Timing for EVFTA ratification could not be better for Vietnam and EU: HSBC

EVFTA provides a means of market diversification for EU and Vietnamese businesses.

With the EU – Vietnam Free Trade Agreement (EVFTA) going to take effect on August 1, the timing could not be better as new trade opportunities under the deal could help to support the post-Covid-19 economic recovery in the EU and Vietnam, according to a HSBC report.

For Vietnam, the Covid-19 impact is intensifying, leading to a near-double-digit contraction in exports in the second quarter of 2020. Vietnamese exports to the EU and UK have taken a hit since the start of this year, collectively falling by 11% year-on-year in the first five months of 2020.

Importantly, the EVFTA provides a means of market diversification for EU and Vietnamese businesses. A number of economies are looking to reduce trade exposure to China in the wake of the Covid-19 pandemic. In fact, the EU is looking to pursue "strategic autonomy” which entails continuing to liberalize trade while reducing dependence on foreign suppliers of critical goods.

For the EU, the EVFTA is notable in enhancing European trade ties with Asian economies. The EU currently has trade agreements in place with three Asian partners: South Korea, Japan, and Singapore. It also has negotiations underway with other Southeast Asian economies such as Indonesia, Myanmar and the Philippines.

The ratification of the EVFTA also reflects Vietnam’s commitment to establishing trade linkages with partners further afield. For instance, Vietnam is already benefitting from the high-standard

Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), and is a member of the 15-member Regional Comprehensive Economic Partnership (RCEP) that is due to be signed this year. Such deals should also help Vietnam diversify export markets and hedge against potential tariff risks, for example from the US.

Under the EVFTA, 99% of all EU-Vietnam tariffs will ultimately be eliminated under the accord. Parties have also agreed to streamline customs procedures, facilitate investment, and protect labor rights and the environment.

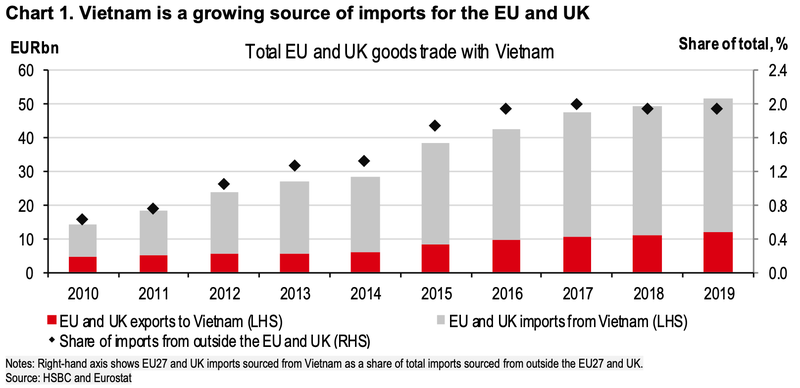

It is also worth mentioning that trade between both parties is complementary: Vietnamese exports mainly consist of labor- intensive goods, while the EU has an advantage in capital-intensive and high-tech products. Europe-Vietnam trade flows have grown over recent years, as Vietnam has risen in importance as a global manufacturing hub.

The EU is already Vietnam’s third largest goods export market (over US$35 billion and behind the US and mainland China), while the UK ranks eighth (US$5.8 billion). On the other hand, Vietnam was the EU’s 31st largest merchandise export destination (US$12.35 billion) and the UK’s 53rd largest export market (US$789.94 million) in 2019 – highlighting significant potential for European businesses to boost exports to Vietnam as trade barriers are progressively lowered under EVFTA.

Benefits for EU

In terms of tariff liberalization, EU exporters of machinery, optical and medical equipment, iron and steel, and chemicals will immediately benefit from duty free access into Vietnam once the deal takes effect. Vietnamese tariffs on sensitive products such as certain vehicles, petroleum oils, and poultry from the EU will be phased out over 10 to 15 years.

The EVFTA also delivers specific benefits for European autos, pharmaceuticals, and food and beverage exporters.

Benefits for Vietnam

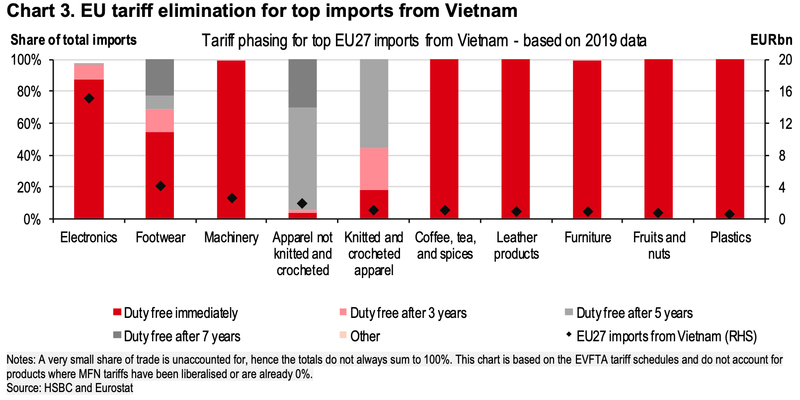

On the other hand, Vietnamese exporters of clothing and footwear, coffee, furniture, fruit and nuts, fish, leather, plastics, and electronics stand to benefit the most. These are Vietnam’s top exports to the EU (and UK) and tariffs will be liberalized relatively quickly. But it is important to note that Vietnamese exporters in certain sectors already face relatively low tariffs in the EU.

For example, around 90% of Vietnamese electronics exports to the EU will be immediately eligible for duty-free access once the deal takes effect (based on the EU’s EVFTA tariff schedule), although at least 75% of Vietnamese electronics exports already enter the EU tariff- free. This is because the EU does not apply tariffs on imports of phones. Vietnam is a major assembly hub for Samsung phones and the EU is Vietnam’s top market for smartphone exports (20% share). This is in line with Samsung’s strong position in the EU market.

Another important aspect is that the deal will provide EU businesses with investment opportunities in Vietnam, for example in manufacturing and financial services. For instance, two EU banks could invest up to 49% in Vietnam’s joint stock commercial banks within five years of the FTA being implemented (up from 30%).

This is good news for Vietnam’s banks, which have large capital shortfall needs to meet the minimum 8% capital-adequacy ratio (CAR) threshold by Basel II standards. Such provisions should help boost EU investment into Vietnam which has traditionally lagged that of other trading partners.

.png)