Vietnam’s credit growth projected to reach 10-year low of 13.2% in 2019

The slow growth comes mainly from state-owned banks, which have become more stringent on their loan disbursements.

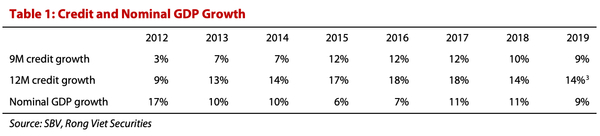

Based on the current pace and credit growth of commercial banks, Vietnam’s credit growth is projected to reach 13.2% this year, lower than the 14% target. If this is the case, that will be the lowest credit growth in the last decade, according to Viet Dragon Securities Company (VDSC).

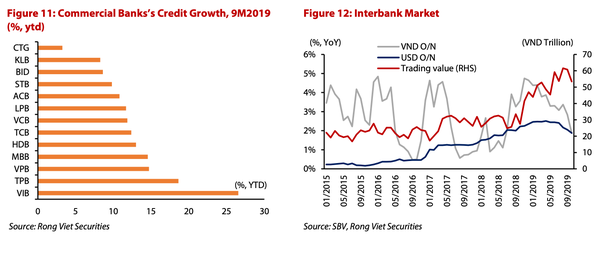

As of the end of September 2019, credit grew 9% year-to-date, below the 10.3% growth recorded in the first nine months in 2018. That means there is room for a further 5% expansion in the last quarter.

The slow growth comes mainly from state-owned banks, including Bank for Investment and Development of Vietnam (BIDV), Vietnam Bank for Industry and Trade (VietinBank) and Vietnam Bank for Agriculture & Rural Development (Agribank), which have become more stringent on their loan disbursements.

Commercial banks continued to extend loans at satisfactory levels. “This begs the question: will the State Bank of Vietnam (SBV), Vietnam’s central bank, redistribute the cap on credit growth among lenders to reach the initial target of 14%?” stated VDCS.

Commercial banks such as Vietnam International Bank (VIB), TienPhong Bank, Vietnam Prosperity Bank (VP Bank), and Military Bank (MB Bank) recorded fast growth of credit and closely reached the limit set by the SBV.

Meanwhile, BIDV and Vietinbank’s credit grew 8.6 and 3.2% year-to-date, below the allowed marks of 12% and 7% year-to-date, respectively. Since the beginning of the year, the SBV declared that any bank, who meets the requirement of Basel II, can be considered for larger credit room. As of mid-2019, many commercial banks have met the requirements.

Interestingly, the gap between credit growth and nominal GDP growth has been shrinking over the years. Currently, the gap between 12-month credit growth and nominal GDP growth is at 5%, well below the range of 7-11% in 2015-2017. In 2018, the gap had narrowed to 3% due to global downside risks and a sudden tightening of credit policy starting in the third quarter of that year. Currently, the environment is favorable to the SBV’s consideration of redistribution of credit growth cap as both the domestic and international situation are improving.

“We note that some commercial banks are asking for larger room,” added VDSC.