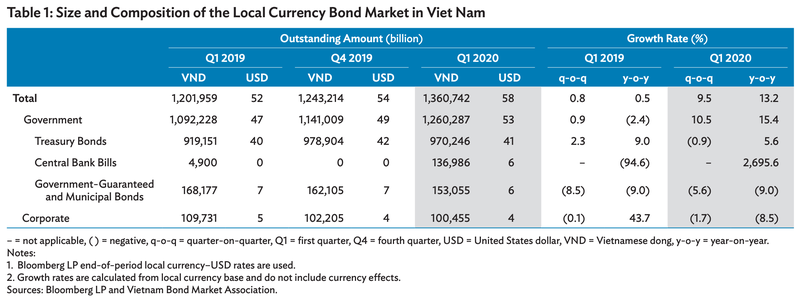

Vietnam bond market grows nearly 10% to US$57.6 billion in Q1

This is mainly due to the government bond segment growing 10.5% quarter-on-quarter in the first quarter, to reach US$53.3 billion.

Vietnam’s local currency bond market posted healthy 9.5% quarter-on-quarter growth in the first quarter of 2020 to reach US$57.6 billion at the end of March, according to the latest edition of the Asian Development Bank (ADB)’s Asia Bond Monitor.

| Vietnam’s local currency bond market posted a healthy 9.5% quarter-on-quarter growth in the first quarter of 2020. |

This is mainly due to a strong growth rate of the government bond segment, growing 10.5% quarter-on-quarter in the first quarter (Q1), to reach US$53.3 billion and accounting for 92.6% of the country’s total bond stock.

On an annual basis, overall market growth accelerated to 13.2% year-on-year in the January – March period from 4.3% in the previous quarter.

The increase in market size in Q1 was solely driven by a jump in the stock of central bank bills. On the other hand, outstanding Treasury bonds and outstanding government-guaranteed and municipal bonds decreased during the period.

Outstanding central bank bills totaled VND137 trillion (US$5.87 billion) at the end of Q1, up from zero in the previous quarter on new issuances during the quarter after all previously outstanding central bank bills had matured in Q4 of 2019.

Corporate bonds, however, contracted 1.7% quarter-on-quarter in the Q1 to reach US$4.2 billion at the end of March given the absence of new issuance over the review period.

Furthermore, a number of corporates in Vietnam issue bonds through private placements in which information is mostly undisclosed, stated the report.

The aggregated bond outstanding of the top 30 issuers in Vietnam’s corporate market amounted to VND96.9 trillion (US$4.15 billion). This nearly comprised the total debt stock of the corporate segment as there are only 46 companies currently tapping the bond market.

Companies in the banking and real estate sectors are the top fundraisers with VND28.1 trillion (US$1.2 billion) and VND27.2 trillion (US$1.16 billion) of outstanding bonds, respectively, at the end of March. Together, these two sectors comprise over half of the total corporate bond market. Of the top 30, 19 are listed companies, 11 are unlisted companies, and 4 are state-owned enterprises.

According to the report, in other bond markets in emerging East Asia, the Covid-19 pandemic would continue to exert its negative impacts, as investment sentiment globally and in the region wane and containment measures limit economic activity.

“Governments and central banks in the region have taken significant measures to mitigate the impact of Covid-19 through fiscal stimulus packages and eased monetary policies. But more needs to be done to strengthen the region’s economies and financial markets,” said ADB Chief Economist Yasuyuki Sawada. “While overall investment sentiment is still down, there are signs of recovery in some economies as quarantine measures are strategically relaxed.”