Vietnam stock market predicted to be resilient amid Covid-19 resurgence

The stock market still proves to be quite attractive in the context of redundant liquidity and other investment channels having not fully recovered.

It is unlikely that Vietnam’s stock benchmark VN-Index would return to its March bottom with a 25% slump, given that investors now have sense of Covid-19 impacts instead of the panic sentiment in the first outbreak, according to Viet Dragon Securities Company (VDSC).

The VN-Index hit its lowest level since December 2016 on March 24 at around 660 points. Since recovering and peaking at 900 in mid-June, the index has continuously corrected and currently trades at 800 points.

VDSC said the market correction is entirely reasonable when macroeconomic data showed the economy did not recover as quickly as had been expected. Besides, the Covid-19 resurgence in Danang and other localities made the fast recovery unlikely.

Foreign investors’ net selling pressure not too strong

One of the reasons for the sharp decline of the market in March was the continuous net selling from foreigners via matching orders.

The net selling value reached a record high in March. Even when the market rebounded strongly in April, foreigners' net selling value was still high. However, VDSC expected this is not likely to repeat this time, due to (1) dollar liquidity is guaranteed by the Federal Reserves (Fed), (2) the Vietnamese dong (VND) has not fluctuated much against USD and the State Bank of Vietnam (SBV), the country’s central bank, is willing to stabilize the foreign exchange market.

In addition, although exports and FDI disbursement were negatively affected by the pandemic, the sharp increase in trade surplus compared to the same period last year, plus the minimal decrease in FDI, had helped the SBV increase USD reserves. Foreigner investors even net bought over VND600 billion (US$25.81 million) in the last few sessions of July since the second outbreak was announced in Danang.

Cash flow remains abundant

The similarity between the first Covid-19 wave and this time is that the domestic cash flow remains abundant. Indeed, when businesses and people were still reluctant to invest and expand businesses, the pandemic has returned. This makes the ability to absorb credit which is already weak (only rising by 3.26% after six months) will even be more limited, asserted VDSC.

In that context, banks will not rush on raising capital when the liquidity in the system is still quite redundant. Therefore, the possibility of low deposit interest rates will maintain at least until a strong credit recovery signals emerge.

While the demand for credit for production activities is limited, the possibility of a surge in real estate roadshows is not high when the government suggests limited crowded events. In this context, the stock market, despite strong fluctuations in recent months, continues to be a potential investment channel. According to Bloomberg statistics, 139 out of 386 stocks have gained year-to-date, in which the stock prices of 83 ticker increased by more than 11% year-to-date.

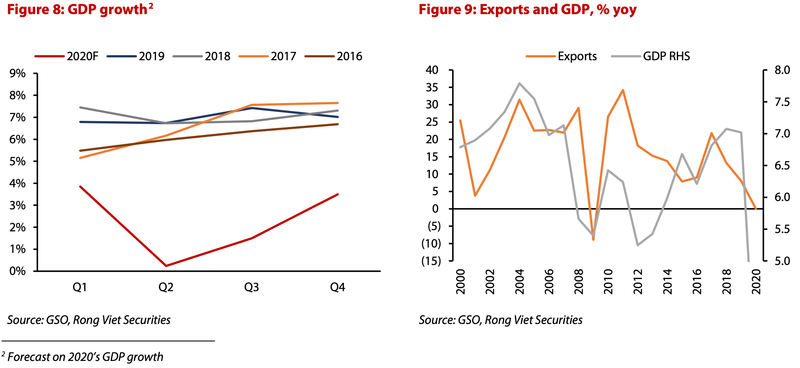

As a result, Vietnam’s stock markets and others in the world have witnessed a rapid recovery after a sharp decline in March. Besides the participation of new cash flow, there is an expectation that the economy will recover quickly after the epidemic is contained. There were times the government sets a target of 5% GDP growth for 2020 before adjusting the figure to 3-4%.

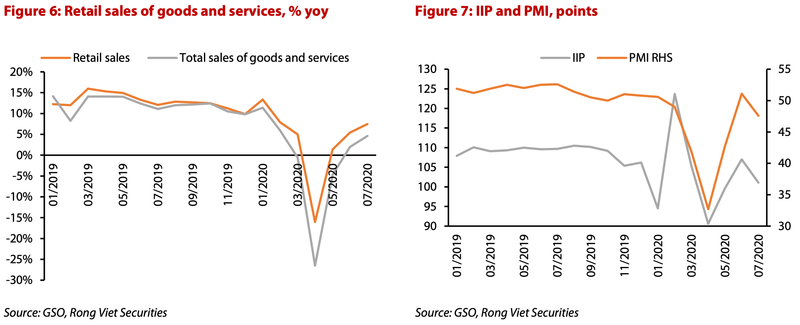

However, economic data shows that the pace of recovery is not as expected when production figures rose by only 1% year-on-year in July, while total retail sales of goods and services only increased by 4.6 % year-on-year compared to a two-digit growth in normal period.

Vietnam’s Manufacturing Purchasing Managers’ Index (PMI) figures were even more negative when it dropped to less than 50 in July (the boundary between expansion and recession) due to lower production and lower new orders compared to June.

Moreover, expectations of opening international flights may need to be revised because of the pandemic can comeback anytime. Therefore, the expectation that the economy will recover quickly in Vietnam in the second half of this year may not be realized, VDSC stated.

However, VDSC also predicted the VN-Index could fall to 720 in case the government announce social distancing in two major cities of Hanoi and Ho Chi Minh City.

.png)

.png)