Vietnam stock market projected to get status upgrade in 2021

A possible delay in the Vietnamese stock market’s status upgrade until next year will result in the country losing a significant catalyst to reverse the trend of foreign selling.

The chance for Vietnam’s stock market to be upgraded to the emerging market status by global provider of financial services FTSE Russell can only occur in its next full annual review by September 2021, according to KB Securities Vietnam Company (KBSV).

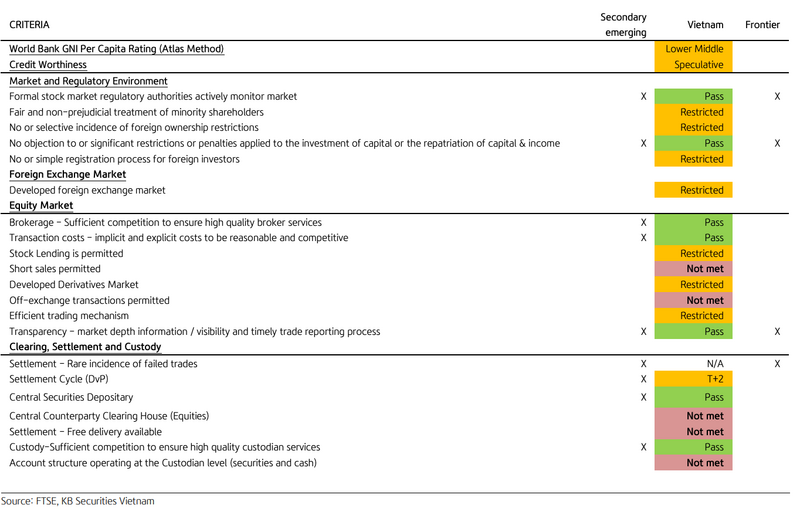

| Vietnam – FTSE quality of market criteria. |

“Although FTSE could signal an upgrade in the March 2021 interim review, we believe Vietnam will unlikely resolve the outstanding issues before this period,” stated the securities firm in a report.

Vietnam is currently in the Frontier Market group, and was added to the FTSE Russell’s watchlist for possible upgrade to Secondary Emerging Market in September 2018. However, after one year of review, Vietnam only met seven out of the nine criteria of FTSE.

According to KBSV, Vietnam has made progress in criteria such as “Market and Regulatory Environment”, but “Clearing & Settlement Mechanism” remains a major obstacle.

Meanwhile, the criterion of “Settlement – rare incidence of failed trades” was not evaluated. The brokerage believed that this is not a big issue, simply due to the limited supply of information from the State Securities Commission (SSC), the country's stock market watchdog.

Sharing the same view, securities company VNDirect said there is high possibility that the local stock market could be upgraded in 2021, adding the authorities are working with a South Korean partner in addressing the bottleneck in “Clearing & Settlement Mechanism”. As such, a new transaction system could be completed by early 2021, VNDirect said.

While the global Covid-19 pandemic has triggered outflow from emerging markets and emerging Asia, with Vietnam also witnessing continued outflow on global recession fears, KBSV expected a delay in Vietnam’s possible FTSE upgrade until next year will result in the country losing a significant catalyst to reverse the trend of foreign selling in the stock market.

“Vietnam will not be immune to the capital outflow seen across the emerging market and this continues to be Vietnam’s biggest challenge in the foreseeable future,” it added.

Moreover, as the process of privatizations and divestment of state capital at state-owned companies is still lagging behind schedule, foreign cash flow is unlikely to flourish in the coming time.

At a ceremony marking the 20th anniversary of the establishment of the Ho Chi Minh City Stock Exchange (HoSE) on July 20, Prime Minister Nguyen Xuan Phuc urged stock market authorities to work out measures so that the market can be upgraded to the emerging market status in a near future.