Vietnam's factory activity drops to record low on Covid-19

Business sentiment dropped to the lowest since this series was added to the survey in April 2012 amid concerns around the effects of Covid-19.

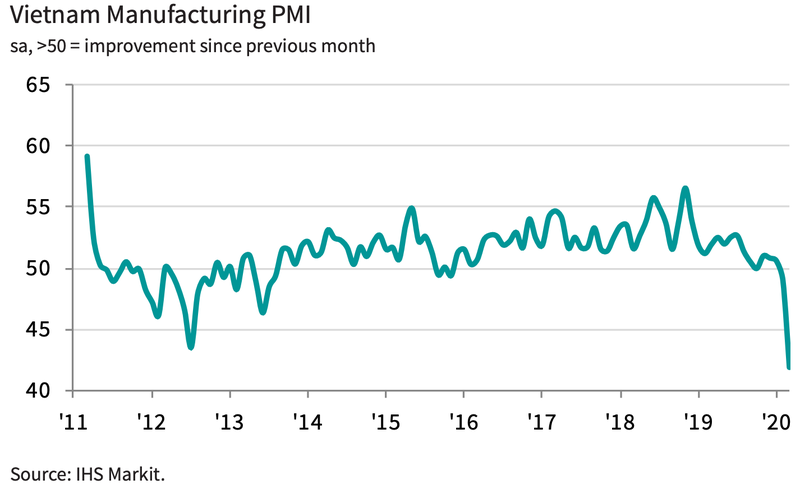

The headline Nikkei Vietnam Manufacturing Purchasing Managers’ Index (PMI) fell sharply to 41.9 in March from 49.0 in February, signaling a steep decline in the health of the manufacturing sector, and one that was the most marked in more than nine years of data collection so far, according to Nikkei and IHS Markit.

A reading below the 50 neutral mark indicates no change from the previous month, while a reading below 50 indicates contractions and above 50 points to an expansion.

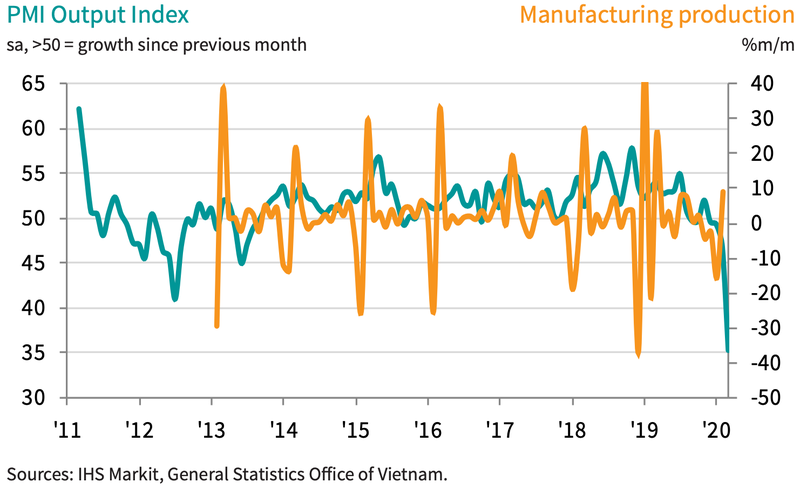

The Covid-19 pandemic led to substantial declines in both new orders and production during March. Both fell at the sharpest rates in the survey's history, with total new business decreasing at a broadly similar pace to new export orders.

Around 42% of respondents saw manufacturing production fall at the end of the first quarter. Steep reductions were registered across each of the consumer, intermediate and investment goods sectors.

A severe drop in new orders as a result of Covid-19 led firms to lower their staffing levels. Employment fell markedly, and for the second month running. Despite job cuts, firms were still able to reduce their backlogs of work given the extent of the decline in new business. Manufacturers also looked to reduce their purchasing activity during March, with input buying down at a record pace. An unprecedented fall in stocks of purchases was signaled as a result.

Stocks of finished goods also decreased markedly, and to the greatest extent in a little over six years.

Despite a lack of demand for inputs, suppliers' delivery times continued to lengthen. In fact, vendor performance worsened to the greatest extent in the survey's history as Covid-19 disrupted supply chains. Delays from Chinese vendors were mentioned in particular.

Input costs rose marginally in March, and at the slowest pace in four months. Where input prices increased, panelists linked this to a scarcity of raw materials. On the other hand, a lack of demand for inputs and lower oil prices led some respondents to record a drop in input costs.

Meanwhile, output prices decreased sharply, and to the greatest extent since July 2012.

Business sentiment dropped to the lowest since this series was added to the survey in April 2012 amid concerns around the effects of Covid-19. More than one-quarter of firms predict output to fall over the coming year. That said, just under 39% of respondents expect production to be higher than current levels, with a recovery expected once the outbreak is brought under control.

“Unsurprisingly, the Covid-19 pandemic had a severe impact on the Vietnamese manufacturing sector in March, with PMI data signaling the worst decline in business conditions since the survey began just over nine years ago,” said Andrew Harker, associate director at IHS Markit, which compiles the survey.

“Many of the survey's variables hit record lows and business confidence tumbled. The key now is how long it will take before the global community can bring the pandemic under control. Once this occurs, manufacturers predict a rebound in production," he added.