Unpacking Vietnam’s 2021-25 five-year plan: Fitch Solutions

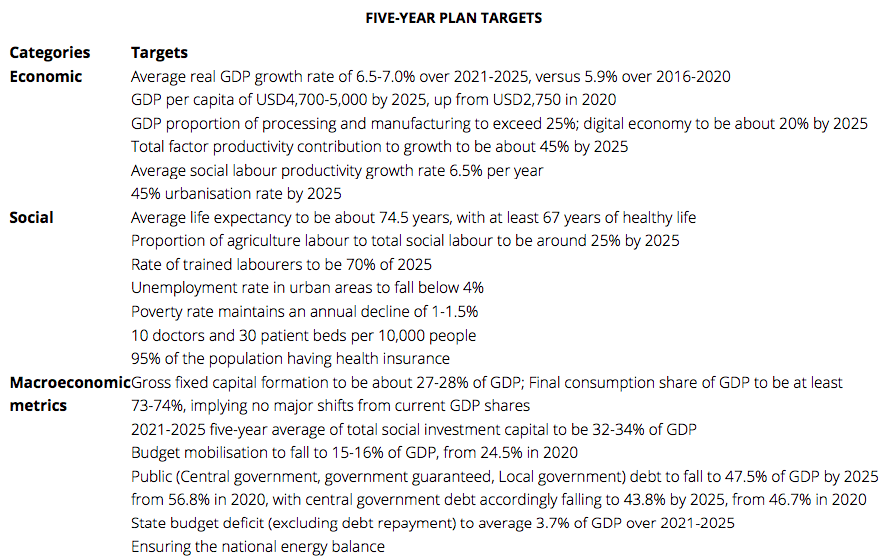

Key goals include continued strong economic growth, driven by manufacturing, and supported by a further integration into global supply chains through the pursuit of trade pacts and export market diversification.

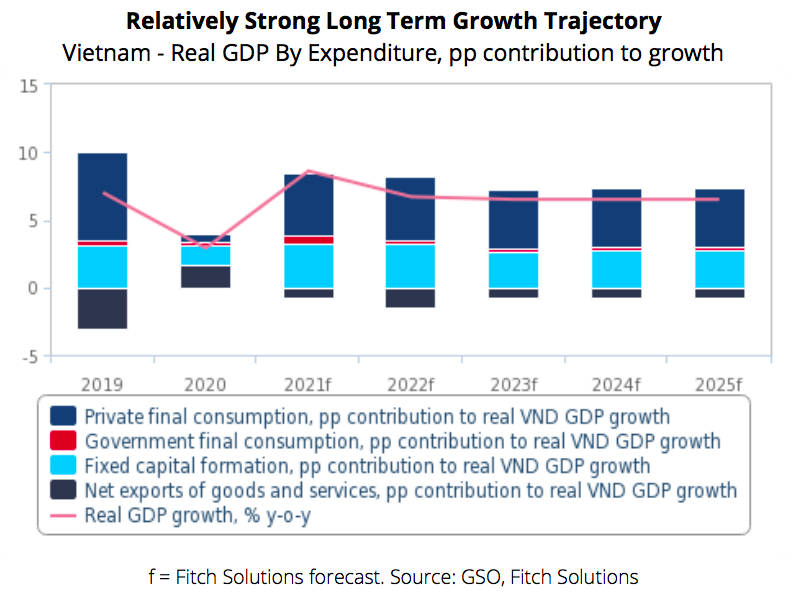

With Vietnam’s 2021-25 five-year plan indicating a continuation of the current economic development model, the country is set to maintain an average growth rate of 6.5% over the coming decade, according to Fitch Solutions, a subsidiary of Fitch Group.

Such forecast is on the lower end of the government’s 6.5-7% average growth target for the 2021-25 period, said Fitch Solutions in a note.

Looking at the country’s five-year socio-economic plan, Fitch Solutions said the government has “a clear direction” to how it wishes to chart its growth over the coming years.

“This is one which relies on an exports-led model which has propelled the economy into strong growth over the past five years, supported by a good business environment, positive labor demographics and relatively low cost of labor versus regional peers,” stated Fitch Solutions.

The continued pursuit of this growth model will also see manufacturing play a larger role in the economy as the government expects, it added.

A key difference in the economic strategy going forward is the government’s aim to ascend in the value chain and grow its high-tech industry.

“This will naturally entail an increase in the skills level of the labor force which can only improve slowly over the coming decade and we expect the skills shortage to pose an impediment to the country’s ascension up the value chain,“ Fitch Solutions added.

While Vietnam had been a hotbed for foreign direct investment (FDI) over the past five years, most FDI had been in low value-added manufacturing due to a skills shortage in the labor force.

Another key challenge the country has to overcome will be logistical bottlenecks given the influx of FDI, which accelerated since 2018 due to the US-China trade war as manufacturers sought to diversify their supply chains away from China.

Although the public-private partnership law which came into effect January 2021 encourages private sector participation in infrastructure development, it is unclear if any acceleration in the pace of project progress will be sufficient to stave off bottlenecks on the roads and at the ports once demand fully resumes post-pandemic.

Transport infrastructure works will also be hindered by permit approvals and also land acquisition issues due to disputes with landowners.

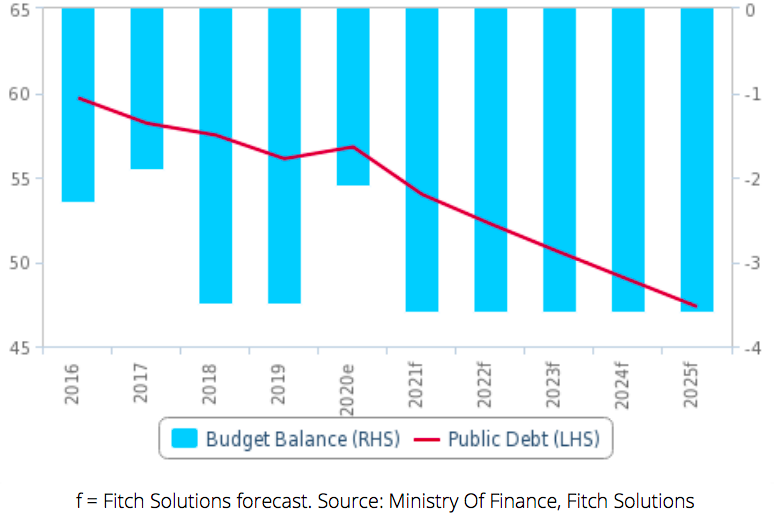

Budget Deficit Management and Public Deleveraging

The 2021-2025 five-year plan is targeting an average budget deficit of 3.7% of GDP, which is above the 3.0% average that Fitch Solutions estimated from 2016-2020.

More Borrowing But A Lower Debt Load As A Result Of Rapid Growth Vietnam – Budget Balance & Public Debt, % of GDP |

“This implies that the government intends to borrow more to fund expenditures over the coming years,” said Fitch Solutions, while adding the Vietnamese government tends to be good at managing its budget deficit.

Unlike many other emerging markets in the region, where governments tend to spend over their budget projections, the Vietnamese authorities seem to be facing a different problem, which is difficulty in disbursing public development capital.

While this does pose its own problems, such as infrastructure project delays, at least on the fiscal aspect, an inability to disburse spending tends to keep the deficit fairly narrow.

According to the five-year plan, despite an increase in public borrowing, more rapid economic growth led by the private sector will help bring down public debt as a share of GDP over the coming five years to 47.5%, further below the 65% statutory limit.

“We believe that this is an achievable target given the strong economic growth potential of the country,” Fitch Solutions concluded.