Vietnam M&A activity in strong position for recovery in 2021: PwC

Covid-19 accelerates deals activity for digital and technology assets in a highly competitive market.

While the market has adopted a cautious approach so far, Vietnam’s M&A activity is in a strong position for recovery as the country started 2021 with a positive economic outlook.

Ong Tiong Hooi, Partner of Transaction Services, PwC Vietnam gave his assessment following the launch of PwC’s latest Global M&A Industry Trends analysis.

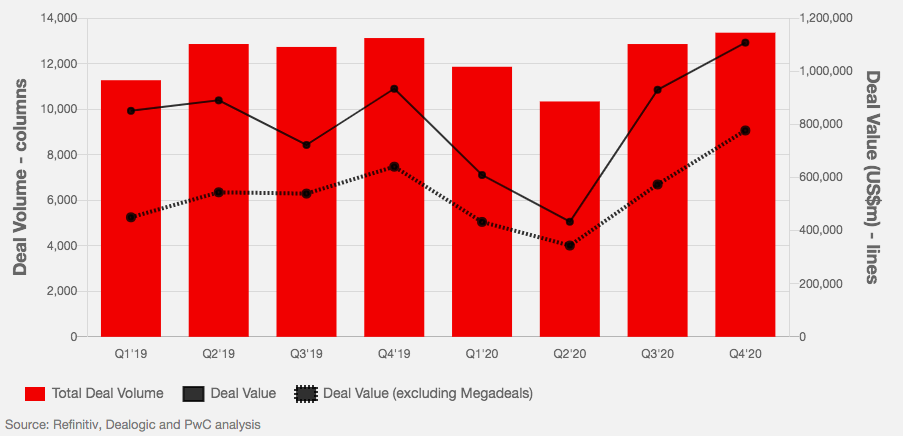

| Global Deal Volumes and Values. |

Covering the last six months of 2020, the analysis examines global deals activity and incorporates insights from PwC’s deals industry specialists to identify the key trends driving M&A activity, and anticipated investment hotspots in 2021.

In spite of the uncertainty created by Covid-19, the second half of 2020 saw a surge in M&A activity.

Deal-making jumped in the second half of the year with total global deal volumes and values increasing by 18% and 94%, respectively compared to the first half of the year. In addition, both deal volumes and deal values increased compared to the last six months of 2019.

The technology and telecom sub-sectors saw the highest growth in deal volumes and values in the second half of 2020, with technology deal volumes up 34% and values up 118%. Telecom deal volumes were up 15% and values significantly rose by almost 300% due to three telecom megadeals.

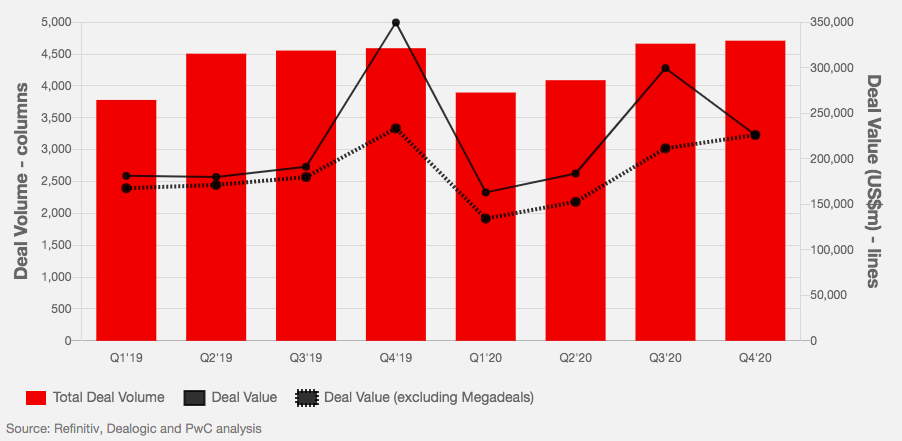

| Deal Volume and Value in Asia Pacific. |

On a regional basis, deal volumes increased by 20% in the Americas, 17% in Europe, the Middle East and Asia, and 17% in Asia Pacific between the first and second half of 2020. The Americas saw the biggest growth in deal values of over 200%, primarily due to some significant megadeals in the second half of the year.

“Reflecting the global trend, the Vietnam M&A landscape is likely to remain active this year,” stated Mr. Ong.

“Furthermore, pent-up demand is likely to kick in as investor and consumer confidence increases in light of the news on the Covid-19 vaccine development,” he noted.

Sharing the view, Brian Levy, PwC’s Global Deals Industries Leader said Covid-19 gave companies a rare glimpse into their future.

“An acceleration of digitalization and transformation of their businesses instantly became a top priority, with M&A the fastest way to make that happen — creating a highly competitive landscape for the right deals,” stated Mr. Levy.

Mr. Ong Tiong Hooi commented: “The new circumstances and challenges caused by Covid-19 have created particular demand and opportunities for digital services and the underlying technology that help our societies and businesses function. Thus, the ongoing acceleration of all things digital has become essential across industries. And it is at the speed that demand has grown favors a buy-versus-build strategy for many companies. This increases the competition to acquire the necessary business infrastructure and forces premium valuations.”

By comparison, assets in sectors that have been hardest hit by the pandemic like industrial manufacturing or those being shaped by factors such as the transformation to net zero carbon emissions are creating structural changes that companies will need to address. Where the future viability of their business models is challenged, companies may look to distressed M&A opportunities or restructuring to preserve value.

Deal makers turn to non-traditional sources

Non-traditional sources of value creation such as the impact of environmental, social and governance factors (ESG) are increasingly being considered by deal makers and factored into strategic decision-making and due diligence, as they focus on protecting and maximizing returns from high valuations and fierce demand.

Last year, the combined M&A transaction value in Vietnam was estimated to decline by 51.4% year-on-year to US$3.5 billion. A strong economic rebound in 2021 could help M&A activities in Vietnam recover from mid-2021 and take the market size to the pre-Covid-19 level of around US$5 billion per year.