wine market in the Association of Southeast Asian Nations (ASEAN) region, at 15.3 million liters in 2020. Only Thailand (103.3 million liters) and Malaysia (26.7 million liters) offer a larger market.

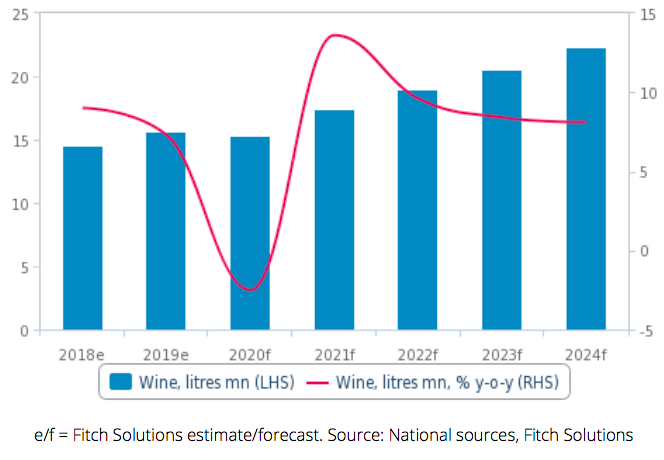

Good Growth In Total Wine Consumption Over The Medium Term Vietnam - Total Wine Consumption, mn litres & % y-o-y (2018-2024) |

With the above-mentioned grow drivers and with demand stemming from a relatively low base Fitch Solutions forecast Vietnam’s wine consumption to grow by an average of 7.4% a year, one of the fastest in the region.

By 2024, the consumption level of wine in Vietnam is projected to reach 22.3 million liters, with per capita consumption of wine forecast to expand to 0.3 liters per adult.

Red wine dominates the wine market in Vietnam, accounting for approximately 76% of total wine consumed in 2020. Proportionally, Fitch Solutions foresees this remaining relatively constant over our medium-term forecast period. White wine accounts for a further 18% of total wine consumption, followed by sparkling wines (2.3%) and fortified wines (2.9%).