Vietnam’s green, social and sustainability debts total US$1.5 billion in 2021

Vietnam has incurred green, social, and sustainability (GSS) debts of US$1.5 billion in 2021, almost five times the $0.3 billion in the previous year, and maintaining steady growth for the third consecutive year.

Major green bonds and loans in Vietnam in 2021 came from the transport and energy sectors. The country remained the second-largest source of green debt in ASEAN in 2021 at $1 billion.

This was one of the key findings in the ASEAN Sustainable Finance – State of the Market 2021, jointly conducted by Climate Bonds Initiative and HSBC.

HSBC Vietnam CEO Tim Evans expressed his impression of Vietnam's significant GSS debt growth in 2021.

Evans pointed out that all forms of sustainable finance aim to help Vietnam achieve its net zero carbon emission by 2050, expecting the demand for green capital to increase further in the coming time.

The Vietnamese bond market has grown to represent over $70 billion in 2021. Over 80% of the volume comes from government debt, with development banks being the second-largest issuer type. In late 2020, the National Assembly of Vietnam passed Environmental Protection Law 2020 with major changes compared to the previous version.

Among the changes are the inclusion of the definition, general requirements of green bonds, and potential incentives applicable to eligible issuers which will be specified in the following sub-law documents. A green taxonomy is being developed together with the promulgation of the law. This new law is expected to be introduced in 2022.

| A corner of Hanoi. Photo: Doan Thanh |

ASEAN’s enthusiasm to facilitate green growth

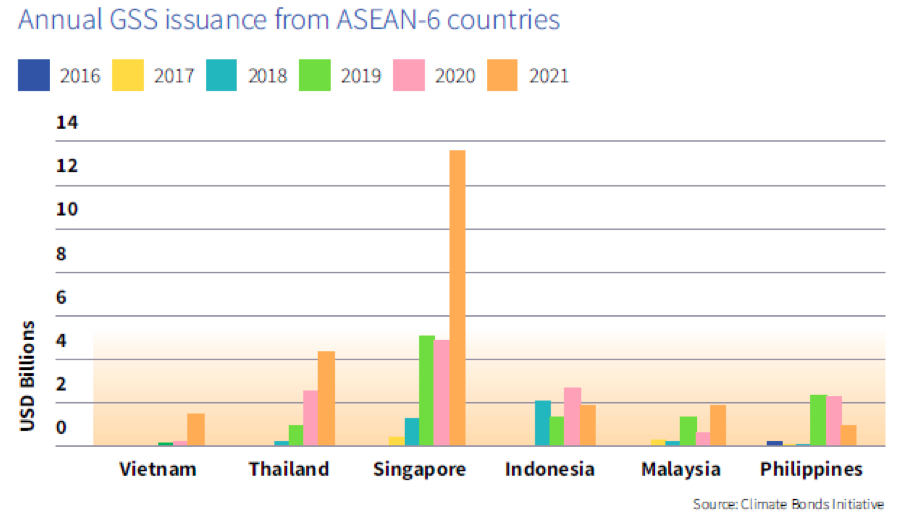

The report noted the sustainable debt market in the six largest ASEAN economies (Vietnam, Thailand, Singapore, Indonesia, Malaysia, and the Philippines) continued to grow rapidly in 2021, with record issuance of GSS debt totaling $24 billion compared to $13.6 billion in 2020, up 76.5% year-on-year, and sustainability-linked debt totaling $27.5 billion compared to $8.6 billion in 2020, up 220% year-on-year.

“This growth reflects the regions’ enthusiasm to allocate capital for the response to the Covid-19 pandemic along with facilitating long-term, low carbon, and climate-resilient economic growth,” noted the report.

Green-labeled debt, encompassing green bonds and green loans, remained the most popular in the GSS debt market in 2021. 63.9% of GSS deals originating from ASEAN in 2021 were green, followed by sustainability (35.5%), with the latter showing an increase compared to 2020 (26%). The region saw a small volume of social debt issuances (0.6%) in 2021.

Meanwhile, buildings and energy continued to represent the main use of proceeds for green-labeled debt in ASEAN. The two sectors received two-thirds of the proceeds in 2019 growing to 79% in 2020. The cumulative regional picture remained the same in 2021. Buildings and Energy combined accounted for 79.5% of the cumulative use of proceeds of green debt issued from the ASEAN region between 2016-2021.

Non-financial corporate issuers were responsible for most (79%) of the ASEAN green volumes in 2021, while sovereign issuance continued to dominate the social and sustainability market, responsible for 51% of issuances.

Growth in the ASEAN sustainable debt market continued to be encouraged by supportive regulatory developments in 2021, noted the report, adding work has been underway to establish green taxonomies that will provide a clear and common definition of sustainable activities.

At the regional level, the ASEAN Taxonomy Board released a draft ASEAN Taxonomy in November 2021, while an increasing number of countries are progressing in developing their taxonomies, such as Malaysia, Singapore, Thailand, and Vietnam.

“We are encouraged by the significant growth in sustainable debt issuance across ASEAN in 2021. While this growth is partly driven by enhanced regulatory support, there is an increasing trend where more companies are aligning climate risk with their business strategies. In particular, this has led to a notable increase in interest from corporates in sustainability-linked loans, which provide the flexible use of proceeds while still enabling corporates to achieve their sustainability objectives and targets,” Kelvin Tan, HSBC’s managing director and head of Sustainable Finance & Investment, ASEAN, said.

“However, significantly more financing needs to be deployed to mitigate and adapt to climate change. This mobilization of finance will support our transition into a low carbon economy, which will be critical to achieving the Paris agreement goals and mitigating the devastating effects of climate change for the ASEAN region,” he added.