Vietnam stays firm in top 10 remittance recipients in 2021 with US$18.1 billion

The year 2021 will be the fifth in a row that Vietnam remains in the top 10 in terms of remittance.

Vietnam has moved up one notch to be the world’s eighth-largest remittance recipient with an inflow of US$18.1 billion in 2021, accounting for 4.9% of its GDP while last year the figure was $17.2 billion, according to the World Bank’s latest data.

| Vietnam is among the top 10 in terms of remittance. |

This will the fifth consecutive year that Vietnam remains in the top 10 in terms of remittance, with the figure being $13.8 billion (2017), $15.9 billion (2018), and $17.2 billion (2019).

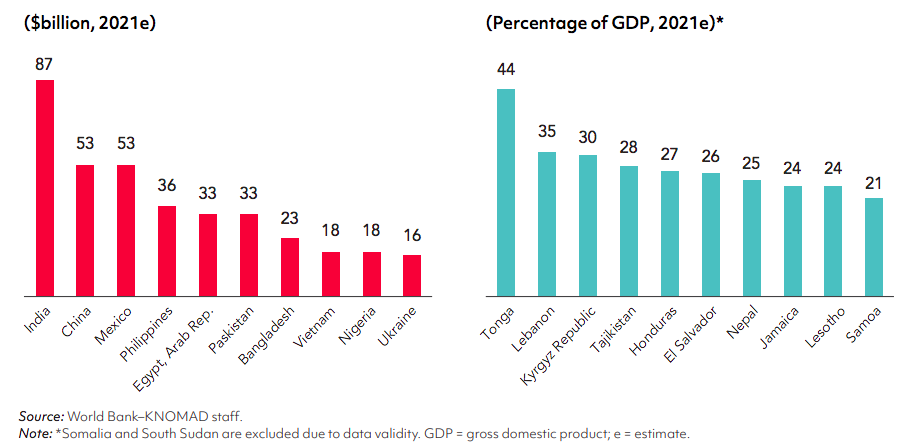

India remained the largest recipient globally with an estimated $87 billion, followed by China and Mexico with $53 billion.

In the East Asian and Pacific region, in 2021, Vietnam ranked third after China and the Philippines ($36 billion) – the world’s fourth-largest recipient.

Nguyen Hoang Minh, deputy director of the State Bank of Vietnam (SBV) in Ho Chi Minh City noted the strong remittance inflow into Vietnam amid the pandemic has had positive impacts on the foreign exchange market.

“A stable US-Vietnam exchange rate would continue to facilitate the Government’s policies favoring businesses and people affected by the pandemic,” he said.

The Vietnamese dong (VND) was among the most stable currencies in Asia, with the USD/VND exchange rate fluctuating around VND23,200-23,250 per US dollar in the first quarter of 2021, around the same as last year. In this regard, other currencies have sharply depreciated against the USD, including JPY (-7.26%), EUR (-4.12%), THB (-4.5%), KRW (-4.19%), and CNY (-0.57%).

Fitch Solutions forecast the VND to average VND23,000/USD, and around VND23,200 in 2022.

| Strong remittance inflow into Vietnam amid the pandemic has had positive impacts on the foreign exchange market. Photo: The Hanoi Times |

Importance of remittance as critical lifeline

On the global scale, the World Bank noted remittances to low- and middle-income countries are projected to have grown a strong 7.3% to reach $589 billion in 2021.

For a second consecutive year, remittance flows to low- and middle-income countries (excluding China) and are expected to surpass the sum of foreign direct investment (FDI) and overseas development assistance (ODA).

This underscores the importance of remittances in providing a critical lifeline by supporting household spending on essential items such as food, health, and education during periods of economic hardship in migrants’ countries of origin.

“Remittance flows from migrants have greatly complemented government cash transfer programs to support families suffering economic hardships during the Covid-19 crisis. Facilitating the flow of remittances to provide relief to strained household budgets should be a key component of government policies to support a global recovery from the pandemic,” said Michal Rutkowski, World Bank Global Director for Social Protection and Jobs.

Factors contributing to the strong growth in remittance are migrants’ determination to support their families in times of need, aided by economic recovery in Europe and the United States which in turn was supported by the fiscal stimulus and employment support programs. In the Gulf Cooperation Council (GCC) countries and Russia, the recovery of outward remittances was also facilitated by stronger oil prices and the resulting pickup in economic activity.

However, the cost of sending $200 across international borders continued to be too high, averaging 6.4% of the amount transferred in the first quarter of 2021, according to the World Bank’s Remittance Prices Worldwide Database. This is more than double the Sustainable Development Goal target of 3 percent by 2030.

It is most expensive to send money to Sub-Saharan Africa (8%) and cheapest in South Asia (4.6%). Data reveal that costs tend to be higher when remittances are sent through banks than through digital channels or through money transmitters offering cash-to-cash services.

“The immediate impact of the crisis on remittance flows was very deep. The surprising pace of recovery is welcome news. To keep remittances flowing, especially through digital channels, providing access to bank accounts for migrants and remittance service providers remains a key requirement. Policy responses also must continue to be inclusive of migrants especially in the areas of access to vaccines and protection from underpayment,” said Dilip Ratha, lead author of the Brief and head of the Global Knowledge Partnership on Migration and Development (KNOMAD).

Remittances are projected to continue to grow by 2.6% in 2022 in line with global macroeconomic forecasts. A resurgence of COVID-19 cases and re-imposition of mobility restrictions poses the biggest downside risk to the outlook for global growth, employment and remittance flows to developing countries. The rollback of fiscal stimulus and employment-support programs, as economies recover, may also dampen remittance flows.