Vietnam’s manufacturing activity signals improvement in May

The sector saw a softer contraction than in April as the Covid-19 pandemic was brought under control in Vietnam.

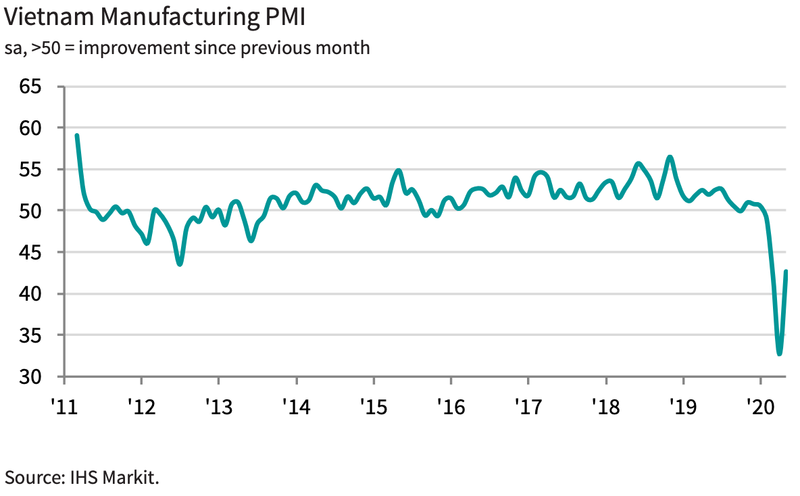

The Vietnam Manufacturing Purchasing Managers' Index™ (PMI) rose ten index points in May, posting 42.7 up from April's record low of 32.7, signaling a much softer decline in business conditions than in the previous month, according to a joint report by Nikkei and IHS Markit.

The 50 neutral mark indicates no change from the previous month, while a reading below 50 indicates contractions and above 50 points to an expansion.

The latest data, however, indicated that the health of the sector continued to deteriorate at a rapid rate.

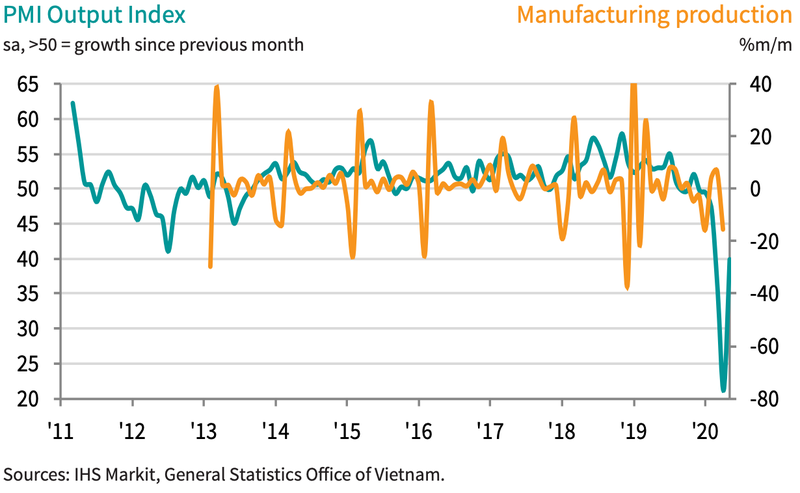

Disruption from the Covid-19 pandemic led to a sixth successive monthly decline in manufacturing production, and one that was substantial. That said, the fall was much softer than seen in April as some firms resumed operations.

Similar trends were seen with regards to new orders, with the rate of contraction remaining rapid but easing from the record seen in April. Some respondents highlighted particular weakness in demand for new export orders, which fell more quickly than total new business.

A further sharp reduction in new orders meant that spare capacity remained evident in the sector. As a result, manufacturers maintained a cautious approach to hiring, often opting not to replace workers who had resigned. Staffing levels decreased for the fourth month running.

Manufacturers also continued to scale back their purchasing activity and inventories of both purchases and finished goods, albeit in each case to lesser extents than in April.

Supply-chain disruption due to Covid-19 remained a key feature of the survey in May, with vendor delivery times lengthening markedly again. Panelists reported particular difficulty in securing imported items.

The scarcity of some materials placed some upwards pressure on input costs during the month. Input prices decreased for the second month running, but only marginally. Where a fall in input costs was recorded, respondents often linked this to lower oil prices.

Manufacturers reduced their own selling prices, as has been the case in each month since February. Although easing from that seen in April, the rate of decline in charges was marked. According to respondents, discounts were offered to try to attract new business.

With Covid-19 brought under control in Vietnam, there was tentative optimism among manufacturers that production would increase over the coming year. This followed a negative outlook in the previous month. That said, sentiment was still the second-lowest since the question was added to the survey in April 2012 amid concerns that the impacts of the pandemic will linger.

“The success Vietnam has had in bringing the Covid-19 outbreak in the country under control means that the economy can begin along the road to recovery. That said, the PMI data for May suggest that the road will be a long one, with the manufacturing sector remaining in contraction mode midway through the second quarter of the year, albeit the decline was much softer than the record seen in April,” said Andrew Harker, associate director at IHS Markit, which compiles the survey.

“The return to growth will likely be gradual, with little support coming from export markets in the near-term at least as the pandemic continues to affect large parts of the world," he added.