Supply chain diversion increases tech giants’ interests in Vietnam: HSBC

The success of Samsung and Intel has led to other tech giants, such as Google and LG, shifting their supply chain to Vietnam.

Supply chain diversion has increased tech giants’ interests in Vietnam, a trend that may have been stalled but not stopped by Covid-19, according to HSBC’s report.

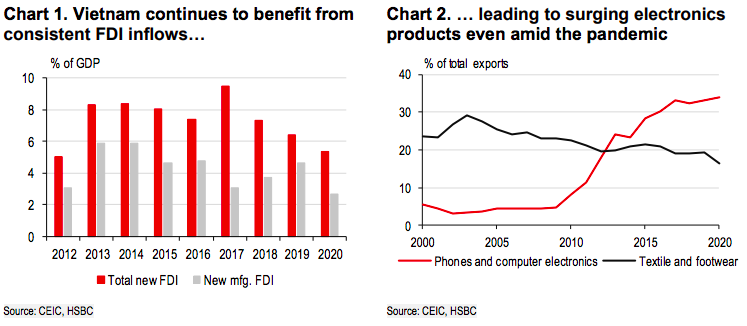

“Vietnam has emerged stronger from the pandemic, in part due to its bourgeoning electronics exports,” noted the bank, saying consistent FDI inflows in tech manufacturing helped Vietnam successfully transform into a key tech production base, gaining substantial market shares in phone and processor chip exports.

In 2020, electronics exports reached a record of US$96 billion, or 34% of its total exports. Yet, it was only less than US$1 billion in 2000, accounting for 5.5% of total exports.

Much of the tech success is thanks to Samsung’s multi-year FDI in Vietnam which started as early as late 2000s, turning Vietnam into its key production base. With investment over US$17 billion over the years, Samsung now has six plants in Vietnam, including two phone factories in the North, producing half of its smartphones and tablets.

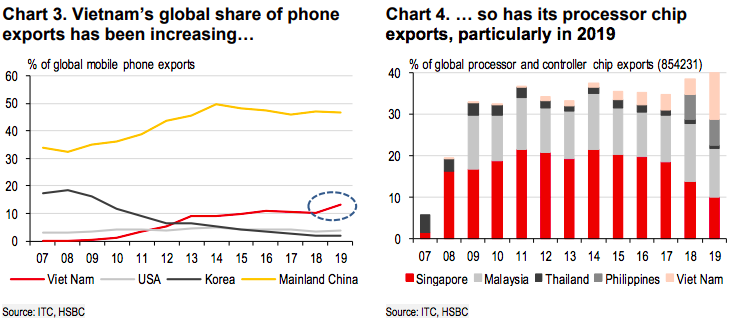

“While China still dominates global phone exports, Vietnam has nonetheless increased its market share,” noted HSBC.

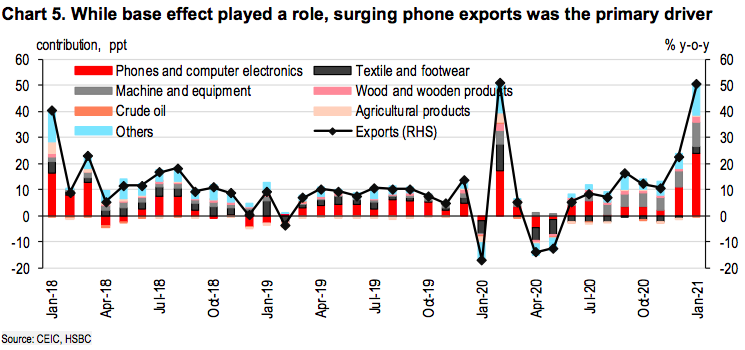

This is particularly evident in Vietnam’s January exports, growing 50.5% year-on-year. While this was in part due to Tết distortions, the primary driver of growth was booming smartphone exports (+115% year-on-year), given the recent release of Samsung’s flagship Galaxy S21.

Although Samsung had an earlier-than-usual release in 2021 (usually in March), the growth in smartphone was still strong after smoothing out the volatilities.

Meanwhile, Vietnam has also emerged as a rising supplier of processor/controller chips (though the ones assembled by Vietnam are relatively lower value chips used in a wide range of electronics products). While China produces 70% of computers globally, Vietnam’s rising production of finished computers has supported chip demand.

