Vietnam urged to ease market regulation for reclassification as emerging market

Vietnam currently does not have a mechanism to limit the failure of transactions similar to other emerging markets in the region.

The sooner Vietnam eases the market regulation, the easier it is for the market to be reclassified as Emerging Market, according to Viet Dragon Securities Company (VDSC).

The move, however, is unlikely to happen in 2020, said VDSC in a report.

Market reclassification is one of the positive factors for the Vietnamese market. However, at present, Vietnam's stock market is facing restrictions on clearing and settlement. More specifically, Vietnam requires pre-funded trades although the settlement cycle is T + 2 because the authorities are worried that the market would collapse when failed trades occur.

Looking at some emerging markets in the region, failed transactions still occur frequently. However, generally these markets have a mechanism to limit the failure of transactions, while in Vietnam, such a clear mechanism for this is not available.

In the Thai market, for example, the authorities developed a series of measures to control the risk of failed trades. Borrowing and lending of stock (SBL) is one of the common methods. Thailand Clearing House Company will borrow and lend shares on behalf of its members. In the event that there is no available stock to lend, the company will assist the investor in purchasing the stocks from another investor and the default member takes responsibility for the price difference (this process is also called buy-ins). In addition, members who want to borrow shares need to have cash collateral of 130% of the loan value. This amount will be refunded when the borrower returns the stock. Meanwhile, buyers are required to have enough money one day before the payment date (SD-1).

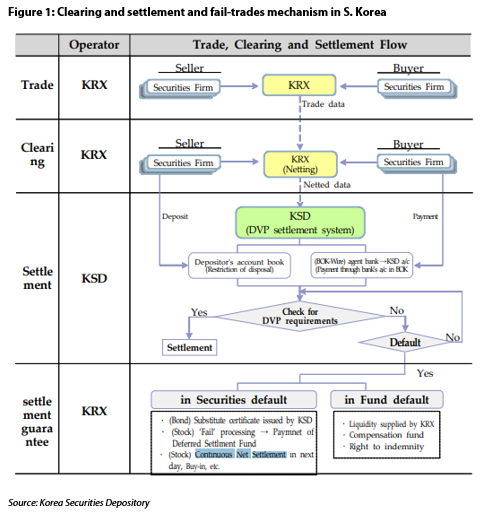

VDSC said Vietnam is learning from South Korea, which has similar methods of Thailand such as SBL and buy-ins. Besides, South Korea also introduces sell-out method (in case investors do not have enough cash at the payment date, the securities company will sell the shares purchased at the lowest price and the investor is responsible for the difference between the proceeds and the payment for the purchase of those stocks). Additionally, South Korea is preparing to apply the Continuous Net Settlement, meaning failing to deliver stocks at the settlement date will be rolled-over for the next day settlement.

Meanwhile in Taiwan (China), although the law does not require pre-funded trades, some securities companies still have this requirement for investors due to the fact that currency conversion is not freely in the market. Therefore, only foreign investors with high credit are not required pre-funded trades by brokers. In case the investor does not have sufficient cash to execute at the settlement date, securities companies must fill in to execute the orders or they will be punished by the authorities. As a result, both FTSE and MSCI have put restrictions on clearing and settlement in Taiwan.

For the Vietnamese stock market, in addition to the fact that it does not have a mechanism to handle failed trades, the ability to manage risks of the securities companies is also important for the law to eliminate pre-funding requirement, because in this case, the risk may go to securities companies.

On the other hand, the post-transaction error correction mechanism in Vietnam is a positive point. For example, the mechanism of stock borrowing and lending from the Vietnam Securities Depository is quite similar to the mechanism for lending and borrowing stocks in other emerging markets. Therefore, the law has the basic elements to be improved and proceeded to abolish the pre-funding requirement.

However, according to a vice chairman of the State Securities Commission, the country’s stock market watchdog, this criteria will only be relaxed when the market develops to a higher level, securities companies have good risk management capacity and investors' consciousness improves.

Vietnam is currently in the Frontier Market group, and was added to the FTSE Russell’s watchlist for posible upgrade to Secondary Emerging Market in September 2018. However, after one year of review, Vietnam only met seven out of nine criteria of FTSE.