Vietnam’s manufacturing sector returns to growth in April

The solid expansion in new orders helped lead to a return to growth of manufacturing production in Vietnam.

The Vietnamese manufacturing sector returned to growth in April as a solid expansion in new orders fed through to a renewed increase in production.

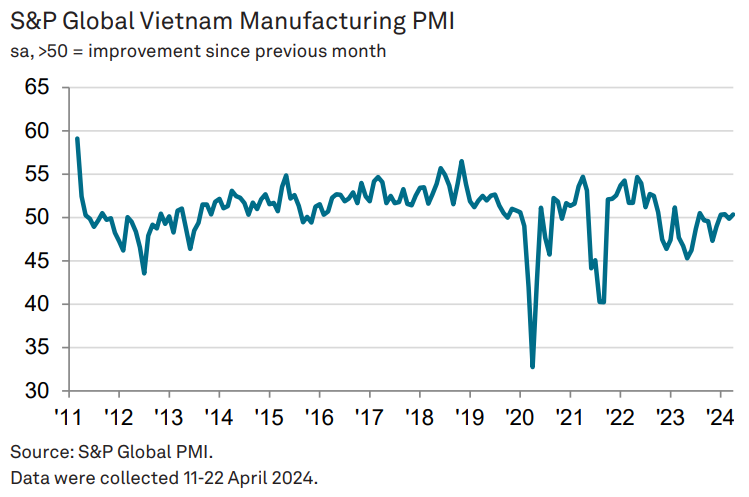

The S&P Global Vietnam Manufacturing Purchasing Managers' Index (PMI) rose back above the 50.0 no-change mark in April, posting 50.3 from 49.9 in March. The reading signaled a marginal improvement in the health of the sector, the third time in the past four months in which this has been the case.

A reading below the 50 neutral marks indicates no change from the previous month or even contractions; above 50 points means an expansion.

“There was a welcome return to growth of new orders in the Vietnamese manufacturing sector during April following recent weakness. There were some signs that the extent of the rebound perhaps took firms by surprise given that they had decided to release workers following the recent period of muted demand conditions, thus resulting in a build-up of backlogs. We could therefore see some of these workers brought back soon,“ said Andrew Harker, Economics Director at S&P Global Market Intelligence.

"More generally, the recent up and down nature of new order inflows was a concern for firms looking forward. We will hopefully see a more stable environment in the months ahead, helping manufacturers to plan production and resourcing effectively."

The main positive from the latest survey was a rebound in new orders, which increased solidly following a fractional decline in the previous month. Moreover, the rate of expansion was the fastest since August 2022.

Panelists reported improvements in market demand and success in securing new customers. New export orders also returned to growth, but the latest rise was only marginal and softer than that seen for total new business, noted the report.

| Electronics production at Hoa Lac Hi-tech Park. Photo: Pham Hung/The Hanoi Times |

Also helping manufacturers to register a rise in new orders was a second successive monthly reduction in selling prices amid efforts to price competitively and respond to requests from clients for discounts. The latest decrease in charges was the most marked in nine months. Firms carried out price discounting despite a further increase in input costs, but the rate of input price inflation was relatively muted, thereby providing some space for firms to lower charges without incurring too much pressure on margins.

Where input costs increased, panelists often mentioned higher oil and shipping prices. There were also some reports of rising sugar costs.

The solid expansion in new orders helped lead to a return to growth of manufacturing production in Vietnam. That said, coming at a time when new orders rebounded, the reduction in staffing levels meant that firms found it harder to complete orders on time.

As a result, backlogs of work increased for the first time in three months, albeit marginally. Purchasing activity increased for the first time in six months in response to higher new orders, but the rate of expansion was only slight amid a reluctance among firms to hold inventories. Stocks of purchases decreased solidly again, extending the current sequence of depletion to eight months.

Stocks of finished goods also decreased, in part reflecting the need to satisfy the solid increase in new orders at a time of still muted production. The pace of reduction softened from that seen in March.

Suppliers' delivery times were unchanged in April, thereby ending a three-month sequence of lengthening lead times. Some firms indicated that stock holdings at suppliers were sufficient to help them speed up deliveries.

Recent market instability led to a drop in confidence, with sentiment down to a three-month low. That said, hopes for a more stable and positive demand environment in the months ahead supported optimism that output will increase over the coming year.