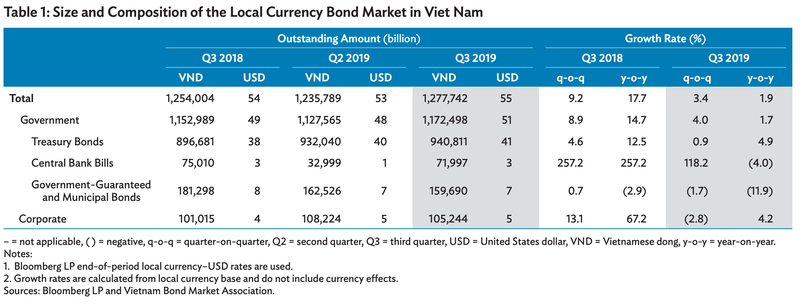

Vietnam’s bond market grows 1.9% in Jan-Sep, reaching US$55 billion

This expansion was due mainly to a 4% on-quarter growth in government bonds to US$51 billion as the central bank increased issuance of bills.

Vietnam’s bond market registered growth of 3.4% on-quarter and 1.9% on-year to US$55.1 billion as of the end-September, according to the latest edition of the Asian Development Bank’s (ADB) Asia Bond Monitor.

This expansion was due mainly to a 4% on-quarter growth in government bonds to US$51 billion as the State Bank of Vietnam (SBV), the country’s central bank, increased issuance of central bank bills.

The overall expansion of the country’s local currency bond market was slightly tempered by a 2.8% contraction on-quarter in the corporate bond market to US$5 billion. Nevertheless, the corporate bond market still posted growth of 4.2% year-on-year.

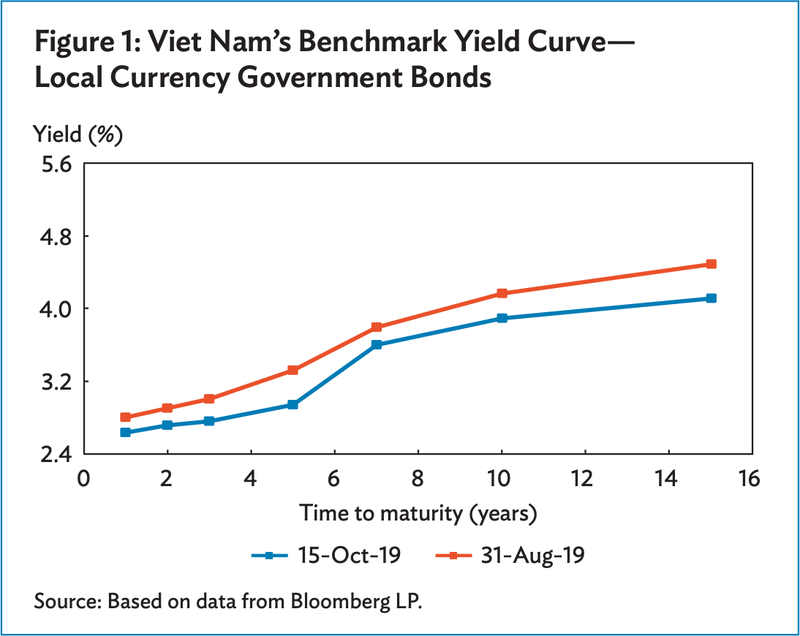

Yield movement

Vietnam’s local currency government bond yield curve shifted downward between August 31 and October 15. Bond yields for all tenors fell, with yields shedding an average of 26 basis points (bps) across the curve. The 5-year tenor and 15-year tenor declined the most at 38 bps each. Yields generally fell more at the longer end than the shorter end of the curve, leading to a narrowing of the 2-year versus 10-year yield spread from 126 bps on August 31 to 118 bps on October 15.

The downward yield movement was driven largely by a policy rate cut by the SBV on September 13. The SBV reduced its key policy rates 25 bps each, bringing the refinancing rate to 6%, the rediscounting rate to 4%, and the overnight rate to 7%.

Unlike other central banks in the region, the SBV’s move was largely in response to easing monetary policies in advanced economies as opposed to declines in domestic growth. The SBV cited negative developments in the global economy and easing monetary policy in the US and European Central Bank. The SBV also noted that the domestic economy remains stable with inflation controlled. Vietnam’s gross domestic product growth remained strong in 2019. In the third quarter of 2019, Vietnam’s economy grew 7.3% year-on-year (y-o-y) after rising 6.7% y-o-y in the second quarter of 2019.

In August, the State Treasury of Vietnam announced its plan to issue VND70 trillion (US$3 billion) worth of government bonds in the third quarter 2019. The issuance plan comprises (i) 5-year Treasury bonds worth VND4 trillion (US$172.4 million), (ii) 7-year Treasury bonds worth VND2 trillion (US$86.2 million), (iii) 10-year Treasury bonds worth VND27 trillion (US$1.16 billion), (iv) 15-year Treasury bonds worth VND26 trillion (US$1.12 billion), (v) 20-year Treasury bonds worth VND6 trillion (US$258.6 million), and (vi) 30-year Treasury bonds worth VND5 trillion (US$215.5 million). The volume of issuance, however, may be adjusted subject to market conditions and the funding needs of the government

According to ADB, the country continues to be a beneficiary of the ongoing China–US trade war as businesses reallocate production to Vietnam. The government indicated that for the first three quarters of 2019, manufacturing was the main driver of economic growth. Exports grew 8.3% y-o-y during the same period. Despite Vietnam’s strong economic growth, inflation remained manageable. Consumer price inflation rose slightly to 2.2% y-o-y in October from 2% y-o-y in the prior month. For the first 10 months of the year, inflation was 2.5% y-o-y.

Emerging East Asia’s local currency bond market posted steady growth during the third quarter of 2019 despite persistent trade uncertainties and a global economic downturn, added the ADB.

“The ongoing trade dispute between China and the US and a sharper-than-expected economic slowdown in advanced economies and China continue to pose the biggest downside risks to the region’s financial stability,” said ADB Chief Economist Yasuyuki Sawada. “However, monetary policy easing in several advanced economies is helping to keep financial conditions stable.”

Local currency bonds outstanding in emerging East Asia reached US$15.2 trillion at the end of September. This was 3.1% higher than at the end of June. Local currency government bonds outstanding totaled US$9.4 trillion, accounting for 61.8% of the total, while the stock of corporate bonds was US$5.8 trillion. A total of US$1.5 trillion in local currency bonds were issued in the third quarter, up 0.9% versus the previous three months.

Emerging East Asia comprises China; Hong Kong (China); Indonesia; South Korea; Malaysia; the Philippines; Singapore; Thailand; and Vietnam.