Vietnam manufacturing activity back in growth territory in Sept

The Vietnamese manufacturing sector returned to growth in September as concerns around the outbreak of the Covid-19 pandemic in the country eased.

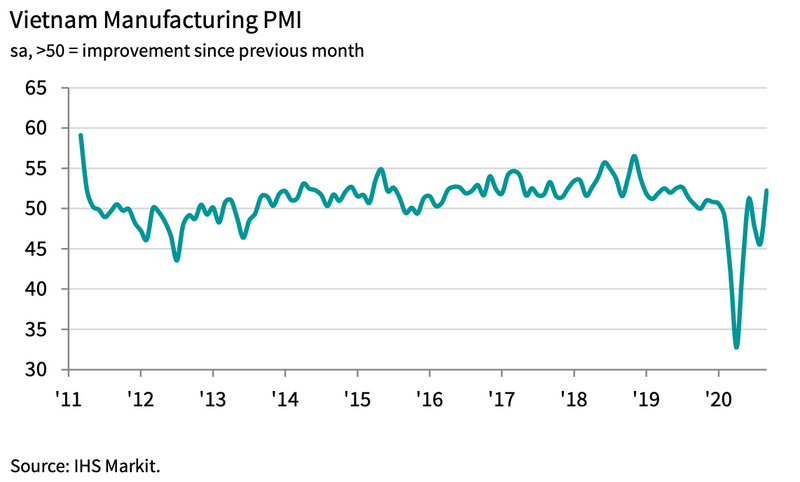

The Vietnam Manufacturing Purchasing Managers' Index (PMI) rose back above the 50.0 no-change mark in September, posting 52.2 from 45.7 in August, pointing to the first improvement in business conditions for three months, and the most marked since July 2019, according to Nikkei and IHS Markit.

A reading below the 50 neutral mark indicates no change from the previous month, while a reading below 50 indicates contractions and above 50 points to an expansion.

Anecdotal evidence suggested that control over the Covid-19 pandemic was a key factor helping to support improvements in operating conditions, after increasing case numbers had been seen in the previous survey period.

Reduced case numbers contributed to stronger client demand, leading to a solid increase in new orders. New business from abroad also increased in September, the first time this has been the case since January.

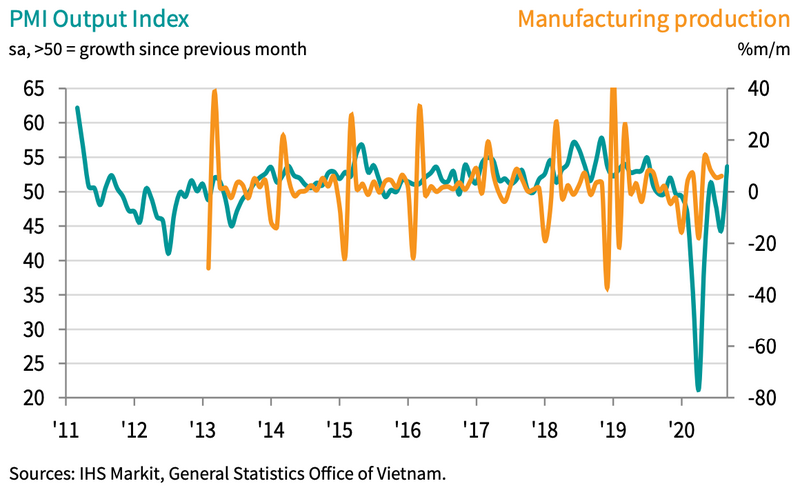

A solid expansion in production was also registered, helped by higher new orders. In fact, the rise in output was the sharpest in 14 months.

Business confidence also improved at the end of the third quarter of the year, rising sharply from August to the highest since July 2019. Projected growth of new orders is expected to lead to increases in output over the coming year, but a number of firms mentioned that positive expectations were based on assumptions that the pandemic will remain under control in the country.

Rising new orders encouraged manufacturers to expand their purchasing activity for the first time in three months, and at a solid pace. This increase in purchasing contributed to a renewed accumulation of pre-production inventories. Some panelists reported efforts to build reserves.

The rate of input cost inflation quickened to a 22-month high and was broadly in line with the series average. Panelists often linked higher input prices to supply shortages for raw materials. This was also a factor behind a lengthening of suppliers' delivery times. That said, lead times lengthened to the least degree since January.

In response to higher input costs, firms raised their selling prices for the first time in eight months. The rate of inflation was only slight, however, amid ongoing competitive pressures.

“After a rise in Covid-19 cases in late-July and early August briefly threw the sector's recovery off track in August, the September PMI results were much more positive. With control of the pandemic regained, firms saw an influx of new orders, ramped up production and were at their most optimistic for over a year. As ever though, sustaining these positive trends is dependent on virus cases not picking up again,” said Andrew Harker, associate director at IHS Markit, which compiles the survey.

"One new development in the latest survey was a return to growth of new export orders for the first time since the pandemic began, a welcome signal that international demand is becoming more supportive of the sector's recovery."