Vietnam needs diversified energy strategy to attract private sector investment: VBF

The combination of private investment in renewables, natural gas and grid infrastructure could meet much of Vietnam’s investment costs in next periods.

A diversified energy system, less dependent on coal, with increasing shares of energy produced by renewables, natural gas, and battery storage will be more secure, affordable and reliable, according to the latest report conducted by the Vietnam Business Forum’s Power and Energy Working Group.

The Made in Vietnam Energy Plan 2.0 (MVEP 2.0) report, released on February 27 in Hanoi, draws on the interest and experience of Vietnam Business Forum members (VBF), which includes 15 domestic and foreign business associations, and provides a high-level policy dialogue channel with the Government of Vietnam.

| Speakers at a press conference of VBF's Power and Energy Working Group in Hanoi on February 26. Photo: Nhat Minh |

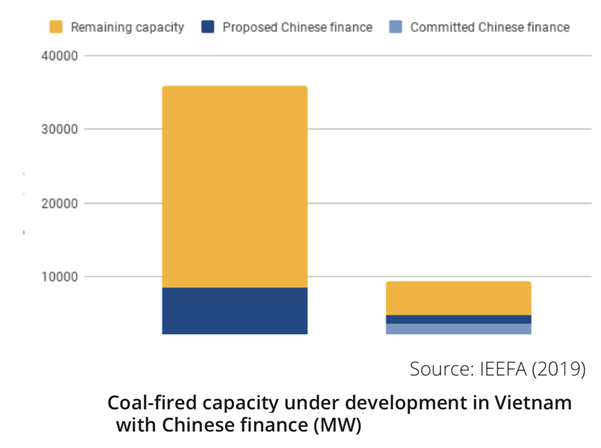

Vietnam’s energy system is imbalanced with generation largely in the north and growing demand in the south. Under the Power Development Plan VII (PDP VII), new coal-fired power stations will be built in the south to resolve that imbalance. MVEP 2.0 proposes a more diverse energy system that includes a greater focus on renewable energy, particularly in the south where new energy sources are needed, combined with adequate new liquefied-natural gas (LNG) terminals and power plants using imported LNG as Vietnam’s domestic sources are brought online.

MVEP 2.0 also proposes increased investment in grid infrastructure to match new energy sources, particularly in the Mekong Delta, Southeast and South-Central regions. In PDP VII, National Power Transmission Corporation (NPT) estimated that buildout of the grid to meet projected demand would cost roughly US$5 billion, with a high initial cost declining 10-15% per year from 2019-2023.

According to the report, this level of investment in grid infrastructure was based on the location of large-scale thermal coal plants. In order to meet the needs of more distributed network that includes renewables, integrated grid battery storage and new LNG power plants, MVEP 2.0 recommends that PDP VIII, now under development, creates opportunities for private sector investment in grid infrastructure. The combination of private investment in renewables, LNG and grid infrastructure could meet much of Vietnam’s investment costs through the next power planning period.

“We can see what the private sector can implement energy plans in a shorter time period. Following the issuance of Feed-In-Tariffs in September 2016, the private sector installed roughly 5.2 GW of solar power, and more is in the pipeline, since moving towards gas as a base load to support renewable dozens of projects proposed,” John Rockhold, head of VBF’s Power and Energy Working Group, remarked.

The first edition of the “Made in Vietnam Energy Plan” (MVEP 1.0) was completed in 2016-2017. However, due to the very new and rapid development of renewable energy in Vietnam and the possibility of increasing the use of LNG in power generation, the VBF Power and Energy Working Group have updated and revised the plan to include six key recommentations for action:

(i) Engage energy specialists from the private sector to assist in producing a PDP VIII with a strong prioritization on investment in renewable energy, natural gas, battery storage, and energy efficiency. With the exception of battery storage, which has only recently become an affordable option, this mirrors the objectives set forth in MVEP 1.0.

(ii) Implement regulatory frameworks and incentives that encourage private investment in large and small renewable energy projects, such as rooftop solar, battery storage, solar farms, floating solar, and offshore and onshore wind projects, biomass, with simplified approval processes, while still maintaining safe power systems.

(iii) Standardize the energy DPPA and PPA as an internationally bankable agreement used internationally and in other ASEAN countries.

(iv) Publish a Roadmap to Retail Electricity Tariffs to 2025 that depicts the move toward market-based pricing, revising the number of peak tariff hours, and consider a differential retail tariff in different power regions and for disadvantaged households.

(v) Assess the urgent demands on the grid transmission system and the least-cost means of developing grid infrastructure to support increased renewable energy and increased distributed energy generation.

(vi) Assess the cause and solutions for Vietnam’s extremely high and growing energy intensity as compared to regional neighbors with similar and higher GDP per capita and prepare a public education campaign on reducing energy waste at residential, office and manufacturing levels.