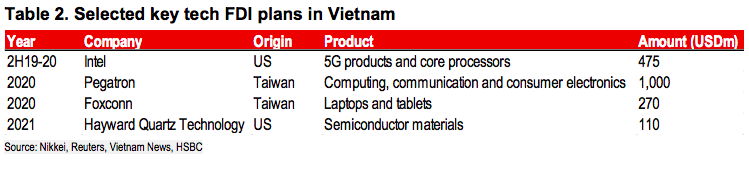

On the other hand, this is likely due to Intel’s US$1 billion investment in a chip assembly and testing facility in Vietnam since 2006. Just recently, Intel was reported to have injected another US$475 million from the final half of 2019 to manufacture its 5G products and core processors.

“The expansion may well explain why Vietnam’s processor exports tripled its share in 2019,” said HSBC.

The success of Samsung and Intel has led to other tech giants, such as Google and LG, shifting their supply chain to Vietnam. The trend intensified during the US-China trade tensions, which has benefited Vietnam not only in terms of booming trade, but also FDI diversion.

Even though the process was somewhat disrupted by the pandemic, increasing FDI interests have resumed as conditions improve, in particular with Apple-related production. Apple has been producing Airpods since May 2020, and is reported to start producing iPads as early as mid-2021.

Indeed, two Taiwanese Apple suppliers, Pegatron and Foxconn, both have announced huge investment plans to ramp up their production capacity in Vietnam. Also, two mainland Chinese Apple assemblers, Luxshare and Goertek, have increased recruitment and started to build a new production facility from late 2020, respectively.

Vietnam’s competitive FDI regime and sound macro fundamentals should continue to attract quality FDI, which is crucial in helping it move up the value chain. Its tech ambition is far from just being a low-end manufacturing hub, thus, more needs to be done to grasp the coming opportunities.

Challenges ahead

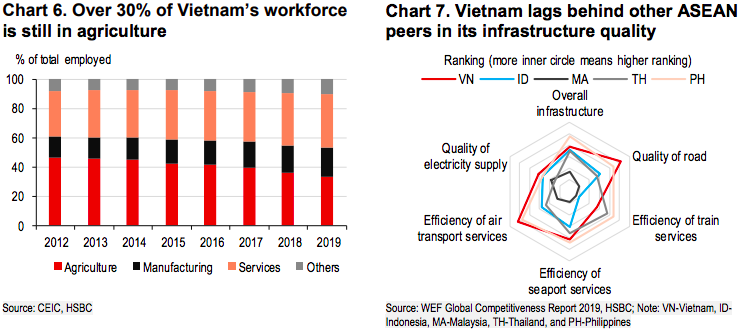

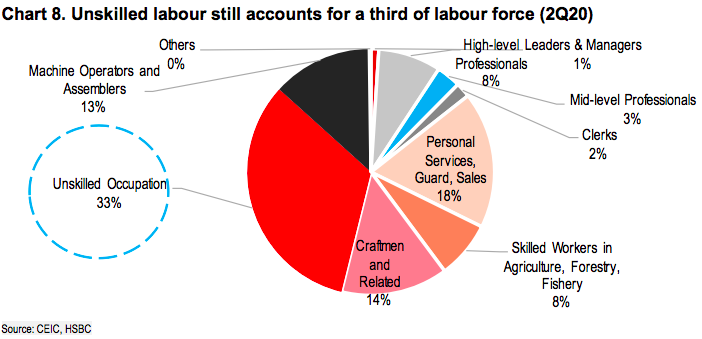

The first task is to improve labor productivity through better-quality education and vocational training. While labor availability to move to the more productive manufacturing sector is an opportunity, as over a third of its workforce still concentrates in agriculture, lack of productivity presents a challenge.

After all, a large proportion (33%) of workforce is still in “unskilled” occupation, as there remains a lack of qualified workers to advance to higher positions. Thus, measures like improving tertiary education and developing industry-specific training programs for technical workers are just some of the examples needed to better equip its human resources.

The other priority should be ongoing infrastructure push, stated HSBC.

Vietnam’s infrastructure spending has been consistently high, but its quality still lags behind other ASEAN economies, hindering its manufacturing potential.

As Public-Private Partnerships (PPP) is an ideal solution to balance Vietnam’s growing infrastructure needs and elevated public debt burdens, “it is indeed encouraging to see the authorities’ ongoing structural reforms in this direction,” stressed HSBC.

“The effective implementation of the revised PPP Law will be key to attracting private investors in these mega projects,” noted the bank.